Originally published via AFIRE

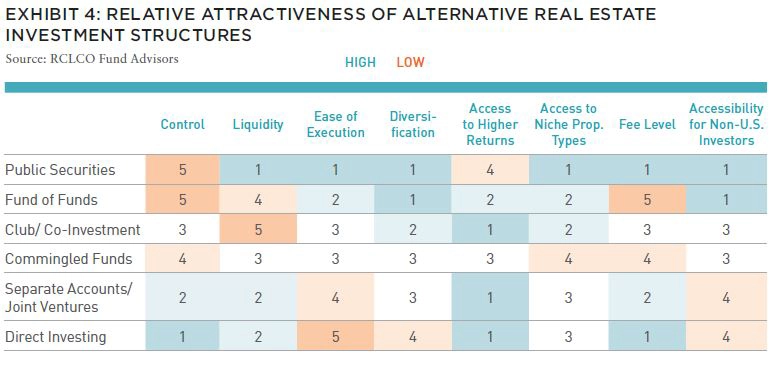

Some recent research argues that more direct approaches to real estate investing can more effectively address the characteristics, opportunities, and risks associated with the current state of commercial real estate.

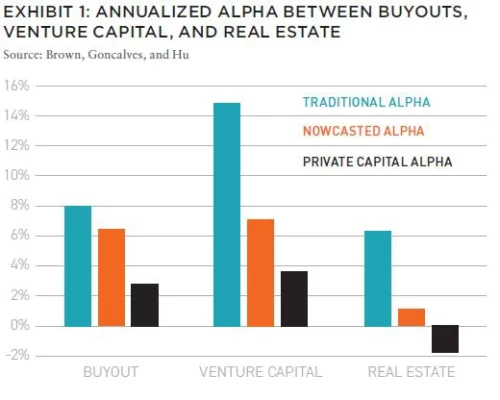

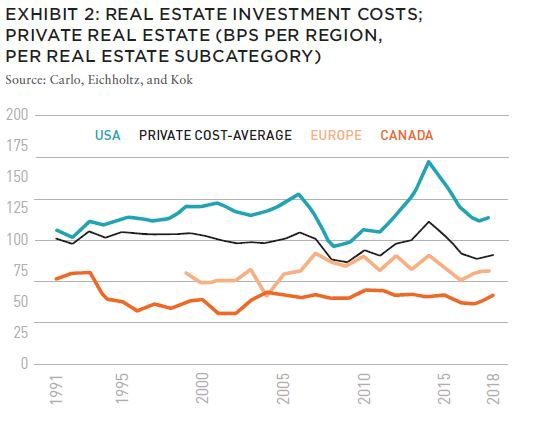

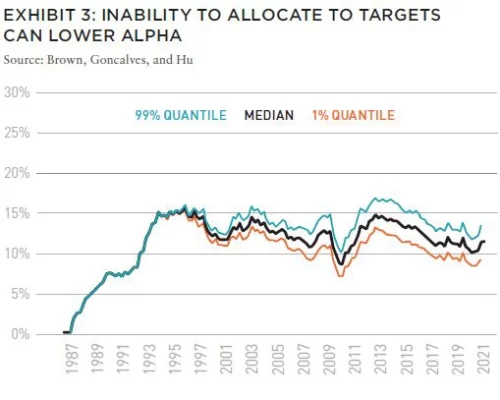

Recent research has found that closed end real estate funds, in aggregate, have broadly underperformed over the past two decades. In particular, Private Equity Real Estate (PERE) funds have not delivered acceptable net returns relative to alternative opportunities, risks, and fees.

Most of the research on this topic has focused on US funds, but there is increasing focus on non-US and global funds. With this in mind, this article examines the research and its implications, looks at potential causes, and evaluates alternative approaches for non-US investors looking to invest in US real estate. In particular, this article argues that more direct approaches to investing in real estate more effectively address the characteristics, opportunities, and risks associated with real estate.