Results Forecast an Extended Run for Real Estate Amidst Tax Cuts Sentiment Survey 2017 Part 1

Key Takeaways

- As of year-end 2017, the RCLCO Real Estate Market Sentiment Index (RMI) has increased and now stands above both the midyear 2017 level and predictions from six month ago as to where the index would be headed.

- Looking ahead, real estate is expected to experience moderately declining market conditions through 2018; however, the RMI is expected to remain above 60, indicating relatively healthy market conditions.

- The tax overhaul is expected to have minimal to moderate effects on the real estate market, skewing slightly towards overall better market conditions, although home values in high-cost markets and the LIHTC sector may take a hit.

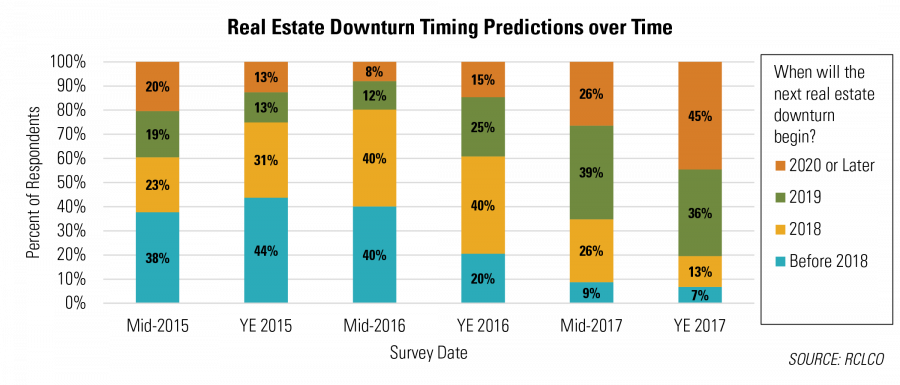

- Nearly half of survey respondents now expect the next real estate downturn to be in 2020 or later, which puts the next cyclical peak significantly later than in previous surveys.

Introduction

Over the past year, RCLCO sentiment surveys have pointed towards sustained confidence in the current real estate market, rebounding from lower levels experienced leading up to and after the Brexit vote and a deteriorating stock market in mid-2016. The unexpected outcome of the 2016 U.S. presidential vote, and hopes that a GOP-controlled Congress would usher in business-friendly policies that would lead to continued expansion in the U.S. economy and real estate markets, nudged the RCLCO sentiment index back in a positive direction by year-end 2016. As the stock market rallied during 2017, respondents became increasingly optimistic about the real estate market, resulting in a more positive sentiment in this year-end 2017 survey than in the midyear 2017 survey. Respondents believe that the expansion will continue, as evidenced by a more positive outlook for the next 12 months than in the previous survey. Furthermore, respondents continue to push out the next downturn farther into the future.

The impact of the tax overhaul on the U.S. real estate market is a key focus of this survey. RCLCO asked respondents whether they believed the tax overhaul would stimulate the economy and positively influence real estate markets, and what the likely real estate sector winners and losers would be?

Overall, real estate market participants are somewhat more optimistic about the current and near-term future trajectory of the economy and real estate markets than they were six months ago. And while most real estate sectors and geographic markets are firmly in the “late stable” stage of the cycle, close to one-half expect the upturn phase of the cycle to last until at least 2020.

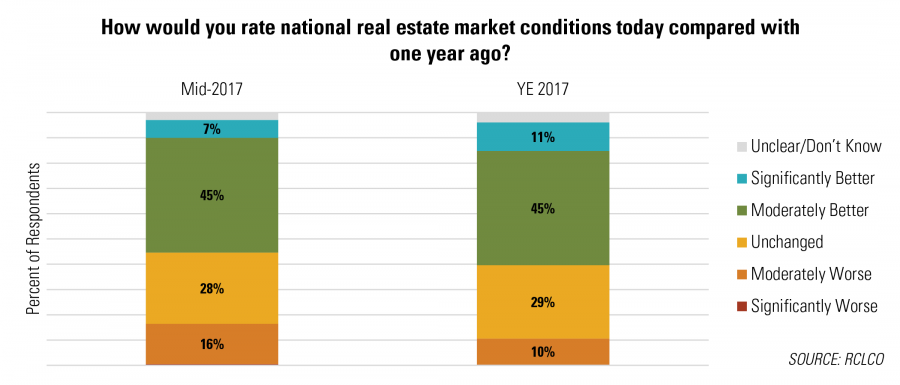

Overall Sentiment Is Up Slightly, Diverging from Previous Predictions

Sentiments about current national real estate conditions remain at a relatively high level, and slightly above where they were six months ago. Over one-half (56%) of survey respondents say national real estate market conditions are moderately or significantly better today than they were 12 months ago. This is four percentage points higher than in the midyear 2017 survey and the same as in the year-end 2016 survey. The share of respondents reporting worse market conditions today than one year ago remains a small minority (10%) and is shrinking compared with the results from the last survey (16%).

