Sentiment Survey 2018 Year-End: Downturn on the Horizon

In this Report:

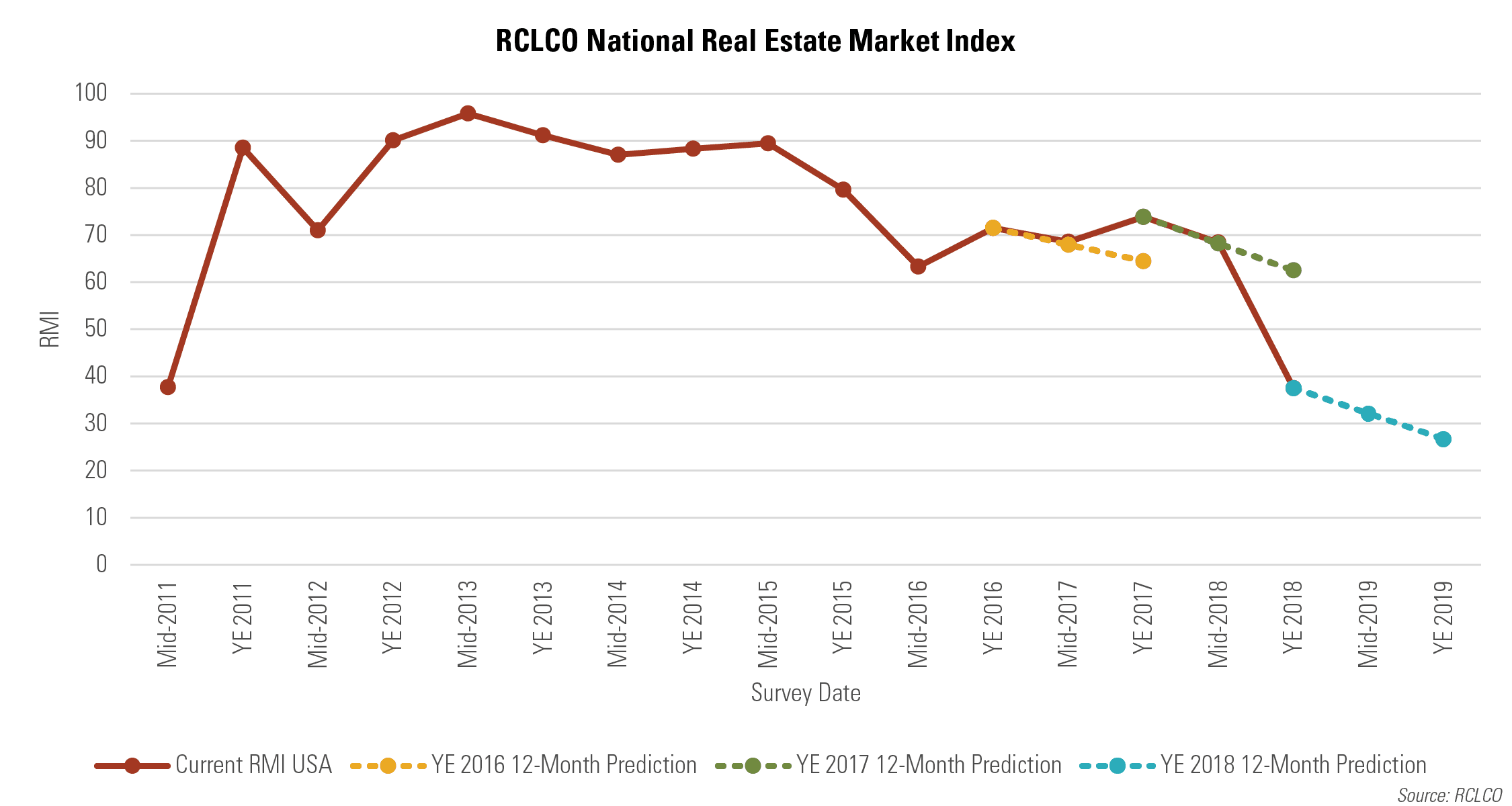

- The RCLCO Real Estate Market Sentiment Index (RMI) has decreased since mid-year 2018 from 68.0 to 37.5, a much more dramatic decline than respondents anticipated six months ago.

