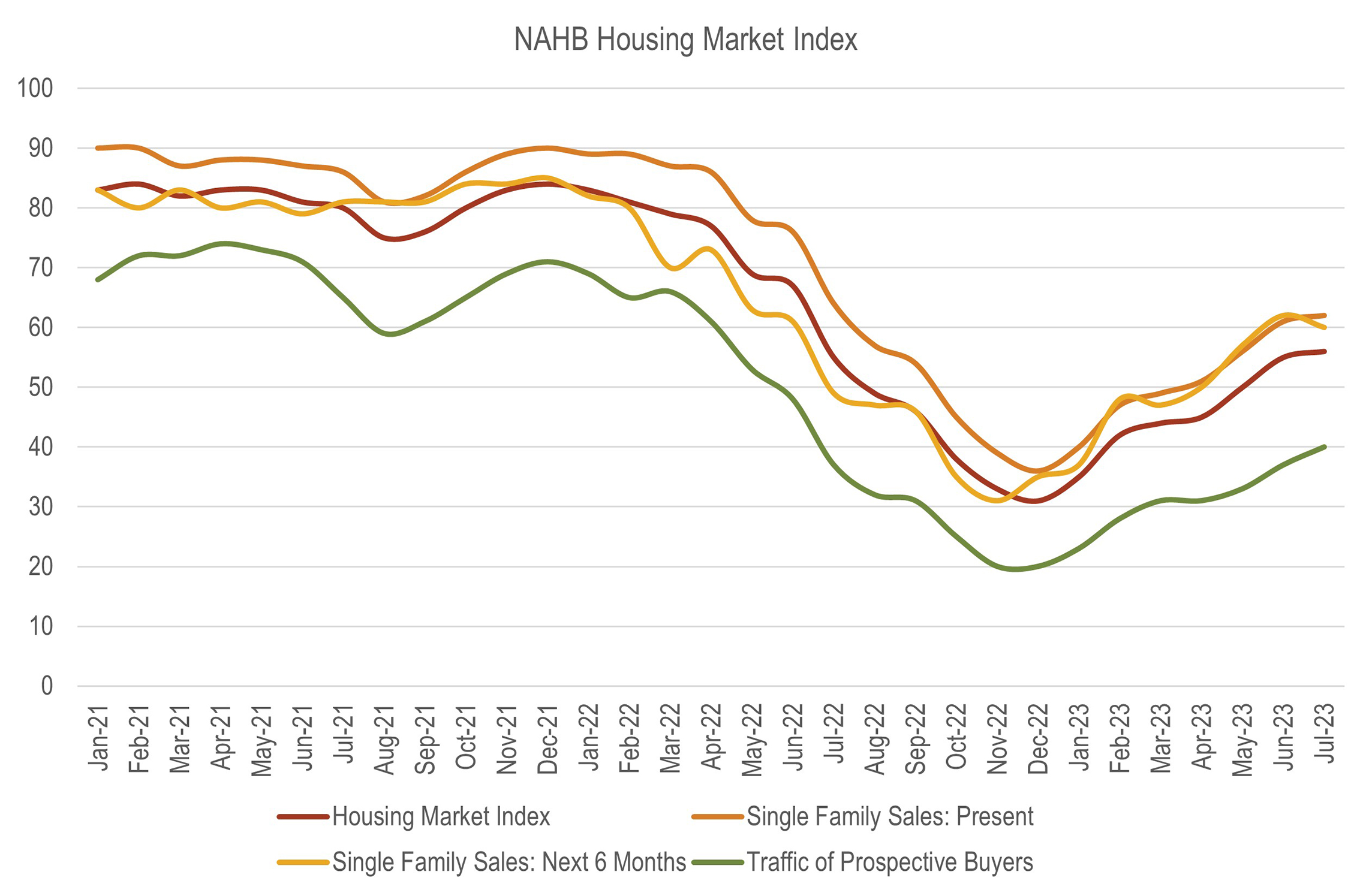

Market optimism among homebuilders has reached its highest level since July 2022. It reached its lowest point in December 2022 and has been steadily increasing in the months since. Furthermore, the underlying demographic trends supporting long-term new housing demand suggests continued growth in the single-family housing market over the long-term, despite the potential for near-term disruptions given fears of a possible recession. Master-Planned Communities, for which there is more underlying demand than supply, appear to have a positive trajectory for the remainder of the year, though the potential for a Federal Reserve induced recession is still a threat to the market. Longer term, MPCs will continue to benefit from strong underlying housing demand across price ranges. That said, the moderate priced end of the housing market remains a shadow of its former self, and MPCs have historically been the places where more creative housing options such as smaller homes at higher densities have been successful. The degree to which a broader range of housing may be offered within MPC developments will continue to impact their total sales and market shares.

The ranking of Mid-Year 2023’s 50 Top-Selling Communities is based on total net new home sales as reported by each individual community. Preliminary sales numbers were provided by communities in mid-June and pro-rated in order to arrive at estimated mid-year sales, with final sales figures provided during the first weeks of July, and in some cases being updated periodically throughout the month. To be included in our ranking, MPCs must have a number of features. True MPCs are developed from a comprehensive plan by a master developer, and incorporate a variety of housing types, sizes, and prices, with shared common space, amenities, and a vital public realm. The best examples of MPCs are developed with a strong vision and comprehensive plan that guide development and unify the community through distinctive signage, wayfinding, entry features, landscaping, and architectural/design standards. Beyond the built environment, MPCs differentiate themselves from typical suburban subdivisions in that they provide a means for interaction among neighbors in the sense of the word “community.” They foster an environment within which generations can live better in terms of housing and the community environment, and many offer educational opportunities, neighborhood shopping and services, and even employment centers to complement the residential neighborhoods. Although rooted in a vision, the most resilient MPCs have flexible master plans that are environmentally sensitive, market responsive, and nurture the lifestyles of their residents.

Given the above criteria, we do not include the collective sales of multiple, separate communities that are unified only through marketing efforts rather than a preconceived community vision, nor do we include communities that are a collection of subdivisions that have few unifying elements other than consistent signage and name.

More on the Top-Selling Master-Planned Communities

Article and research prepared by Gregg Logan, Managing Director, and Karl Pischke, Principal. Additional research support was provided by Kim Asbell, Shanren Brienan, Maggie Henderson, and Jameson Logan.

RCLCO provides real estate economics and market research services, strategic planning, and management consulting to real estate developers, investors, financial institutions, home builders, public agencies, and anchor institutions. Client’s turn to us for trusted, unbiased third party recommendations regarding highest and best use, product definition, market positioning/pricing, and absorption potential for any proposed development concept, site, or product type. Interested in learning more about RCLCO’s Master-Planned Community Services? Please visit us at www.rclco.com/master-planned-communities-services/.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.