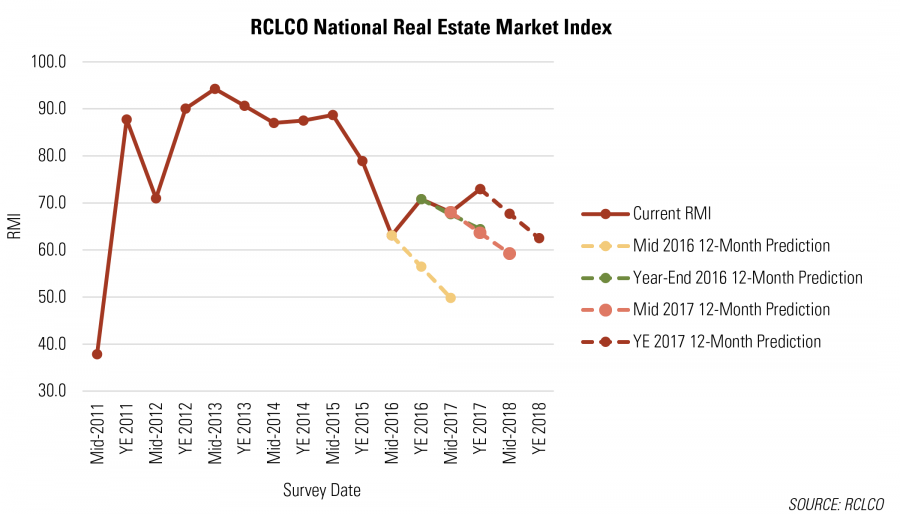

This increase in sentiment is reflected in RCLCO’s Real Estate Market Index (RMI),[1] which measures sentiment on a 100-point scale. The RMI increased to 72.9 in this survey, which is 4.9 points above where it was six months ago. This increase was not anticipated by respondents in the year-end 2016 and midyear 2017 surveys, who respectively predicted the current RMI to be 64.4 and 63.6 at year-end 2017. While current sentiment is the highest it has been since year-end 2015, respondents expect sentiment to decline to the low-60s within the next 6-12 months.

Since the abrupt decline in midyear 2016, sentiment has broken its downward trend. Current sentiment is higher than it was six months ago and is at its highest level since year-end 2015. With RMI stabilizing in the range of 68 to 73, real estate markets continue to experience very good market conditions that are indicative of the mature phase of the current real estate cycle.

Sentiment reached its lowest point since midyear 2011 in midyear 2016, with the RMI falling sharply from 78.9 in the year-end 2015 survey to 63.1 in midyear 2016. The decrease in sentiment was reflective of respondents’ unease about the future due to the Brexit vote, declining oil prices, and a struggling stock market. This unease resulted in 80% of respondents anticipating the next recession to start in 2018 or sooner and an expectation from respondents that RMI would continue to trend downward to the low-50s within 12 months.

Year-end 2016 respondents exhibited increased optimism for the health of real estate markets, which was largely attributed at that time to the anticipated positive impacts of the newly elected president, with the support of a Republican congress. By midyear 2017, current sentiment remained close to its year-end 2016 level, but only a third of respondents still expected President Trump to have a positive impact over the next 12 months.