- Looking ahead, real estate is expected to experience deteriorating market conditions over the next 12 months, as the RMI is expected to drop into the mid-twenties.

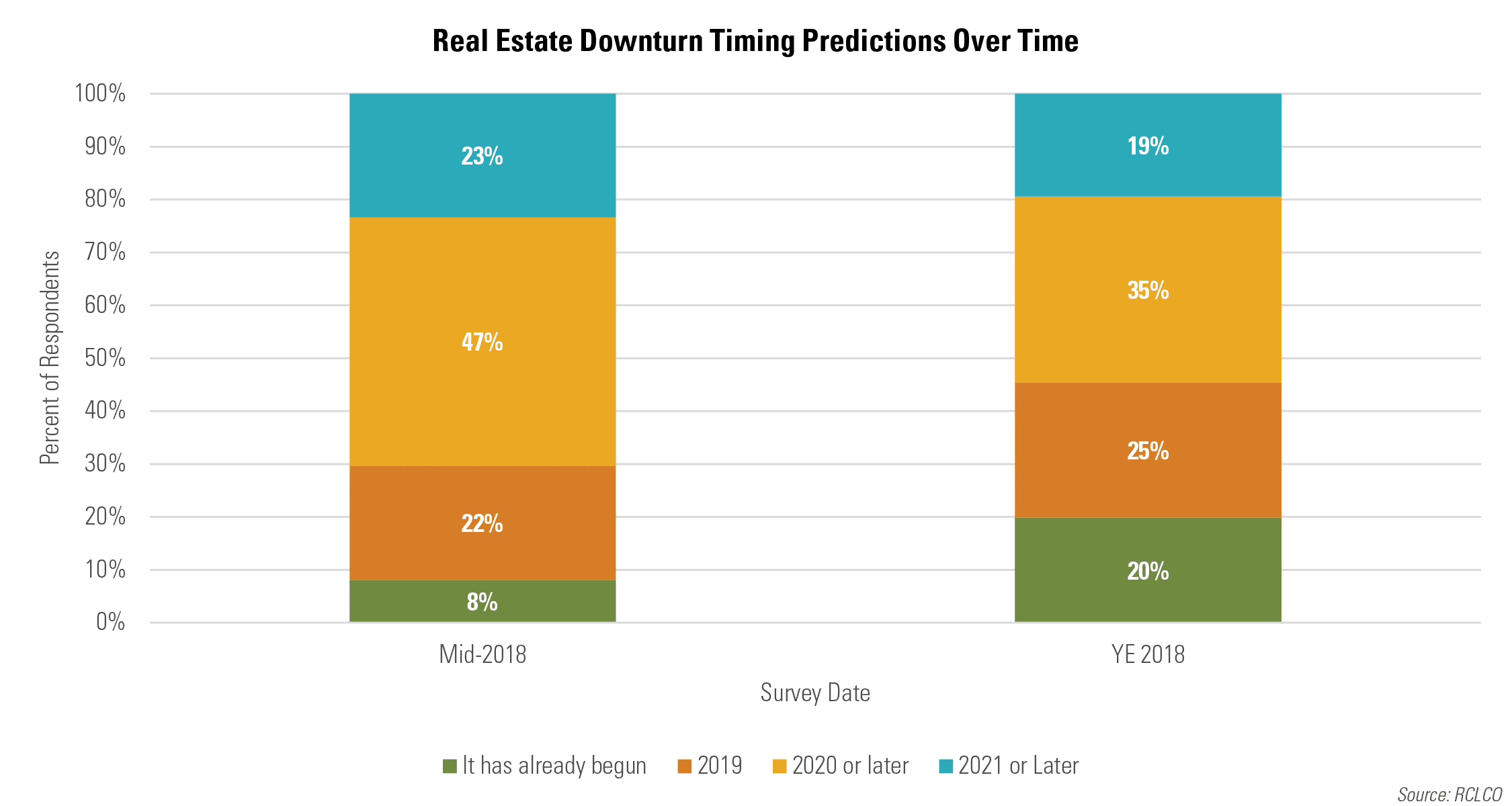

- One-fifth of survey respondents (20%) now believe that the downturn has already begun, a significantly more pessimistic view than in previous surveys. Just under one-half of survey respondents (46%) now believe the downturn has already begun or will start in 2019, a 16 percentage point increase from the mid-year 2018 survey.

