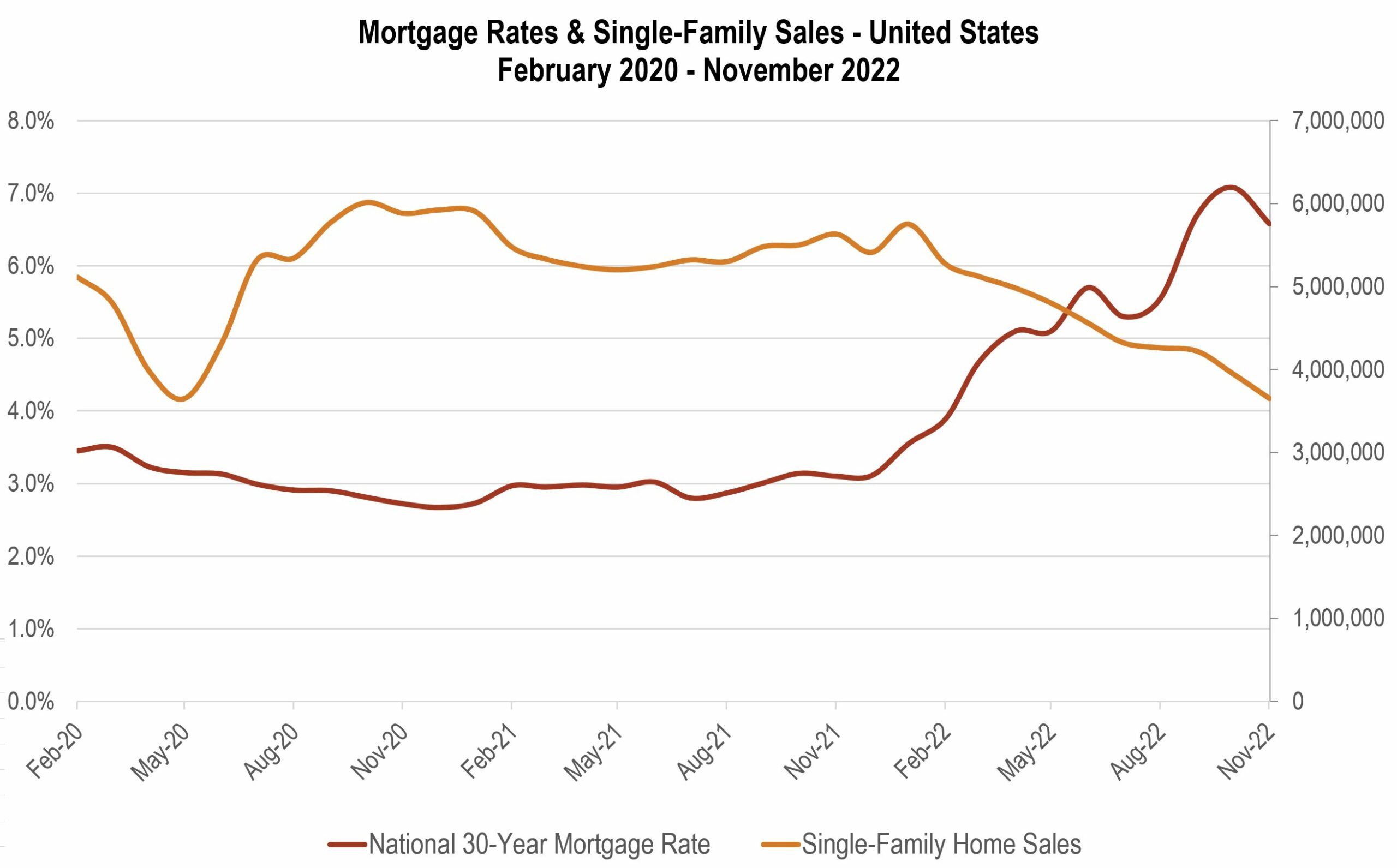

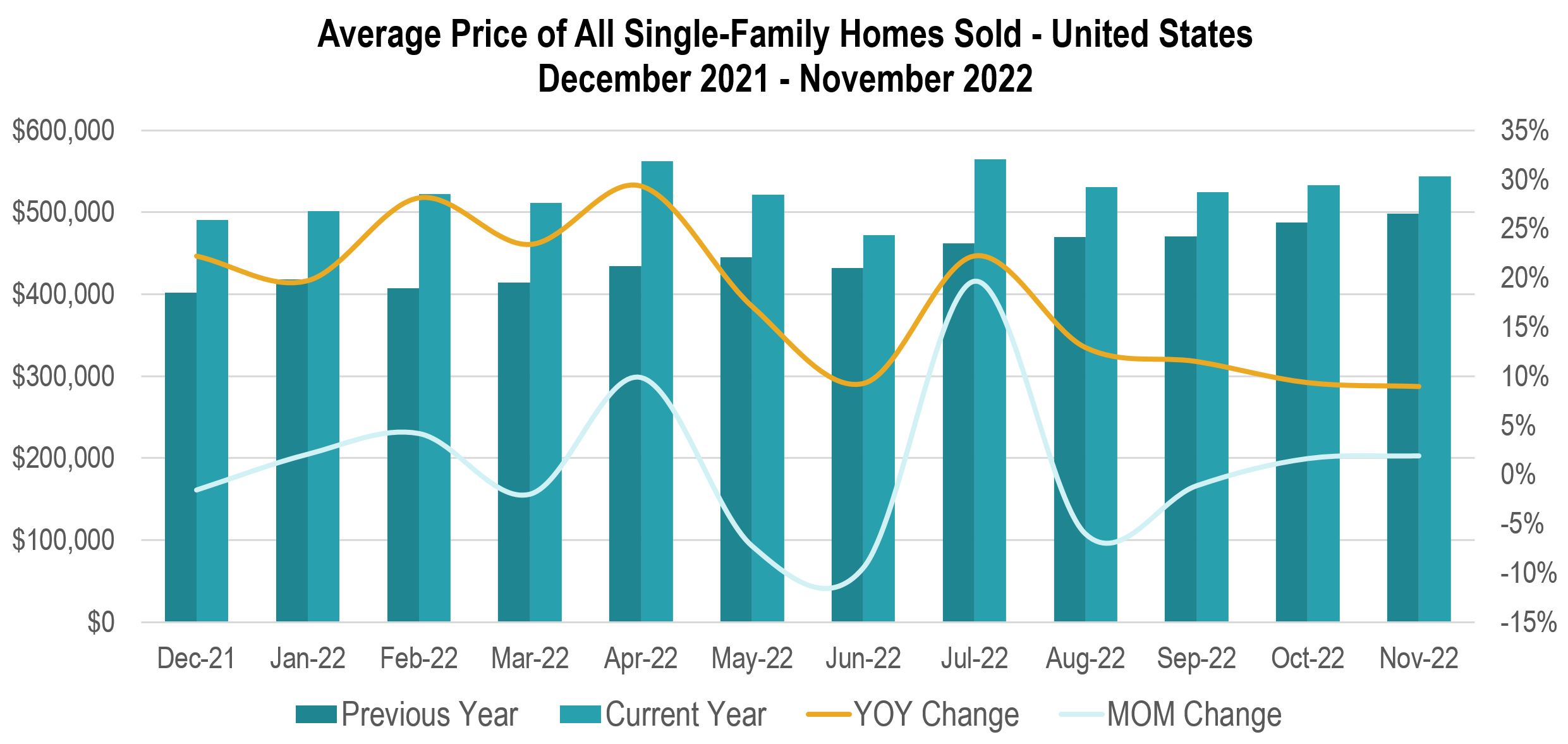

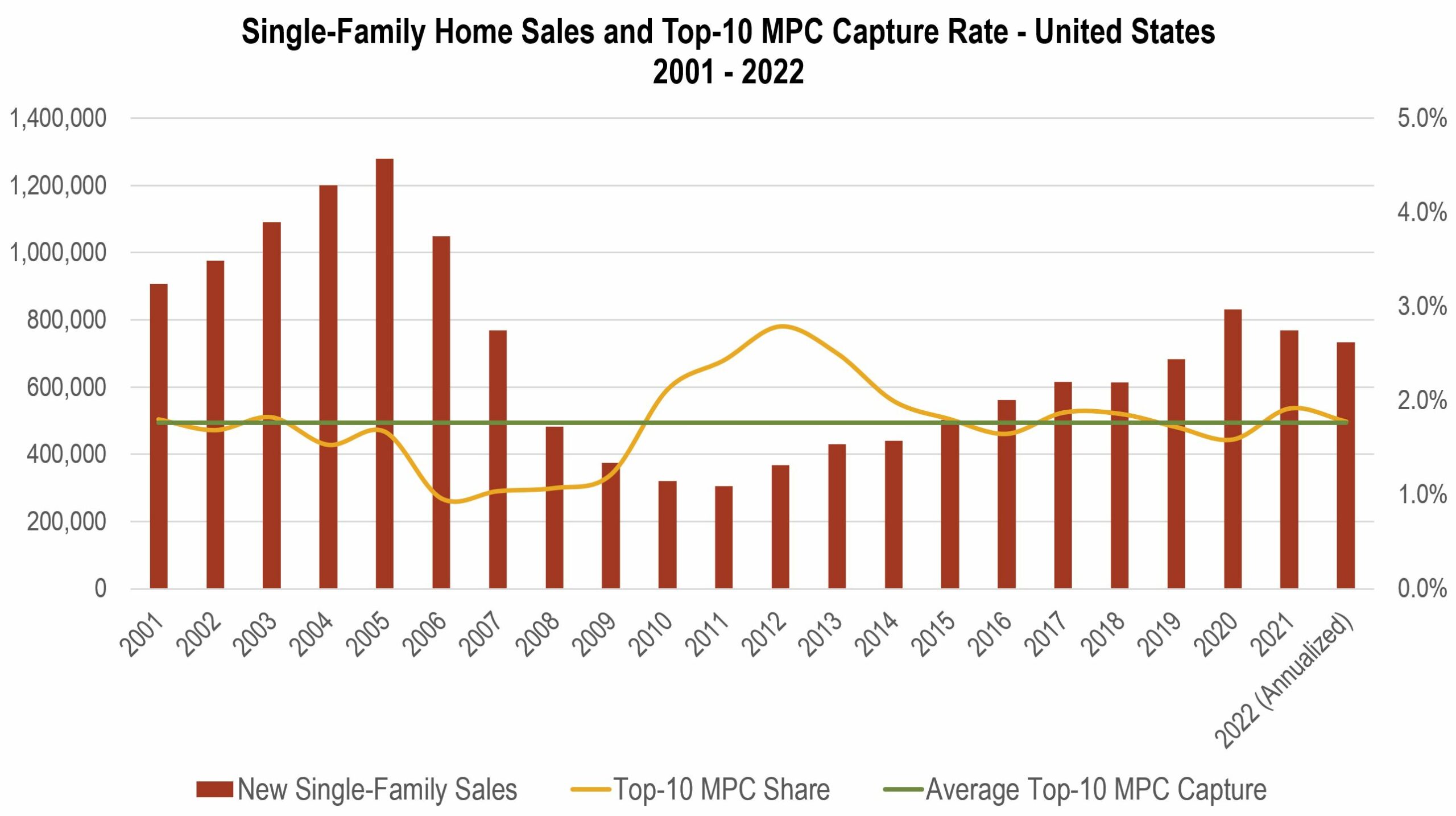

High median new home prices and rising mortgage rates have contributed to the long-term trend of declining housing affordability, and recent declines in permitting, starts and new home sales. Nonetheless, the underlying demographic trends supporting long-term demand for new housing strongly indicate that permits, starts, and new home sales will likely rebound substantially following the stabilization of interest rates and further healing of supply chain issues. The developers of the top-selling communities surveyed at the end of 2022 generally tend to believe that the recent decline in new home sales is a short-term trend, and the long-term future for the housing industry, and especially for home sales in Master-Planned Communities, for which there is more underlying demand than supply, looks very positive. Although a slowing new home market is always a challenge to navigate, long term success in the MPC space depends in part on not over-reacting to short term trends. Those communities that continue to plan and position themselves for the next upturn, possibly by mid-2024, will be in a better position to capitalize on the positive long-term demographics in contrast to those that over correct.