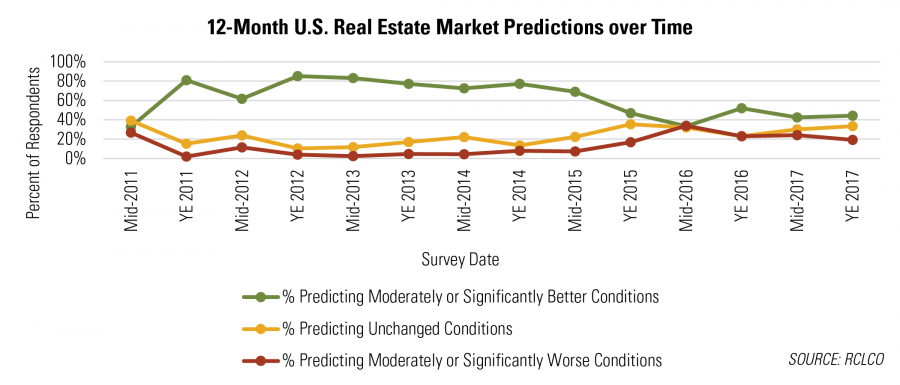

Whatever the cause, sentiments have remained relatively stable through the year-end 2017 survey: 44% of respondents expect real estate market conditions to improve over the next 12 months, which is in line with 43% of respondents six months ago. While the percentage of year-end 2017 respondents who expect real estate market conditions to improve is below year-end 2016 (52%), it is still well above the 33% of respondents in the midyear 2016 survey. The percentage of respondents anticipating worse conditions within the next 12 months is even lower in this survey (19%) than in the previous survey (24%). The improved overall outlook when compared with the previous survey is not a result of more respondents expecting improved conditions, but rather to a larger proportion of respondents believing that future conditions will be unchanged and a lower percentage believing that conditions will be worse in the next 12 months.

Impact of the Tax Overhaul Is Expected to Be Modest

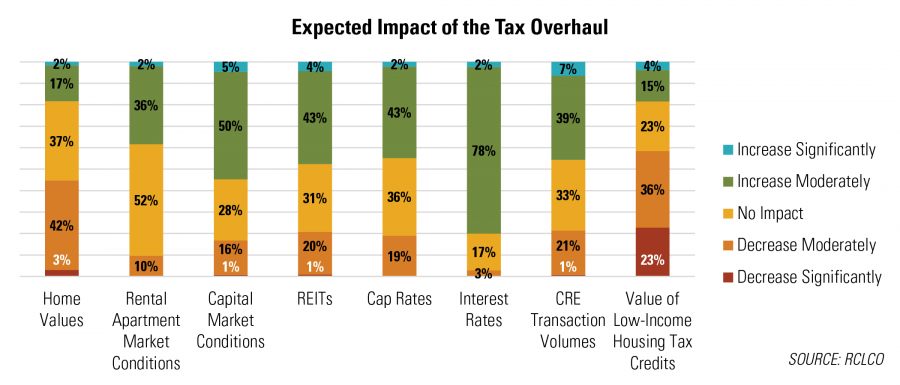

The massive “Tax Cut and Jobs Act” (TCJA) passed in late 2017, leaving many wondering what the impact will be on U.S. real estate markets. Respondents to the year-end 2017 RCLCO survey were asked what impact the tax overhaul would have on various real estate indicators and market conditions. The main takeaway is that most expect the tax overhaul to have only moderate effects on real estate. A number of respondents said that it was too early to tell what the effects of the bill would be given the lack of clarity about the details of the legislation, and up to a quarter of respondents said that they did not know what impact the tax overhaul would have on several important economic indicators affecting real estate, including home values, interest rates, and cap rates.[2]

Nearly 80% of respondents who have an opinion forecast that interest rates will increase moderately as a result of the new tax law. Otherwise, respondents believe the tax overhaul will slightly improve or have minimal impact on real estate market conditions and indicators, with two key exceptions: Low-Income Housing Tax Credits (LIHTC), and home values in high-cost and high-tax areas.

Nearly a quarter of respondents forecast that the value of Low Income Housing Tax Credits (LIHTCs) will decrease significantly, and 36% believe the value of LIHTCs will decrease moderately. The thinking is that the decrease in the corporate tax rate from 35% to 21% in the new tax law will substantially reduce the value of corporate tax exemptions.

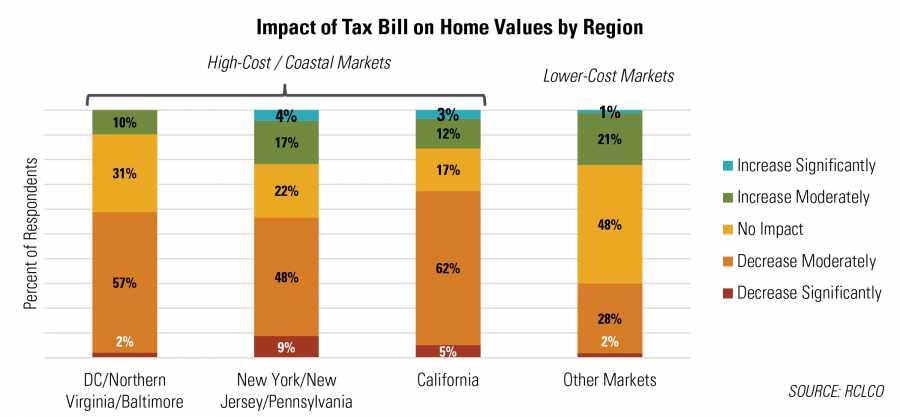

With respect to home prices, the tax overhaul reduced the mortgage interest deduction from $1 million to $750,000 and introduced a cap of $10,000 on state and local tax deductions, making owning a home in high-cost markets and markets with high state and local taxes more costly. A higher percentage of respondents active in generally high-cost and high-tax markets predict that the tax overhaul will decrease home values than respondents active in generally medium- and low-cost markets: 57% or more of respondents in high-cost markets anticipate that the tax overhaul will decrease home values, compared with 30% in other markets. But even in high-cost markets, very few respondents expect home price decreases to be significant.

