Shining Light on a Shadow Market: Understanding the Single-Family Renter

Evolution from Shadow Market to Institutional-Grade Product

Single-family renter households have been growing in prominence throughout the U.S., particularly in markets that were hit hardest by the Great Recession and/or where for-sale affordability remains a challenge. Whether a result of income limitations, credit issues, the stage of life of the household members, local market pricing and supply/demand fundamentals, or other reasons, millions of households fall into the single-family renter category. Previous RCLCO research investigated the dramatic increase in single-family home rentals over the prior decade to better understand the market conditions driving single-family home rentals.

The increase in the size of the single-family rental market during the past decade, coupled with the ongoing institutionalization of the single-family renter market, have transformed this real estate product from an informal economy to a professionalized product. Historically, the single-family rental market has been a space reserved for individual “mom & pop” landlords operating in the shadow market. However, the terrain has been shifting dramatically in the fallout of the Great Recession.

Between 2005 and 2014, single-family rentals in the U.S. accounted for 90% of the net increase in occupied single-family stock and nearly two-thirds of the increase in total occupied units.[1] Private equity funds were some of the first institutional investors to recognize the market opportunity for purchasing, improving, and renting homes that could be purchased at bargain prices relative to the peak levels of the housing bubble. In recent years, some developers have also been delivering purpose-built, single-family rental projects to capture this growing market opportunity.

Single-Family Renters: Emerging Opportunity for Investors and Developers

In order to better understand the single-family renter market segment, RCLCO selected the five metro areas that have seen the largest volume of institutional investor activity in single-family rentals: Atlanta, Dallas, Houston, Phoenix, and Tampa. By combining and analyzing the households in these markets utilizing 2014 Census data, we were able to provide a detailed portrait of the demographic characteristics of this market segment.

One in Five Single-Family Households Rent their Homes

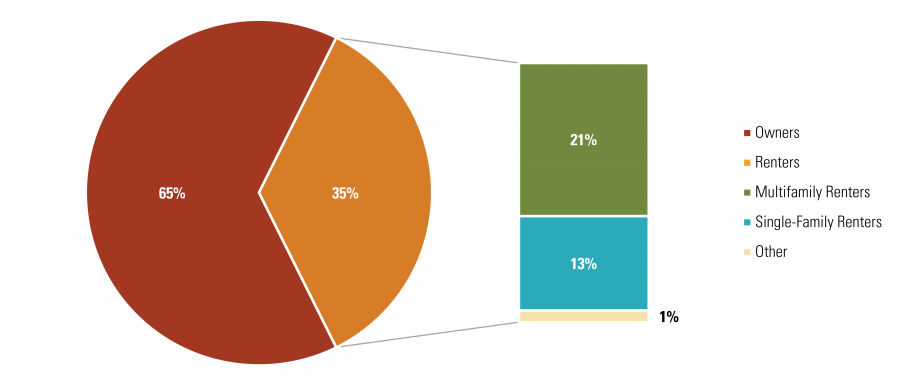

In these five metros, renters account for 35% of households, and 37% of those renters rent single-family homes. Three-fourths (76%) of households live in single-family residences; 19% of these households rent, while the remaining 81% own.

Breakdown of Owners Versus Renters

SOURCE: U.S. Census Bureau

Single-Family Renters Are More Likely to Be Unmarried, and to Have Children and Bigger Families

