Strategy for Real Estate Companies: How to Manage for the Cycle – Part 2

Part 2: Real Estate Market Cycle Stages and Strategies

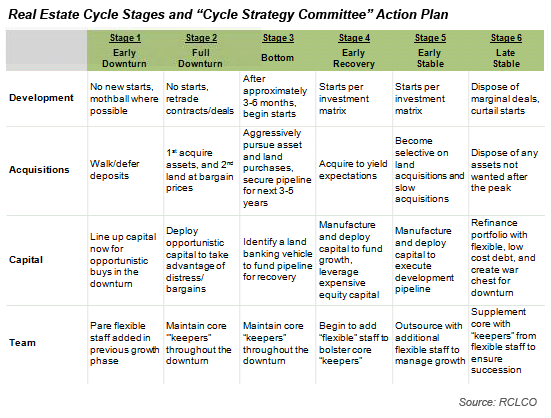

In the previous installment (see: Part 1: Real Estate Market Cycles – Making the Call) we discussed the importance of “knowing” where your company, your markets, and your real estate segments are on the cycle, and having a point of view about the near- and mid-term consequences for your business. In this second installment, we discuss various real estate cycle “stages,” and what companies in the real estate industry should be doing in response to changing economic and real estate market conditions, both on the way up and on the way down.

Real Estate Market Cycles Stages

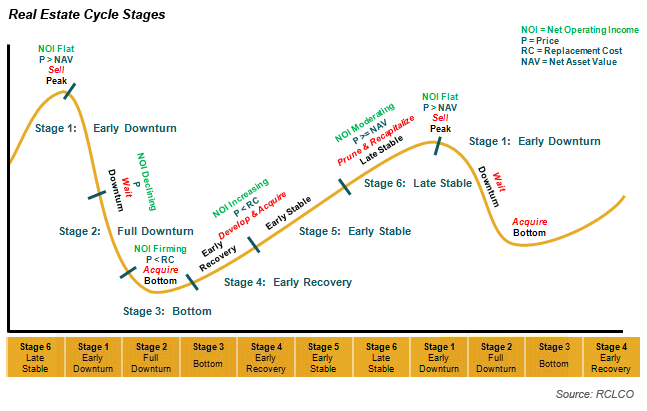

First of all, what are the various “stages” of the cycle, and how do I know where I am? That part is simple, and for most real estate concerns it boils down to trends in income and the relationship between price and asset value and/or replacement cost. If you can divine the relationship between these few variables, you will have a better than average view of the real estate cycle. Trouble is, of course, clear patterns in these variables are not always easy to identify.

Stage 1 – Early Downturn

Following a cyclical peak, the economy and real estate markets enter the downturn. This is the stage when income, prices, and asset values are all falling. Credit is typically harder to come by on attractive terms, if at all, and most market participants try to go into sleeper mode. Developers curtail starts and mothball deals where possible. Acquirers try to defer, retread, and in many cases walk on deposits. This is the time when savvy real estate players begin to line up capital for opportunistic buys in the downturn. This is also the time when real estate companies pare down their overhead, ideally with flexible staff added in latter part of the previous growth phase, and work hard to keep their “keepers.” Companies that reach this stage without having deployed intermediary cycle strategies will be ill prepared. They should have positioned themselves to take advantage of such adverse conditions. Instead, they become those who create opportunities for others. At this stage, the company’s strategic activities must be reevaluated. Investments and activities that made sense in a growing economy, and still worked in a slowing economy, may make little sense in a severe downturn. This is the stage at which the company is focused on weathering the downturn.

Stage 2 – Full Downturn

As the downturn takes hold, companies should continue monitoring “trip wires” and be prepared if and when it will be necessary to move to a full-blown survival mode. For a company to resort to survival, the market has turned so severely that senior management must seriously evaluate the company’s future as a going concern. At this stage new development activities are abandoned, and further cuts in G&A are made to size operating costs to the size of the company. Rarely, companies emerge from survival mode without radical changes. Most simply don’t survive. The object, of course, is to avoid going into survival mode. Indeed, success in this stage derives from having capital and the capacity to capitalize on the opportunities created by the failure of those who were caught ill-prepared. In this stage, most developers refrain from starting any new projects and try to renegotiate contracts and retrade deals wherever possible. Real estate companies that have developed a war chest in the waning stages of the expansion begin to deploy opportunistic capital to take advantage of distress and attractive pricing that is offered by those that did not plan well. As prices are typically below replacement cost, this is the time to buy assets, first, and then land, at bargain prices.

