Webinars: Contrarian Real Estate Investing Parts I & II

We invite you to view webinars produced by National Real Estate Investor online, featuring RCLCO. Both webinars are free and available on demand by clicking the links below.

- Part I: Strategies for Identifying Value in a Market that Seems Fully Priced and Fairly Crowded

- Part II: A Road Map for Underwriting Investments that Cut Against Conventional Wisdom

In addition to watching the webinar, you can download the presentation slides without the recording. Click here for Part I and here for Part II.

Part I: Strategies for Identifying Value in a Market that Seems Fully Priced and Fairly Crowded

Summary

As the queue of capital continues to build and the opportunities for finding yield or creating values continues to dwindle, investors in real assets may consider contrarian, unfashionable, difficult to underwrite or slightly esoteric asset types, investment, markets and positioning strategies. The challenge, of course, is pricing the risk in this approach and understanding where you are getting paid for avoiding the herd mentality and where you are taking long bets with uncertain payoff. In this webinar RCLCO will present our framework for identifying and processing this investment perspective, guidance on the underwriting approach, case studies of where this approach has paid off and where it has disappointed and why.

We will share:

- What macro drivers of how American’s live, work, learn and play are changing and how that creates value in real estate

- Practical tools for projecting revenue, growth, cap rate movement and liquidity for new products or sub-asset classes

- Structuring techniques that work against conventional wisdom and create upside

- Specific investment opportunities presented at this time in the cycle

- A discussion of asset management requirements arising from this investment style

- A discussion of the impact of the real estate cycle on contrarian real estate investing

Part 2: A Road Map for Underwriting Investments that Cut Against Conventional Wisdom

Summary

In this hour-long interactive session, we explore:

- Constructing a portfolio that “stacks” contrarian real estate investments with more easily underwritten investments

- Understanding the market cycle and how it applies to contrarian investments and more conventional investments

- Debt or creative capital stack formation to facilitate over-looked and under-appreciated sector allocation

- A “how-to” guide for underwriting a manager’s contrarian strategy

- Monitoring and asset management in a space where data might be sparse and benchmarking difficult

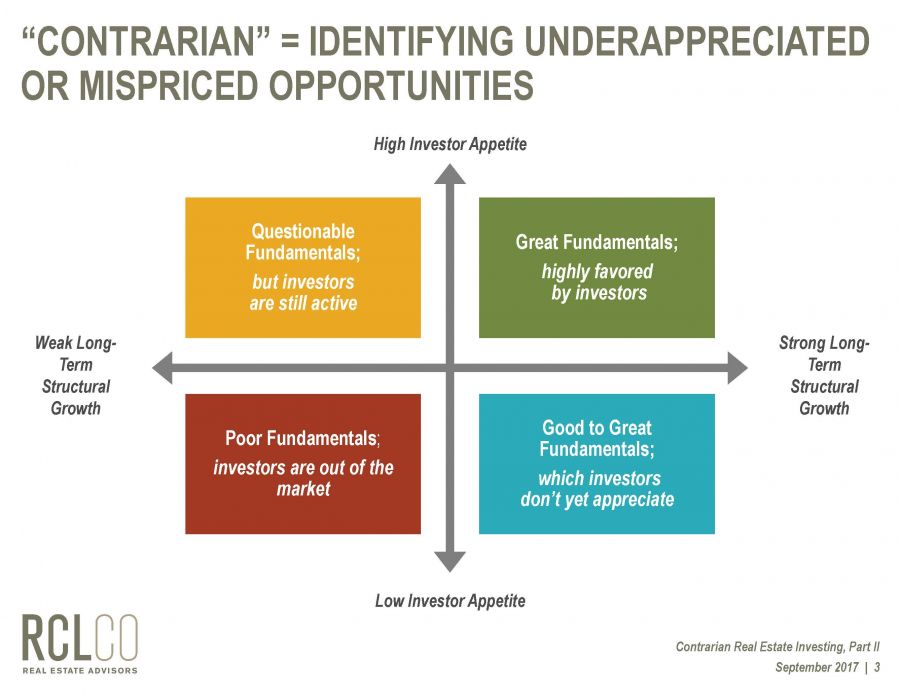

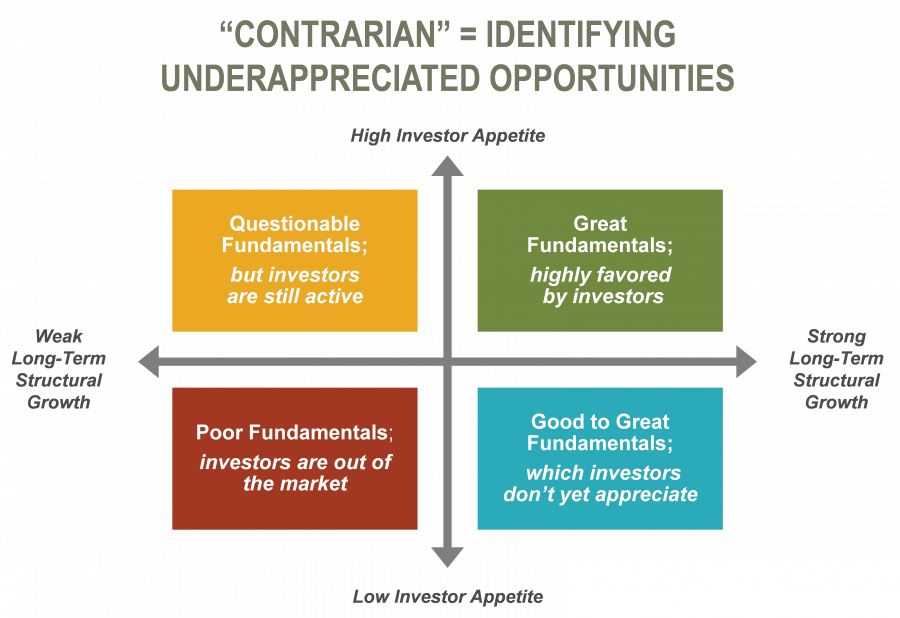

The graphic below might serve as an introduction to this framework.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us