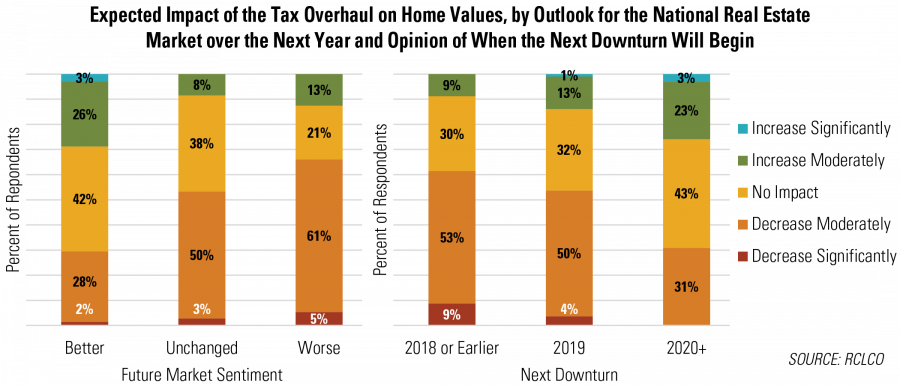

Although very few respondents believe that the tax overhaul will have significant impacts on real estate, optimism about real estate markets and belief that the tax law will have positive impacts on real estate appear to be strongly correlated. Those who anticipate that real estate market conditions will be worse within the next 12 months are more likely to believe that the tax law will negatively affect home values than those who predict real estate market conditions will improve over the next 12 months (66% vs. 30%). In addition, respondents who expect that the next downturn will begin before 2020 are more likely to believe that the tax law will negatively impact home values than those who predict the downturn will begin in 2020 or later.

Let the Good Times Roll

Nearly half of year-end 2017 respondents (45%) believe that the downturn will not begin until 2020 or later, a substantial increase from the 26% in the last survey. Roughly the same percentage of respondents in the current survey as in the last survey believe that the next downturn will begin in 2019 (36% and 39%, respectively), and many fewer respondents (13%) predict a downturn in 2018, compared with 26% in the midyear 2017 survey. Fewer than 10% of respondents believe the downturn has already begun. As has been the case in previous surveys, respondents continue to push the anticipated downturn farther into the future.

Up Next—Part 2

In the next installment of the 2017 year-end Sentiment Survey, RCLCO will do a deeper dive on the product types and sectors that are still performing well and those that are expected to outperform in 2018, and offer RCLCO’s take on the near-term prospects for U.S. real estate.

Who Took the Survey?

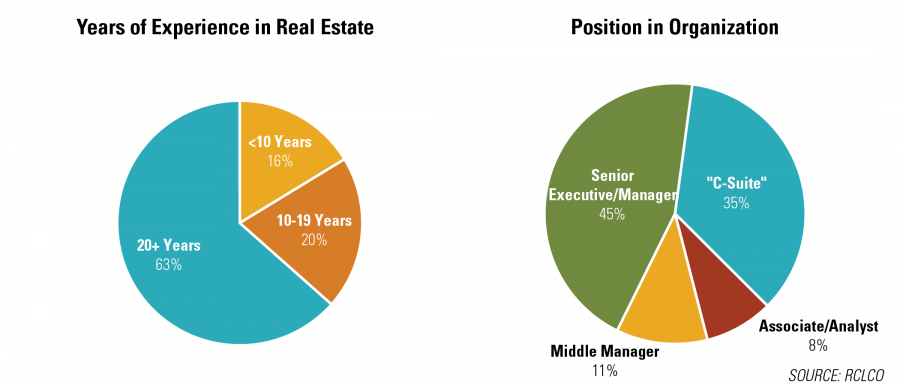

RCLCO’s Market Sentiment Survey tracks the sentiments of a highly experienced pool of real estate professionals from across the country and across the industry. Two-thirds of respondents have worked in the real estate industry for 20 years or more, and 80% of respondents are C-suite or senior executives in their organizations.