Stage 3 – Bottom

Again, it typically takes three to six months before most market participants will “know” that the bottom of the cycle has been reached. And it is probably okay to miss the bottom by a quarter or two; missing the peak can cause much more damage. Gutsy call to make, and you have to have the capital, but this is absolutely the best time to begin development projects and make acquisitions. Prices are still likely well below replacement costs; construction labor and material costs have either stalled, or, in some cases, have come down; and the pipeline of competitive project starts has been held largely in check during the downturn. Real estate companies should aggressively pursue asset and land purchases in an effort to secure a pipeline of projects that will sustain the organization for the next three to five years. If I only knew then what I know today, wow?!

Stage 4 – Early Recovery

By the time the market has moved into this stage, everyone generally knows, or acknowledges, that the market has passed the bottom, and while there is still some nervousness regarding the robustness of the recovery, market participants and capital are again entering an increasingly competitive marketplace. Prices are still somewhat below replacement costs, and development and acquisitions should be made according to the company’s investment/yield matrix. This is the time when real estate companies will want to identify and deploy less expensive debt capital to fund growth and leverage expensive equity capital. With regard to overhead, this is the time to begin to add staff to bolster the core group of “keepers” that you were able to keep during the downturn.

Stage 5 – Early Stable

This is the stage that comes closest to representing equilibrium in the real estate markets. Because it takes time for real estate companies to gear up and deliver new projects to the market, there remains some pent-up demand and forward momentum in the marketplace. Prices are increasing and are close to matching or exceeding replacement costs. Most developers continue to start new projects per their investment/yield matrix. However, this is the time when acquirers should become more selective on land acquisitions that will take time to bring to market, and asset acquisitions should be slowed by virtue of increasing hurdle rates to eliminate marginal deals. Real estate companies need to continue to manufacture and deploy both debt and equity capital to execute the development pipeline. And organizations should look for opportunities to outsource with flexible staff or partner to manage growth and avoid the age-old problem of expanding and contracting overhead like a well-worn accordion.

Stage 6 – Late Stable

In the late stable portion of the cycle leading up to the peak, prices that market participants and investors seem to be willing to pay for assets (be they finished lots, raw land, stabilized income-producing assets, etc.) exceed asset values—not the inflated sugar-plumbs-dancing-in-your-head values, the real, or, even, reasonable values of the asset. If you are anything other than a very low-leverage long-term (as in generational) owner of real estate, this is the time to sell. This is the time to dispose of any marginal assets, or assets that are not wanted after the peak. This is also the time to refinance your portfolio with flexible, low-cost debt, and create a war chest for the downturn to take advantage of dislocations in the market. One of the hardest decisions real estate executives have to make is to sell into what may feel like a continuing expansionary market. However, you must have courage to sell into an upturn. The downside is that you may leave some money on the table between the time you sell and the actual peak. But by pulling the trigger sooner on assets you want to sell, you avoid not being able to sell them after the peak. At the peak, the market turns in an instant from a sellers’ market to a buyers’ market, and it may be very challenging to sell any asset you wanted to, at least at the price you had hoped for.

Market Monitoring & Cycle Stage Declaration

Okay, so that all makes sense, and sounds super easy to figure out what to do once you are sure what cycle stage you are in fact in—but I still am not sure how I will really “know.” Repeat—you will never really know—but you should have a point of view and a conscious consensus among those charged with executing the company’s strategy in order to avoid the natural tendency to shrug this off because you will never know with perfect clarity.

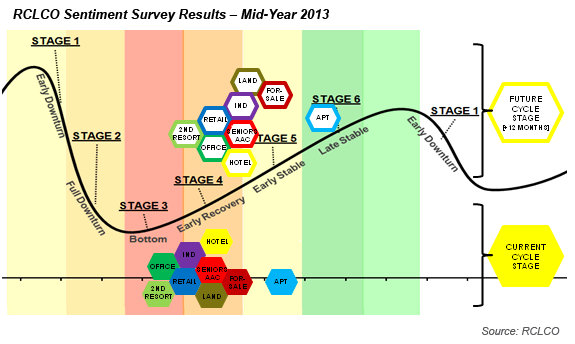

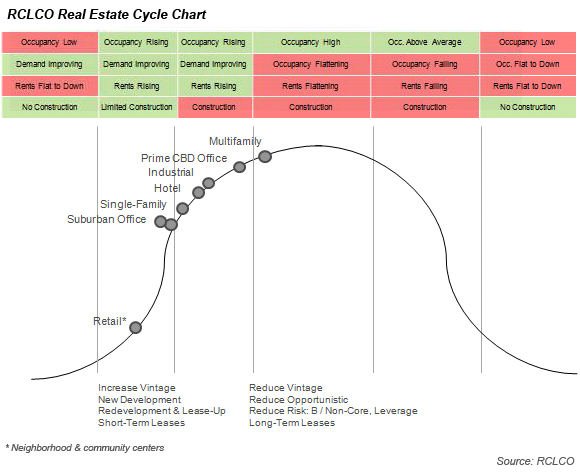

Where you are now depends significantly upon the market, and even submarket, in which you are active, and the type of real estate business you’re in. In the last year, great strides have been made across all sectors of real estate. In RCLCO’s Q3 2012 Market Sentiment Survey, multifamily rental apartments led the pack in Stage 4-Early Recovery, as other land uses continued to bump along the bottom. The most recent survey results in mid-year 2013 told quite a different story. The resort/second home and office sectors were nearing Stage 4-Early Recovery, and all other sectors with the exception of multifamily rental were steadily climbing towards Stage 5-Early Stable. Stay tuned for the year-end 2013 results early in 2014.