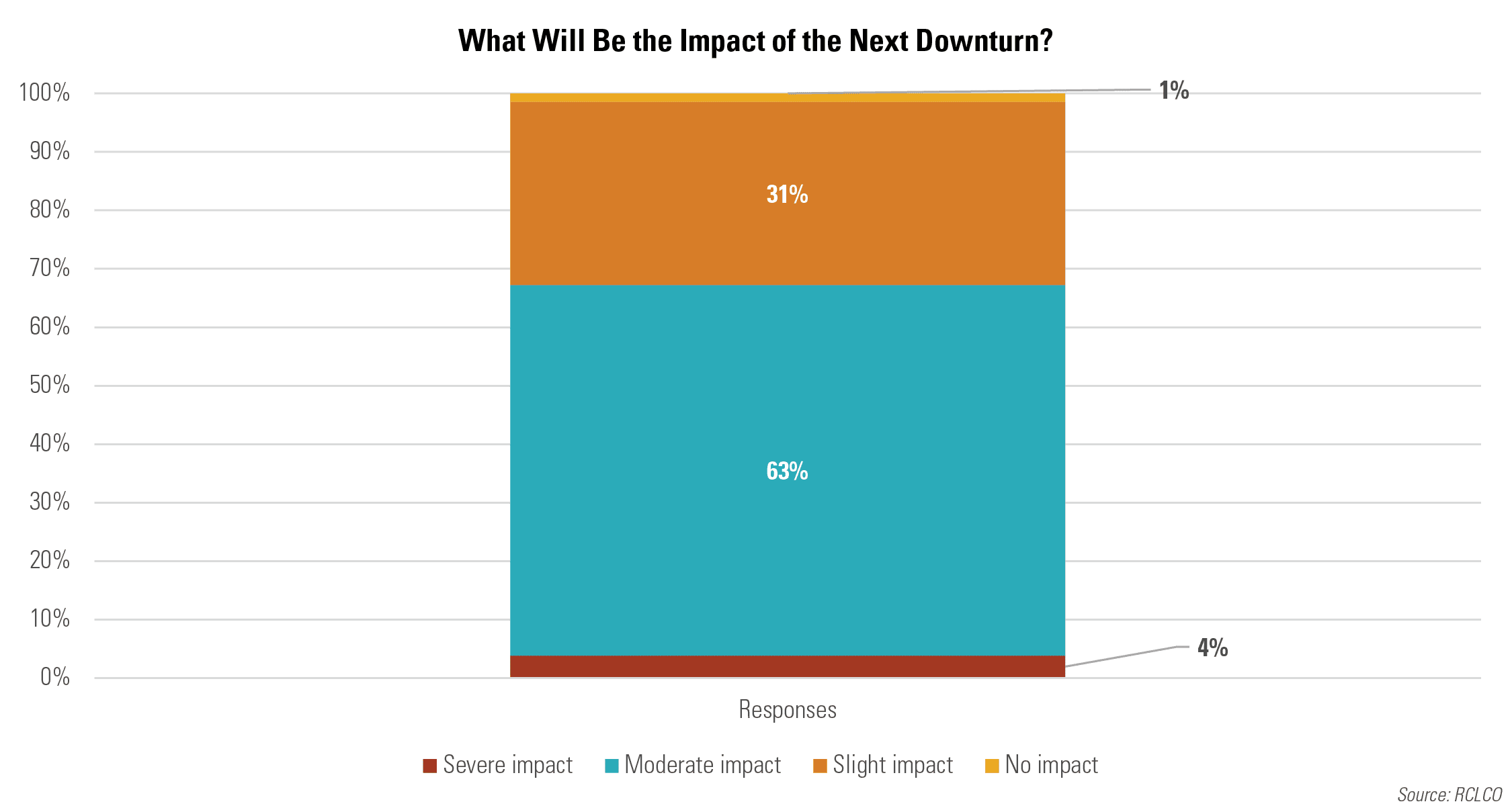

- While almost one-half of respondents believe that the downturn is either approaching imminently, or is already upon us, respondents do not appear to be overwhelmingly concerned with the overall impact, as 95% of respondents believe the impact will be “slight” or “moderate.”

