Trends Among Florida’s Top-Selling Active Adult Communities

Florida’s active adult communities (AACs) are attracting a significant share of 55 and older households who are migrating to Florida to enjoy a new phase of their lives. These communities offer independent, relatively maintenance-free living along with social and recreational amenities for households in this age range. In the following discussion we’ve used the terms “retirement” and “retiree” to describe this lifestage, while recognizing that the meaning is changing. Just as the concept of retirement itself is being redefined (and many in this age range are still working), the most successful builders and developers are continuing to redefine the active adult community.

AAC homebuyers are not simply seeking real estate; they are choosing a community and lifestyle defined by the amenities, activities, and unique view orientations. These orientations include golf, lakes, and open space. Golf is still important, but so is water. Pulte’s DiVosta has been very successful with its series of VillageWalk and IslandWalk developments that orient homes on canals and feature a central village center amenity with social, recreational, and commercial services. There is greater emphasis on health and fitness, and socializing, and homes in these communities are generally moderately priced. Shea Trilogy Orlando provides a good example of the “lifestyle” element, having recently completed a 57,000 square foot clubhouse with extensive dining, social, and fitness activities. It features an athletic center, professional demonstration kitchen, sports bar and grill, indoor and outdoor lap pool, resort-style pool, tennis, and artist’s studio. On-site health and fitness trainers offer both classes and personal instruction, and residents can join over 25 special interest clubs. Its not just the ‘hardware’ that creates the lifestyle, its also the ‘software’, the programming implemented by “lifestyle directors” who facilitate the clubs and activities.

Maximizing views by minimizing back-to-back orientations and orienting homes to natural areas or manmade waterways can also attract buyers and generate premiums. Consumers are willing to pay premiums for amenity frontage lots, both for their attractiveness and for the privacy they provide. The desirability of privacy is highlighted by the fact that in The Villages, where most products do not have fences, the fenced Z lots are one of the top-selling new home products. In addition to emphasizing open space and amenity frontage, communities are designing trail systems to be much more organic, combining soft and hardscape trails routed through true natural areas as opposed to more engineered environments such as detention ponds, “fence canyons,” and other inauthentic open spaces.

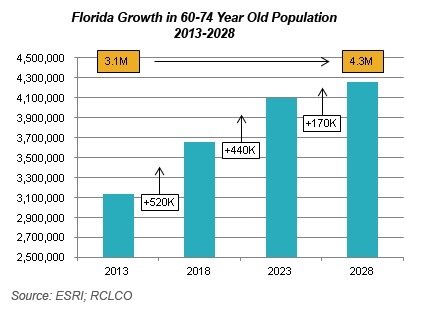

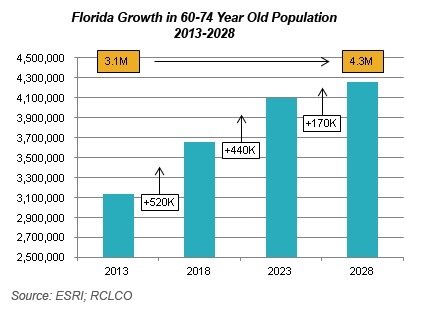

Among the 10 states that are attracting the most 55+ in-migration, seven are in the Sunbelt: California, Arizona, Nevada, Texas, North and South Carolina, and Florida. Although Florida has experienced increased competition from other states, such as North Carolina, it still captures more relocating 55 to 74 year olds than any other state in the nation. Florida is expected to have 4.3 million persons age 60 to 75 by 2028—1.2 million more than in 2013. Population in this age range is expected to increase by 520,000 between 2013 and 2018, and by another 440,000 from 2018 to 2023. Florida has the combination of elements these mature households are seeking: warm climate, moderate housing costs, quality healthcare, and close proximity to the beach. Low taxes are important, but not the most important; if they were, more retirees would be migrating to Alaska or Wyoming. In fact, Florida is ranked 10th in taxes, but first in 55+ migration. It also helps that there are three major interstate highways in the state, with I-75 providing a direct route from the Midwest and I-95 from the Northeast and Mid-Atlantic states, and both providing excellent access from the Southeast.

Among the 10 states that are attracting the most 55+ in-migration, seven are in the Sunbelt: California, Arizona, Nevada, Texas, North and South Carolina, and Florida. Although Florida has experienced increased competition from other states, such as North Carolina, it still captures more relocating 55 to 74 year olds than any other state in the nation. Florida is expected to have 4.3 million persons age 60 to 75 by 2028—1.2 million more than in 2013. Population in this age range is expected to increase by 520,000 between 2013 and 2018, and by another 440,000 from 2018 to 2023. Florida has the combination of elements these mature households are seeking: warm climate, moderate housing costs, quality healthcare, and close proximity to the beach. Low taxes are important, but not the most important; if they were, more retirees would be migrating to Alaska or Wyoming. In fact, Florida is ranked 10th in taxes, but first in 55+ migration. It also helps that there are three major interstate highways in the state, with I-75 providing a direct route from the Midwest and I-95 from the Northeast and Mid-Atlantic states, and both providing excellent access from the Southeast.