These RCLCO Sentiment Survey results from mid-year 2013 were fairly consistent with the most recent RCLCO U.S. Real Estate Chart Book published in November 2013. In this version, multifamily continues to lead the way with construction in most markets and occupancy beginning to flatten out, which is consistent with markets moving from Stage 5-Early Stable to Stage 6-Late Stable. Construction is well underway in core CBD office markets and some hotel markets. The single-family sector, and land with it, have improved significantly in the first three quarters of the year.

Over the years, I have searched for the Holy Grail, the perfect set of trip wires, the sublime algorithm that would tell me to the fifth decimal point exactly where the economy and real estate market are at this moment and where they will be six months from now?! And I have found it, twice. Twice I have constructed a set of indicators that did a perfect job of describing the past 11 cycles, and even would have given me early warning “trip wire” indicators three to six months before a change from one stage of the cycle to the next. The problem is that these algorithms only worked perfectly looking backwards, and they were not particularly effective at predicting the current cycle, let alone the next one.

Turns out that a cycle graph is not a particularly good metaphor for what actually happens in the economy or real estate markets. A much better metaphor is a wave crashing onto a beach—each one has a different height and amplitude. They look somewhat similar, but no two seem to break in exactly the same way, and each is influenced by a unique set of circumstances, wind, tide, and turbidity. (Come on, how many times does a real estate guy get to write “turbidity?!”)

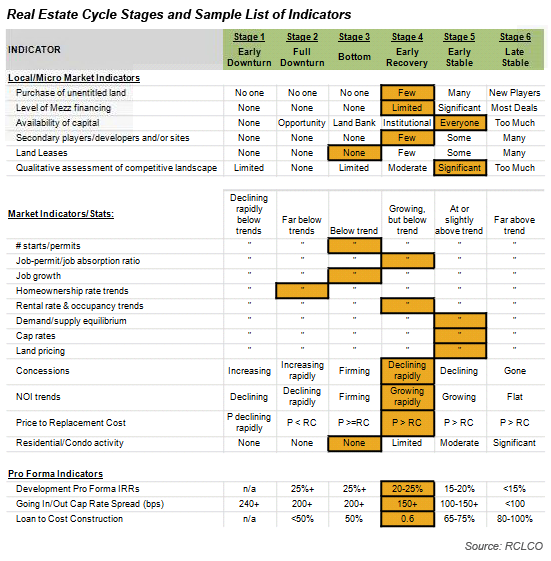

The better course of action is to identify a series of indicators that are specific to your business, your real estate sector(s), and your market(s)—some may be quantitative, while others may be purely qualitative but still no less valuable in determining your particular cycle stage. My advice is to rely on a combination of internal company data—often this is timelier than secondary source data—and external factors.

Your company’s “Cycle Strategy Committee”—whether that is a committee of one, or the entire leadership team—should convene on a regular basis, say quarterly, semi-annually, or more frequently as rapidly changing market conditions may dictate, to review, discuss, and debate the various factors that feed into your company’s trip wire model.

If this committee meets quarterly, it should declare a cycle stage for the current quarter, compare that with the stage from the previous quarter, and predict the expected stage for the next quarter and the expected velocity with which the market is expected to change. The committee should then consider which, if any, of the predetermined cycle strategies to deploy in the face of this consensus view of the world in which the company operates. And, above all, resist the temptation to rationalize away the information that is staring you in the face.

Simple, Right?

Early planning and ongoing monitoring will help provide real estate executives with the tools necessary to avoid getting in trouble. First, you need to have a comprehensive strategy for all portions of the real estate cycle. Then, you need to be nimble as you shift your activities from one strategic initiative to the next—from growth to hesitation to rationalization strategies. Lastly, you need to be able to anticipate so you can be among the first, not last, to realize what is going on and do something about it before it is too late. As you plan for and ultimately implement your cycle strategy, you must be prepared to act decisively, as history has shown how companies that hesitated too long often failed.

By my reckoning, we all have anywhere between eight and 38 months to get our cycle strategies in order before the next peak?! As the “head coach” of your real estate enterprise, be sure to huddle between games with your assistant coaches, figure out your game plan, write down all the possibilities, laminate your play card, and don’t forget to refer to it during the game.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us