Originally published via AFIRE

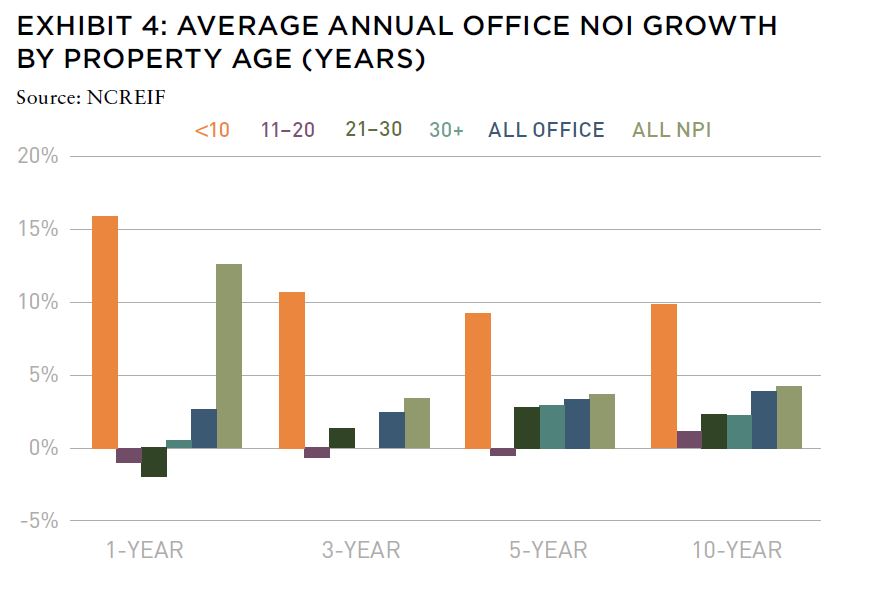

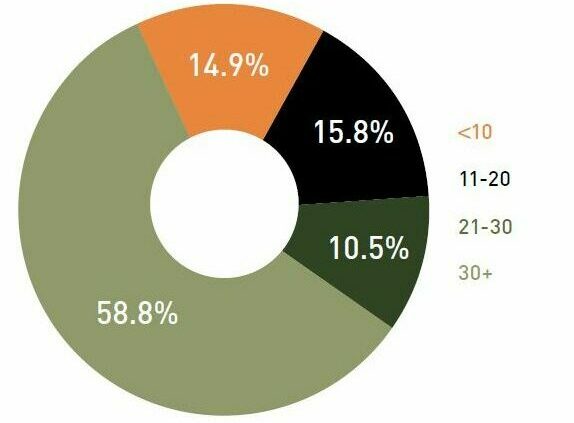

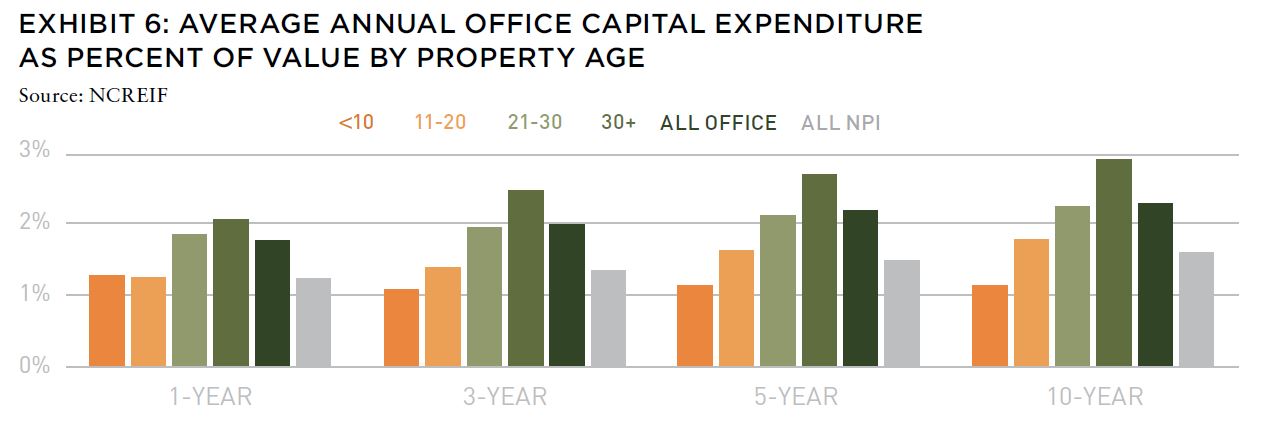