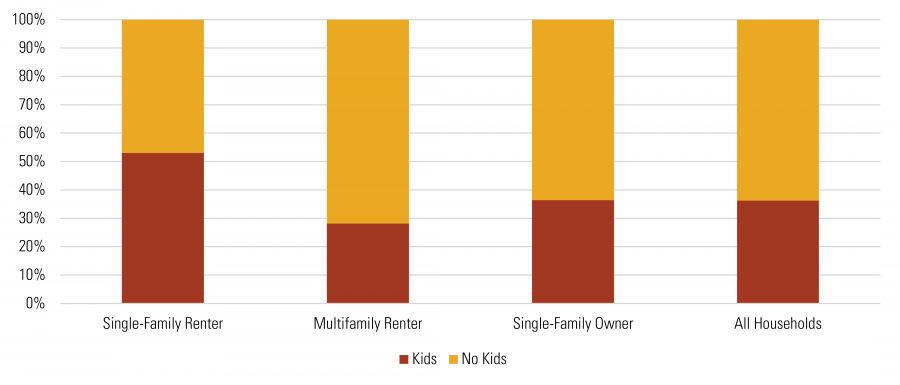

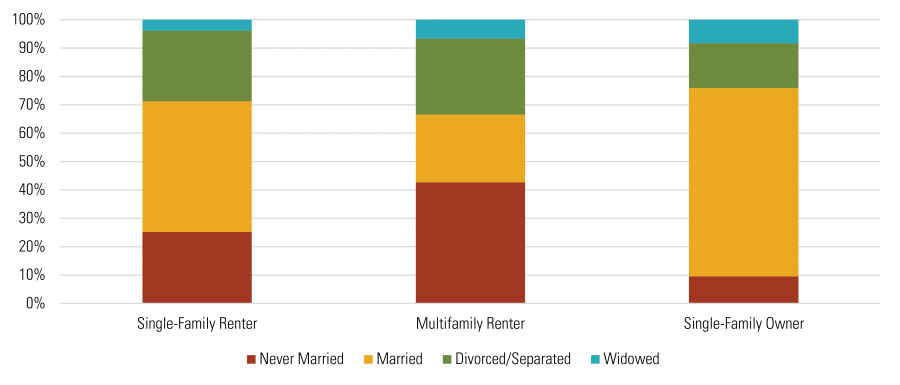

Single-family renters are more likely to have children at home, and are also likely to have more children, than either multifamily renters or single-family owners. Over one-half (53%) of single-family renters have kids at home, much higher than either multifamily renters (28%) or single-family owners (36%). Intuitively this metric makes sense, as families with children, and particularly multiple children, usually desire more bedrooms, living space, and outdoor play area than multifamily buildings typically offer. The lower percentage of single-family owners with kids may be due to the “empty nester” effect, whereby single-family owners remain in their home once their children are grown and have moved out. It is interesting to note that while the percentages of divorced/separated households and widowed households are roughly equivalent between single-family and multifamily renters, 46% of single-family renters are married while 25% have never married. The opposite is true for multifamily renters: 24% are married, and 43% have never married. Single-family owners, by comparison, are even more heavily skewed toward married couples (66%): significantly smaller percentages have never married (10%) or are widowed (8%) or divorced/separated (16%).

Presence of Children

SOURCE: U.S. Census Bureau

Marital Status

SOURCE: U.S. Census Bureau

Incomes Lag Behind Single-Family Owners, Ahead of Multifamily Renters

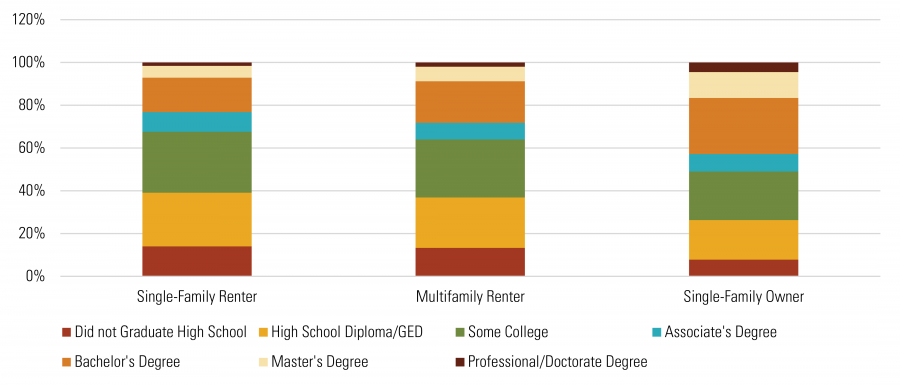

Renters, regardless of whether they live in a single-family or multifamily unit, have a similar distribution of educational attainment. Single-family renters, however, are less likely than single-family owners to have earned a college or graduate degree. Only one-third of single-family renters have an associate’s degree or higher, while just over one-half of single-family owners have an associate’s degree or higher.

Educational Attainment

SOURCE: U.S. Census Bureau

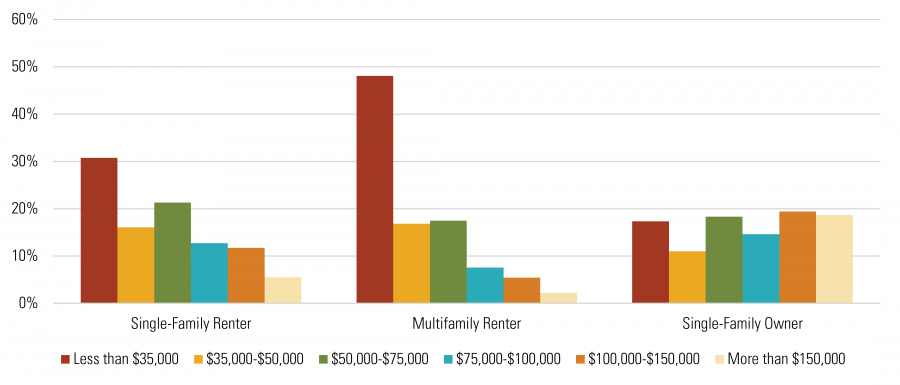

This difference in education is mirrored in household income: 39% of single-family owners have annual incomes of $100,000 or more, versus 19% for single-family renters. The income disparity is even more extreme with multifamily renters: only 10% of multifamily renters have incomes of $100,000 or more. On the low end of the income range, multifamily renters make up the largest portion of renters with annual incomes under $35,000, with nearly 48% falling into this category. Only 31% of single-family renters fall into this lower-income bracket, and even a lower percentage (17%) of single-family owners fall into this range.

