Much has been made of office-to-residential conversions in recent headlines (see last month’s RCLCO publication regarding Office to Residential: 6 Myths and Facts Regarding Market Dynamics of Conversions), and rightfully so as remote and hybrid working arrangements have prevailed longer than expected.

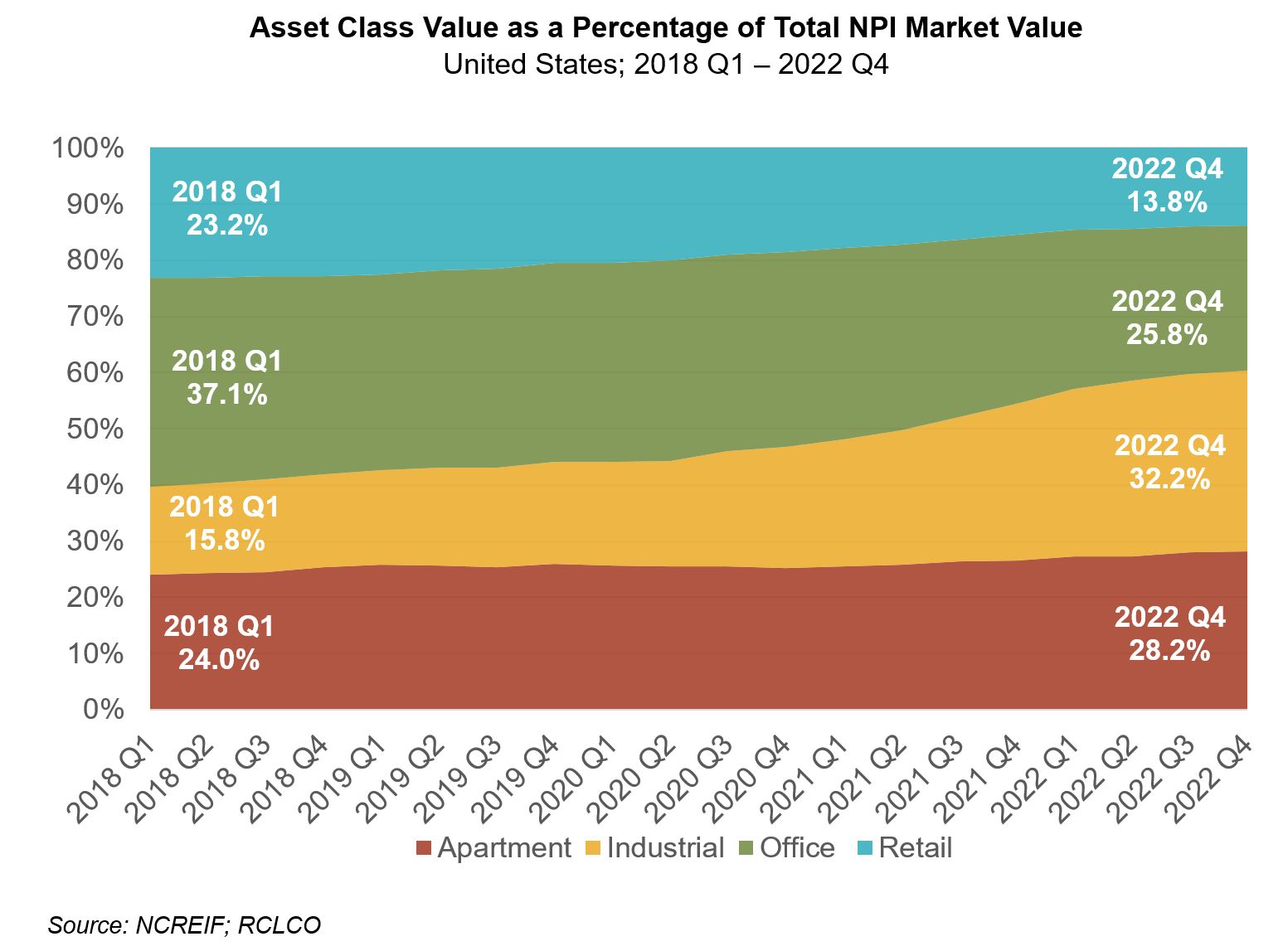

The changing nature of where and how people spend their days is not just impacting office properties, but also having a profound effect on retail. While these changing lifestyle preferences have exacerbated market value declines in office, we also see retail having a smaller focus among institutional investors as many of these assets face headwinds, a trend that started even before the pandemic. At the end of 2022, retail asset values as a percent of total NCREIF’s Property Index (NPI) was 13.8%, down from 23.2% at the beginning of 2018.