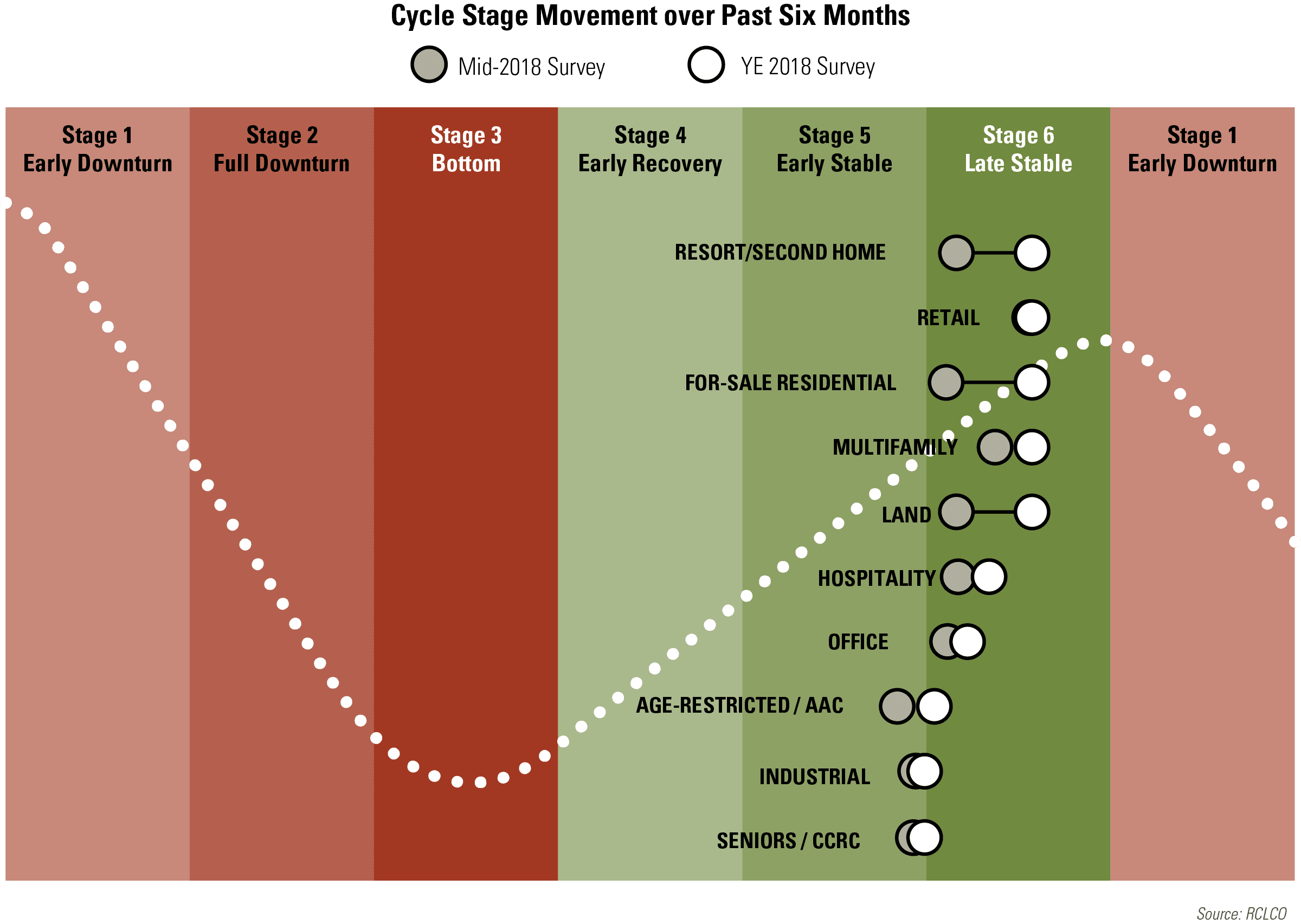

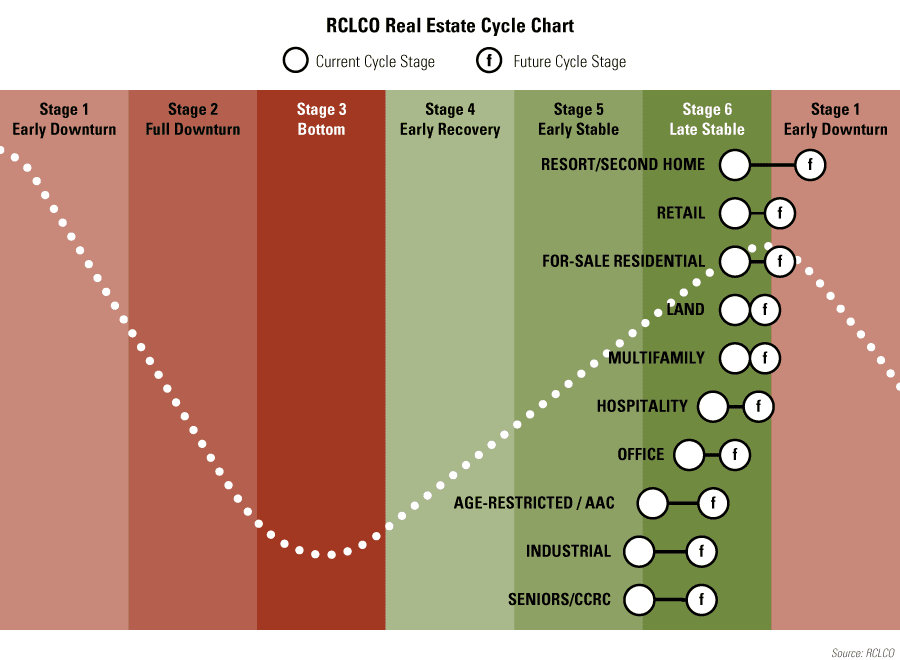

- Respondents indicate that most product types have moved firmly into the “late stable” phase of the real estate cycle, with the other product types quickly approaching that phase.

- A majority of respondents anticipate that within the next 12 months, for-sale residential, resort/second home, and retail will have moved past the peak and into the “early downturn” phase.

Over the past few years, RCLCO sentiment surveys have indicated continued confidence in real estate market conditions. The 2016 election and the passage of the “Tax Cut and Jobs Act” (TCJA) in late 2017 helped to keep sentiments positive. Respondents to the year-end Sentiment Survey are notably more pessimistic with regard to current and future real estate market conditions than in previous surveys.

Responses from the year-end 2018 Sentiment Survey indicate that the downturn is forthcoming. Fewer respondents are continuing to push out the predicted next downturn farther into the future, as in previous surveys. In fact, many respondents (20%) believe that the downturn has already begun. Furthermore, most real estate sectors are firmly in the “late stable” stage of the cycle, and several are predicted to be in the “early downturn” phase within the next 12 months.