Income Distribution

SOURCE: U.S. Census Bureau

Single-Family Renters Spend More on Rent, Same Share of Income as Multifamily Renters

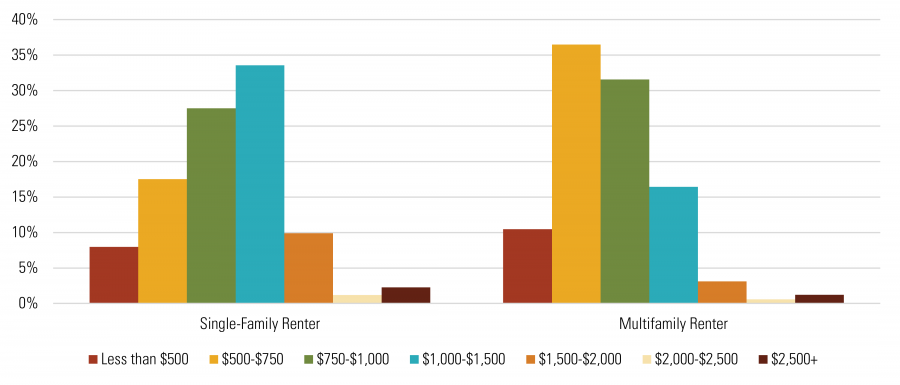

Finally, we investigated the absolute rent that tenants pay and the relationship of rent to income. Single-family renters and multifamily renters pay similar shares of income in rent, but with their higher average incomes single-family renters pay higher rents than multifamily renters. Roughly one-half (53%) of single-family renters pay less than $1,000 on monthly rent, compared with 79% of multifamily renters. This difference is most likely due to the premium placed on single-family housing units, along with larger average unit sizes.

Rent per Month

SOURCE: U.S. Census Bureau

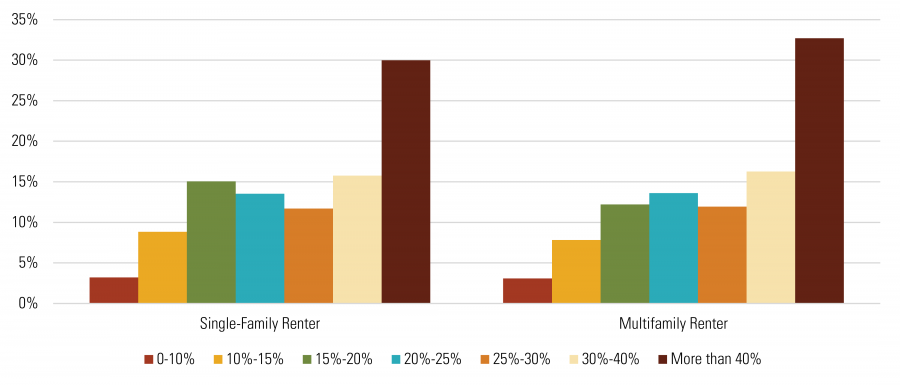

Rent as a Percentage of Income

SOURCE: U.S. Census Bureau

References

[1] Rachel Bogardus Drew, “A New Look at the Characteristics of Single-Family Rentals and Their Residents,” Working Paper W15-6, Joint Center for Housing Studies at Harvard University, July 2015, accessed 10/13/2016 http://goo.gl/jLoKRl

Article and research prepared by Derek Wyatt, Vice President; Mark Simpson, Senior Associate; and Taylor Neiman, MBA Intern.

RCLCO provides real estate economics and market analysis, strategic planning, management consulting, litigation support, fiscal and economic impact analysis, investment analysis, portfolio structuring, and monitoring services to real estate investors, developers, home builders, financial institutions, and public agencies. Our real estate consultants help clients make the best decisions about real estate investment, repositioning, planning, and development.

RCLCO’s advisory groups provide market-driven, analytically based, and financially sound solutions. Interested in learning more about RCLCO’s services? Please visit us at www.rclco.com/expertise.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us