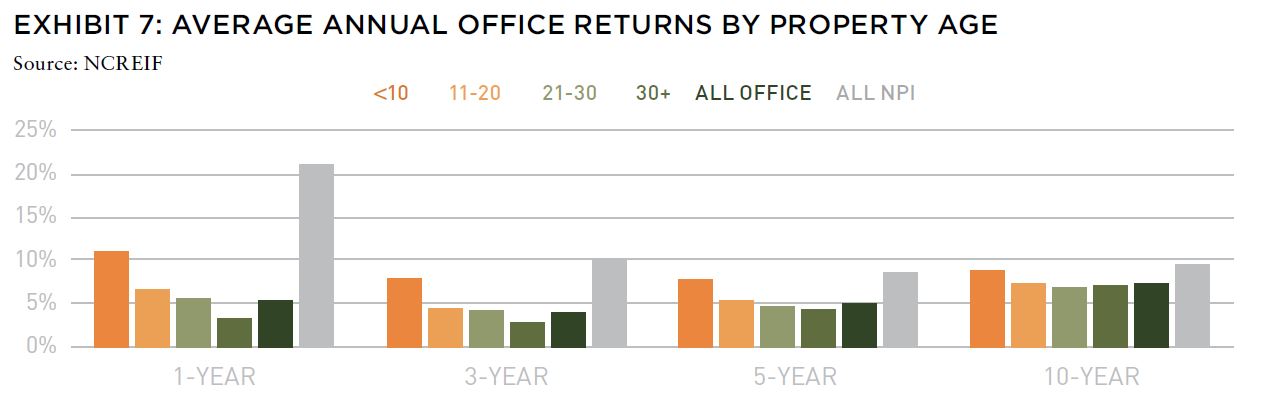

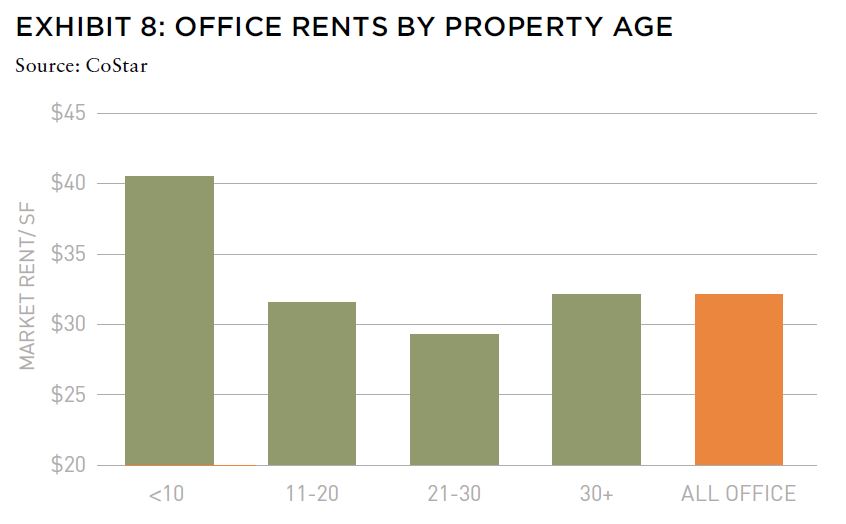

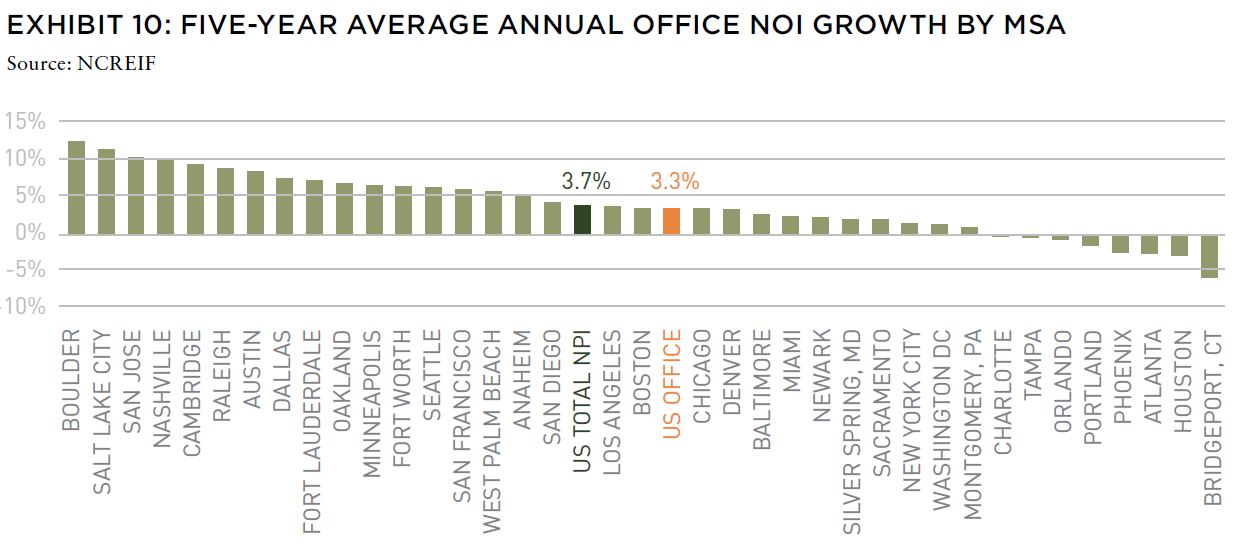

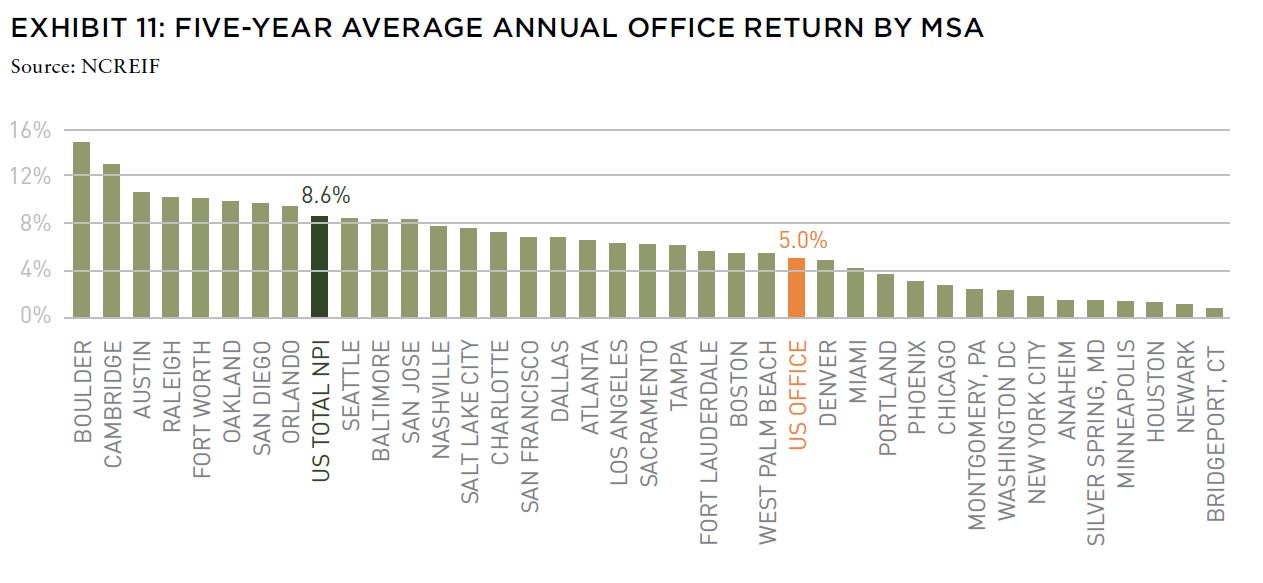

Even as the US office sector has lagged other property types, there could be an important (and valuable) difference of office performance based on property age and market.