Overall Sentiment is Notably More Pessimistic Than in Recent Years

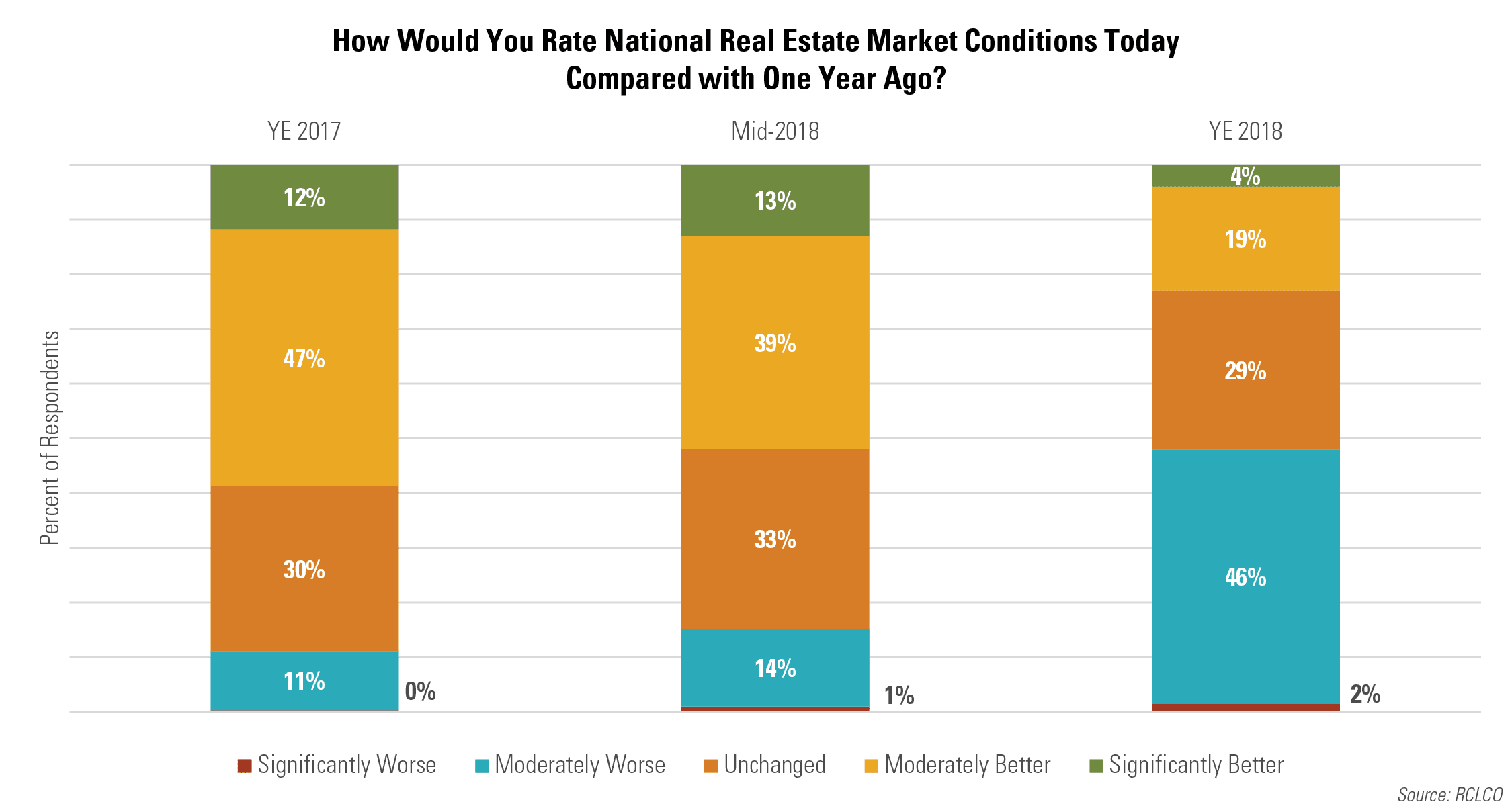

Sentiments about current national real estate conditions are noticeably more pessimistic than they were six months ago. Just under one-half (48%) of survey respondents say national real estate market conditions are moderately or significantly worse today than they were a year ago. This is 33 percentage points higher than in the mid-year 2018 survey. Conversely, the share of respondents reporting better market conditions today than one year ago decreased to 23%, down 29 percentage points from the mid-year 2018 survey. The proportion of respondents believing conditions are unchanged is similar to the level in the mid-year 2018 survey.

This decrease in current sentiment is reflected in RCLCO’s Real Estate Market Index (RMI),[1] which measures sentiment on a 100-point scale. The RMI decreased to 37.5 in this survey, which is a 30.5-point drop from the 68.0 six months ago. A decrease was anticipated by respondents in the year-end 2017 survey, but the drop has been much more precipitous than the 62.5 RMI predicted a year ago. Respondents expect the RMI to continue to decline to the mid-20s within the next 12 months.