The ranking of 2022’s 50 top-selling communities is based on total net new home sales as reported by each individual community. Preliminary sales numbers were provided by communities in early December and pro-rated in order to arrive at estimated year-end sales, with final sales figures provided during the first week of January, and in some cases being updated periodically throughout the month. To be included in our ranking, MPCs must have a number of features. True MPCs are developed from a comprehensive plan by a master developer, and incorporate a variety of housing types, sizes, and prices, with shared common space, amenities, and a vital public realm. The best examples of MPCs are developed with a strong vision and comprehensive plan that guide development and unify the community through distinctive signage, wayfinding, entry features, landscaping, and architectural/design standards. Beyond the built environment, MPCs differentiate themselves from typical suburban subdivisions in that they provide a means for interaction among neighbors in the sense of the word “community.” They foster an environment within which generations can live better in terms of housing and the community environment, and many offer educational opportunities, neighborhood shopping and services, and even employment centers to complement the residential neighborhoods. Although rooted in a vision, the most resilient MPCs have flexible master plans that are environmentally sensitive, market responsive, and nurture the lifestyles of their residents.

Given the above criteria, we do not include the collective sales of multiple, separate communities that are unified only through marketing efforts rather than a preconceived community vision, nor do we include communities that are a collection of subdivisions that have few unifying elements other than consistent signage and name.

More on the Top-Selling Master-Planned Communities

Article and research prepared by Gregg Logan, Managing Director, and Karl Pischke, Principal. Additional research support was provided by Maggie Henderson, Nikita Shetty, Sean Kluver, Shanren Brienan, and Thomas Phillips.

RCLCO provides real estate economics and market research services, strategic planning, and management consulting to real estate developers, investors, financial institutions, home builders, public agencies, and anchor institutions. Client’s turn to us for trusted, unbiased third party recommendations regarding highest and best use, product definition, market positioning/pricing, and absorption potential for any proposed development concept, site, or product type. Interested in learning more about RCLCO’s Master-Planned Community Services? Please visit us at www.rclco.com/master-planned-communities-services/.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.