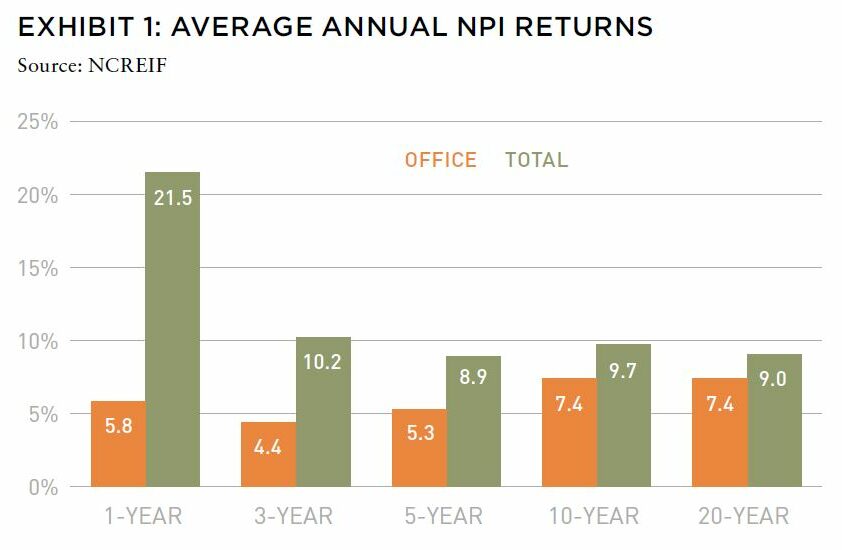

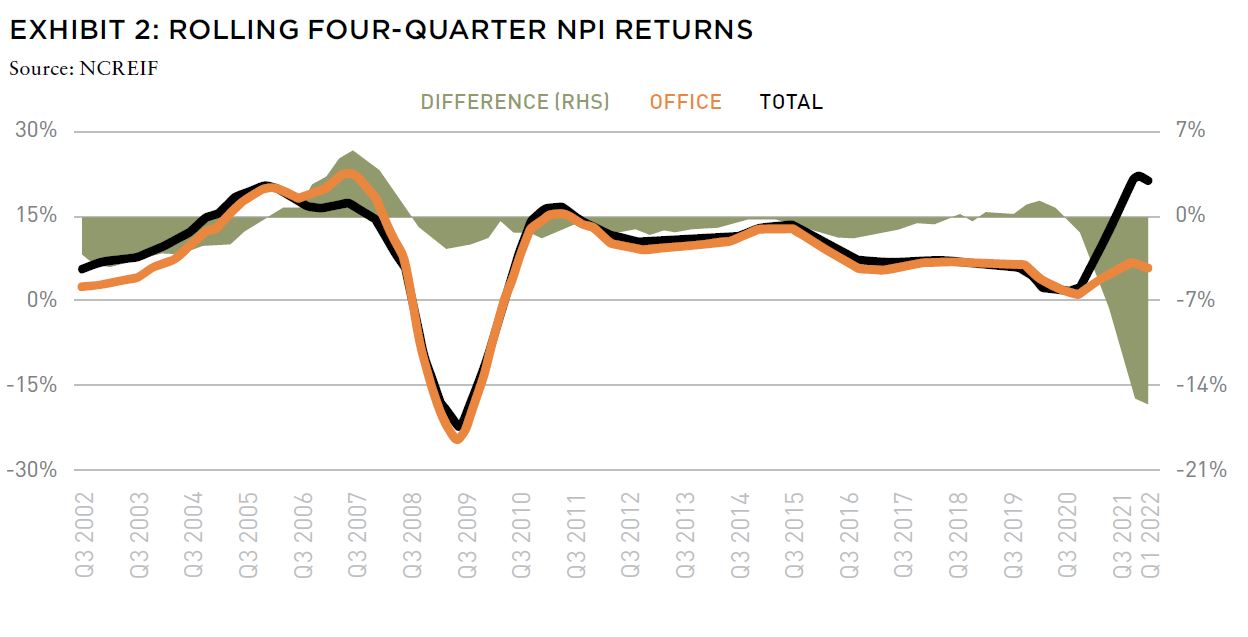

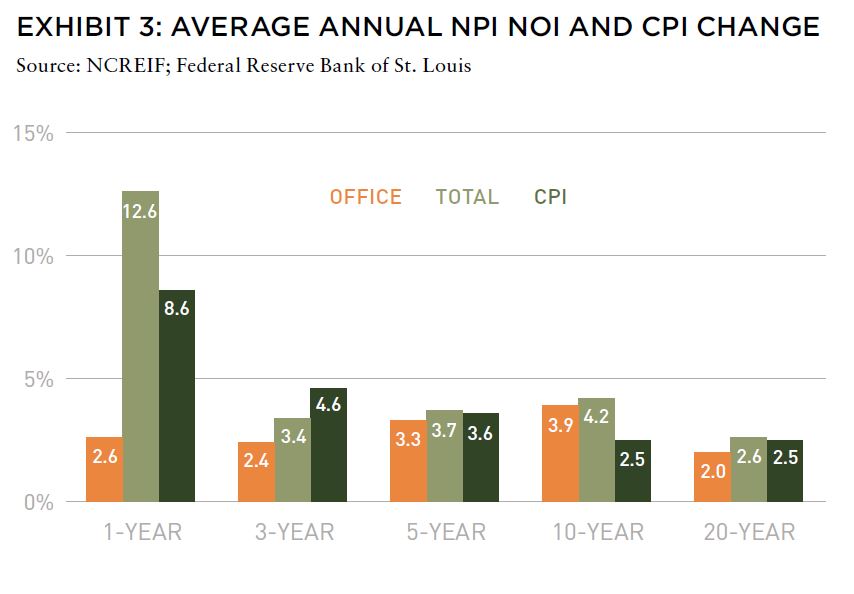

US office performance has lagged other property types and the overall NCREIF Property Index (NPI) in both total returns and net operating income (NOI) growth for at least past twenty years. This overall trend, however, masks variations within the sector as office properties bifurcate between “have” and “have not.” Have-not properties struggle to maintain current values as NOI growth is weak (or negative) and required capital expenses detract from value, while “have” properties are able to grow NOI and increase values. Using NCREIF data, this article examines the bifurcation of office performance based on property age and market.