The decrease in year-end 2018 RMI has broken a slightly upward trend in RMI between mid-year 2016 and mid-year 2018. Such a sharp decline in the RMI over the past six months, and predictions of further declines over the next 12 months, are suggestive of the early stages of a downturn in the real estate market.

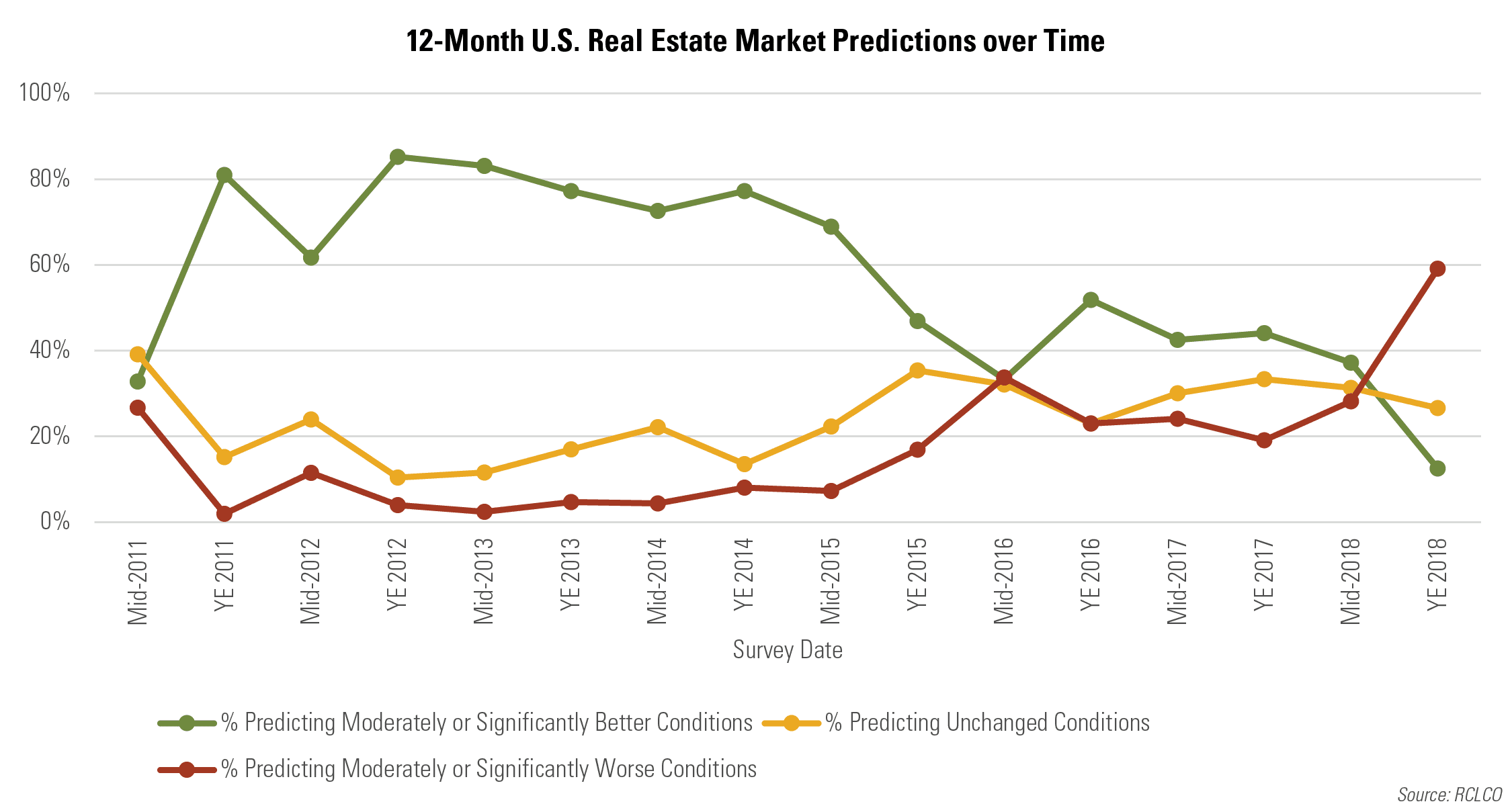

Since year-end 2016, a plurality of respondents to each survey indicated that they expected real estate market conditions to improve over the following 12 months. The year-end 2018 survey has reversed this, with respondents strongly anticipating deteriorating real estate market conditions over the next 12 months.