A recent RCLCO Advisory noted that The Villages AAC community in Ocala, Florida, continues to be the top-selling master-planned community in the U.S. The Villages maintains hundreds of units in inventory, selling anywhere from 200 to 250 new homes a month, engaging multiple local builders. The community attracts many friends of enthusiastic residents, which has created enviable momentum. While no other community matches The Villages in total annual sales, other Florida AACs are also doing well relative to non-AAC master-planned communities. Many are being developed by builder-developers such as Pulte, Lennar, Taylor Woodrow, Shea, AV Homes, and others. For example, Pulte’s Del Webb Ponte Vedra, located near Jacksonville within the larger Nocatee master-planned community, is currently selling at a rate of 240 homes per year, accounting for about 29% of Nocatee’s total. Del Webb has made significant investments in lifestyle amenities, and benefits from being located near a major metro area, as well as from its desirable Ponte Vedra address. Pulte is one of the biggest players in the active adult arena, in Florida and elsewhere.

Florida’s most successful AACs use sophisticated product segmentation to broaden their appeal and boost sales. While single-family detached product is dominant, about half also offer attached product. Lennar’s Heritage Hills in Clermont, Florida, achieves strong absorption by offering multiple product lines, including attached villas and single-family detached homes on 50’, 60’, and 75’ wide lots. Base home prices range from the mid-$150,000s to the mid-$350,000s. Unit sizes range from 1,400 to 2,900 square feet. Most active adult product in Florida is priced below $350,000, and the best-selling plans tend to be in the 1,900 to 2,100 square foot range.

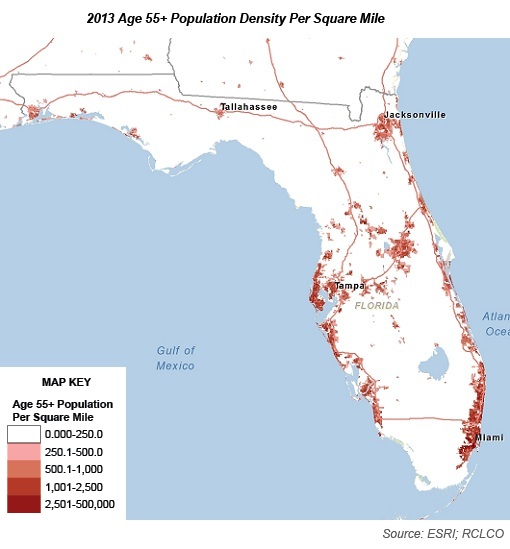

Florida’s 55+ population is concentrated along both coasts: in Southeast Florida and Southwest Florida, as well as around the Orlando metropolitan area and Central Florida where The Villages is located. While the greatest increase in 55+ population is forecast for Central Florida, The Villages is nearing sell-out and expects to be out of the residential development business by 2017 (it will continue with commercial development, development of senior living facilities, and other activities).

Florida’s 55+ population is concentrated along both coasts: in Southeast Florida and Southwest Florida, as well as around the Orlando metropolitan area and Central Florida where The Villages is located. While the greatest increase in 55+ population is forecast for Central Florida, The Villages is nearing sell-out and expects to be out of the residential development business by 2017 (it will continue with commercial development, development of senior living facilities, and other activities).

The best AACs provide tangible value to their customers, allowing them to enjoy an amenity-rich environment at a moderate cost. Successful active adult developers and builders understand that their buyer is typically “downsizing” and looking to simplify life, while reinvigorating their social life. These buyers are looking for ways to lower home maintenance costs and improve their quality of life. Some buyers are also thinking about the future, when their lifestyle may shift from active to less active due to age. Important design components include single-story living and sustainable materials that will reduce maintenance and operational costs. Shea provides one of the more innovative approaches to minimizing operational costs with their SheaXero package, which combines a solar power system with other energy-efficient features to virtually eliminate the homeowner’s electric bill. For households on limited or fixed incomes, reducing or locking in costs are very important considerations.

With The Villages wrapping up residential development in about 2017, it comes as no surprise that many are wondering who will become the next “Villages” by attracting 55+ households on a large scale. St. Joe Company, one of the largest landowners in Florida, believes that the growing 55+ demographic could be the economic driver needed to stimulate activity on about 50,000 acres of its landholdings in the Florida Panhandle, not far from its successful WaterColor development. Unlike WaterColor and nearby Seaside, which both attract wealthy second-home buyers and vacationers, St. Joe Company plans to develop retirement communities similar to The Villages. However, it is not just expecting to clone the success of The Villages and move it north. St. Joe Company’s property, although inland, will have better access to the beach, will not be as densely developed as The Villages, and will focus on healthy, active, environmentally oriented lifestyles. It will also capitalize on the food-fun-and-sun environment of nearby Highway 30A.

While many of the current Florida AACs are doing well, it is critical to continue to do the research and analysis necessary to keep these and newer communities fresh and relevant to an evolving consumer. The most successful active adult communities deliver on their lifestyle promise at a moderate cost. Although long considered a retirement destination by virtue of the legions of retirees that have already made Florida home, forecasts for boomer retirement to Florida suggest the state’s future as a retirement destination is as strong as ever, and many opportunities remain to capitalize on growth in the segment.

Article and Research prepared by Gregg Logan, Managing Director, and Clinton Howell, Associate.

RCLCO provides real estate economics, strategic planning, management consulting, litigation support, fiscal and economic impact analysis, and implementation services to real estate investors, developers, home builders, financial institutions, public agencies, and anchor institutions. Our real estate advisors help clients make the best decisions about real estate investment, repositioning, planning, and development.

RCLCO’s advisory groups provide market-driven, analytically based, and financially sound solutions. RCLCO’s Community and Resort Advisory Group produced this newsletter. Interested in learning more about RCLCO’s Services? Please visit us at www.rclco.com/community-and-resort.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us