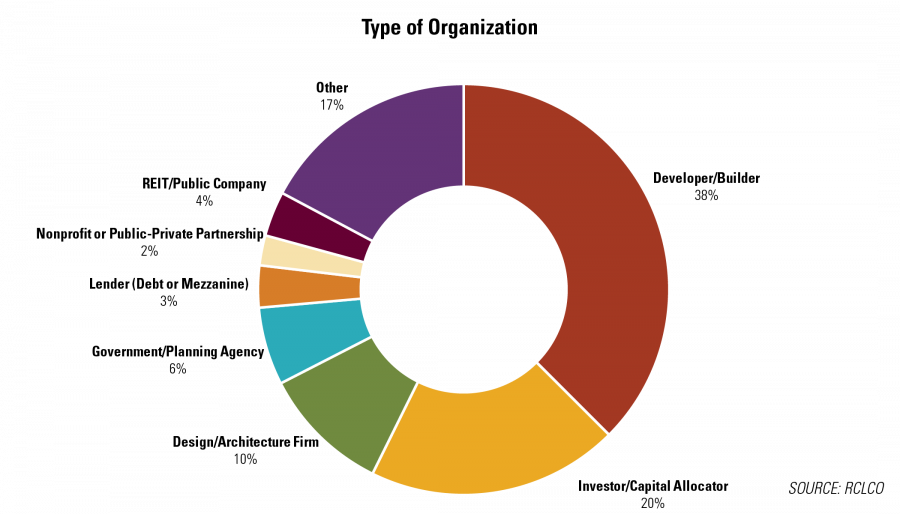

Developers and builders comprise the largest share of respondents, at 38% of the sample. Another 20% are investors or capital allocators, followed by 10% in design or architecture firms. The remaining one-third of respondents come from a variety of other types of organizations within the real estate industry.

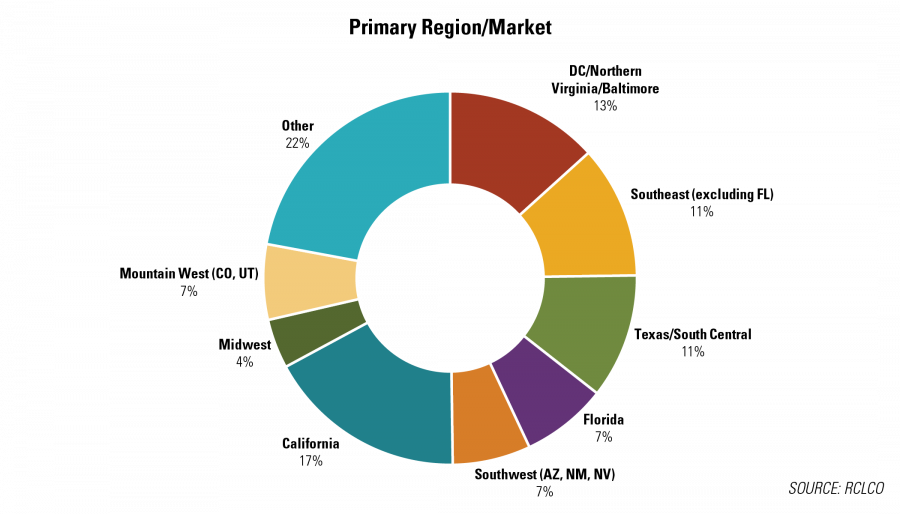

The respondent mix is representative of the U.S. as a whole; however, it is weighted towards those who report working primarily in coastal and Sunbelt markets. This respondent mix reflects markets where there has been significant development activity in this cycle.

Click here to read Part 2 of our Year-End 2017 Sentiment Survey findings >>

Article and research prepared by Len Bogorad, Managing Director, and John Rendleman, Associate.

References

[1] The Real Estate Market Index (RMI) is based on a semiannual survey of real estate market participants and is designed to take the pulse of real estate market conditions from the perspective of real estate industry participants. The survey asks respondents to rate real estate market conditions at the present time compared with one year earlier (Current RMI), and expectations over the next 12 months (Future RMI). The RMI is a diffusion index calculated for each series by applying the formula “(Improving – Declining + 100)/2.” The indices are not seasonally adjusted. Based on this calculation, the RMI can range between 0 and 100. RMI values in the 60 to 70+ range are indicative of very good market conditions. Values below 30 are typically coincident with periods of economic and real estate market stress/recession.

[2] All percentages below regarding impact of the tax overhaul are based only on respondents who had an opinion.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us