Will the North American Second Home Buyer Look Offshore Again?

RCLCO Research Shows Surprisingly High Levels of Interest in International Vacation Home Locations

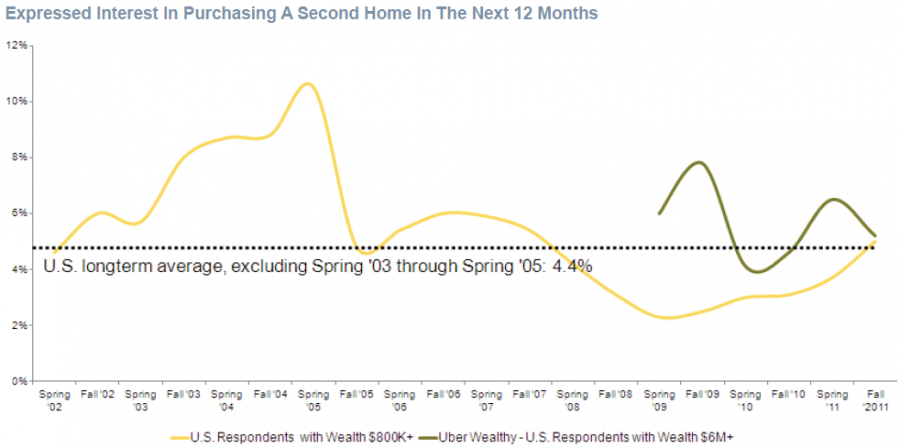

At the end of last year, RCLCO fielded several questions regarding second home purchase interest in in- ternational destinations in the American Affluence Research Association’s semi-annual survey. This survey is completed by roughly 500 households with a minimum net worth of $800,000. Households with this level of net worth or higher are the vast majority of second home buyers both here in the States and overseas.

RCLCO has historically hypothesized that interest in overseas purchase was probably not more than 10% of the affluent second home market. The survey results suggest that the overseas preference level might be at least this high or higher. Here is what we learned:

- 25% of the affluent households expressed a desire to purchase a new, additional, or different vacation home in the next five years, which is quite encourag- ing (see more on this below).

- Of the likely buyers, 17% reported being “very likely to consider a location outside the U.S.,” and an additional 22% reported being “somewhat likely to consider a location outside the U.S.”

- The level of interest in overseas locations was remarkably similar when we isolated just those households with net worth above $1.5M, the much discussed 1%.

- There was no significant regional variation between the Northeast and West (which represent the biggest source markets for second home activity).

Of course, not everyone who might consider an off- shore location will actually make such a purchase, but even if we assume that 50% of the “Very Like- lies” and 25% of the “Somewhat Likelies” actually do purchase overseas, this means that offshore transactions might represent as much as 14% of total activity.

If 25% of the 1.1M households with net wealth of $1M or more do buy a new or different vacation home in the next five years, and 14% of them buy internationally, this represents a potential market of almost 40,000 homebuyers.

Of course, developers and their financial partners need to carefully quantify the distribution of this demand by level of wealth and supportable purchase price, and correlate this purchasing power with specific price ranges and product types. For instance, by far the deepest pool of demand for product in off-shore loca- tions is in the $200,000 to $400,000 price range, while the size of the market for $1M+ homes (far too often the focus of new product in the last cycle) is much narrower. Similarly, the interest in fractional, destination club, and other alternatives to whole ownership in these locations appears to be quite high. So where do they want to buy? While the sample size of this survey is not large enough to quantify the destination pref- erence precisely, the most popular destinations include (note that more than one selection was allowed):

- Europe – 40%

- Costa Rica – 25%

- The Caribbean – 21%

- Panama – 11.5%

- The Bahamas – 11%

- Canada – 11%

- West Coast of Mexico 8.5%

- Bermuda – 7%

- Gulf Coast of Mexico 5.5%

While the U.S. market for second homes both domestically and internationally remains depressed relative to peak levels during the housing boom, this data and other tracking data suggests that there is still sig- nificant appetite for second-home ownership and that buyer interest in purchasing has begun to increase. The challenge is that there is very little sense of urgency and a fear that despite the “discounts” available now, it still may not yet be the time to buy.

RCLCO is currently seeking sponsors to help us make this research more robust, as we believe information of this kind can help developers and their investment partners improve project performance. The investment even in continuing to market communities overseas, let alone in developing new ones, is frightfully expensive, and research of this kind can help target those dollars and improve the industry’s return on its investment.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us