Specifically, 59% of respondents expect real estate market conditions to worsen over the next 12 months, which is well above the 31% of respondents six months ago and 19% of respondents in the year-end 2017 survey. Conversely, the percentage of respondents anticipating better conditions within the next 12 months is significantly lower in this survey (12%) than in the previous survey (37%) and in the year-end 2017 survey (44%). The proportion of respondents expecting unchanged real estate market conditions has remained stable, with 27% of respondents predicting unchanged conditions in the year-end 2018 survey–slightly below the 31% in the mid-year 2017 survey.

Respondents Indication that the Downturn is Quickly Approaching, or Already Upon Us

Over the past few surveys, respondents had demonstrated a tendency to push off the anticipated timing of the next downturn approximately two years from the time of the survey. In the year-end 2017 survey, 70% of respondents indicated they believed that the downturn would not begin until 2020 or later, and only 8% of respondents believed the downturn had already begun. In the year-end 2018 survey, a mere six months later, the proportion of respondents believing that the downturn will not occur until 2020 or later has dropped 16 percentage points, to 54%. Moreover, the proportion of respondents who believe the downturn has already begun has increased 12 percentage points to 20%. Unlike in previous surveys, respondents are beginning to sense the downturn is impending or is already upon us.

The Majority of Respondents Believe the Next Downturn Will Have a Slight to Moderate Impact on the Real Estate Economy

Supplementing the anticipated timing of the next downturn, the year-end 2018 survey solicited responses regarding the impact of the next downturn on the real estate economy. The first notable takeaway is that very few respondents anticipate either a “severe impact” (4%) or “no impact” (1%). Rather, most respondents land somewhere in the middle, as 31% of respondents said the downturn would have a “slight impact” and 63% of respondents indicated that the next downturn would have a “moderate impact.”

The three most common reasons that respondents anticipate only a “slight impact” or “moderate impact” were as follows:

- Sound real estate fundamentals, with supply and demand relatively balanced;

- Fewer markets overbuilt than in previous downturns; and

- Tighter leverage and credit relative to the downturn of 2008.

Respondents who answered “severe impact” provided a variety of responses; however, most of them point to the rationale that any economic downturn, by definition, activates a variety of structural changes that will have a severe economic impact. Respondents who answered “no impact” have faith that the economy is still strong and believe that widespread pessimism is symptomatic of a pessimistic media.

Consistent Cycle Movement for a Majority of Product Types Over the Past Six Months

Respondents report notable cycle movement for most product types over the past six months, with all products either firmly in or creeping towards the late stable phase of the real estate cycle, consistent with the significant decline in sentiment since RCLCO’s mid-year 2018 survey.

In this survey, resort/second home, retail, for-sale residential, multifamily, land, hospitality, and office all moved definitively into the “late stable” phase, with age-restricted/AAC, seniors/CCRC, and industrial uses continuing to creep into the early stages of this phase. Although the various product types are positioned differently within the “late stage” phase and have moved at varying speeds over the past six months, their current positions are consistent with the general sentiment that the downturn is approaching, as well as with RCLCO’s point of view regarding where each product is on the cycle curve.

Resort/Second Home, Retail, and For-Sale Residential Anticipated to Cross the Threshold into “Early Downturn” Phase

Respondents believe that all land uses will be, at the very least, in the “late stable” phase within the next 12 months, with some uses–resort/second home, retail, and for-sale residential–crossing into the “early downturn” phase. Following closely behind, land, multifamily, and hospitality are expected to move close to the end of the late stable stage. Office, age-restricted/AAC, industrial, and seniors/CCRC are all expected to be in the middle of the late stable phase.

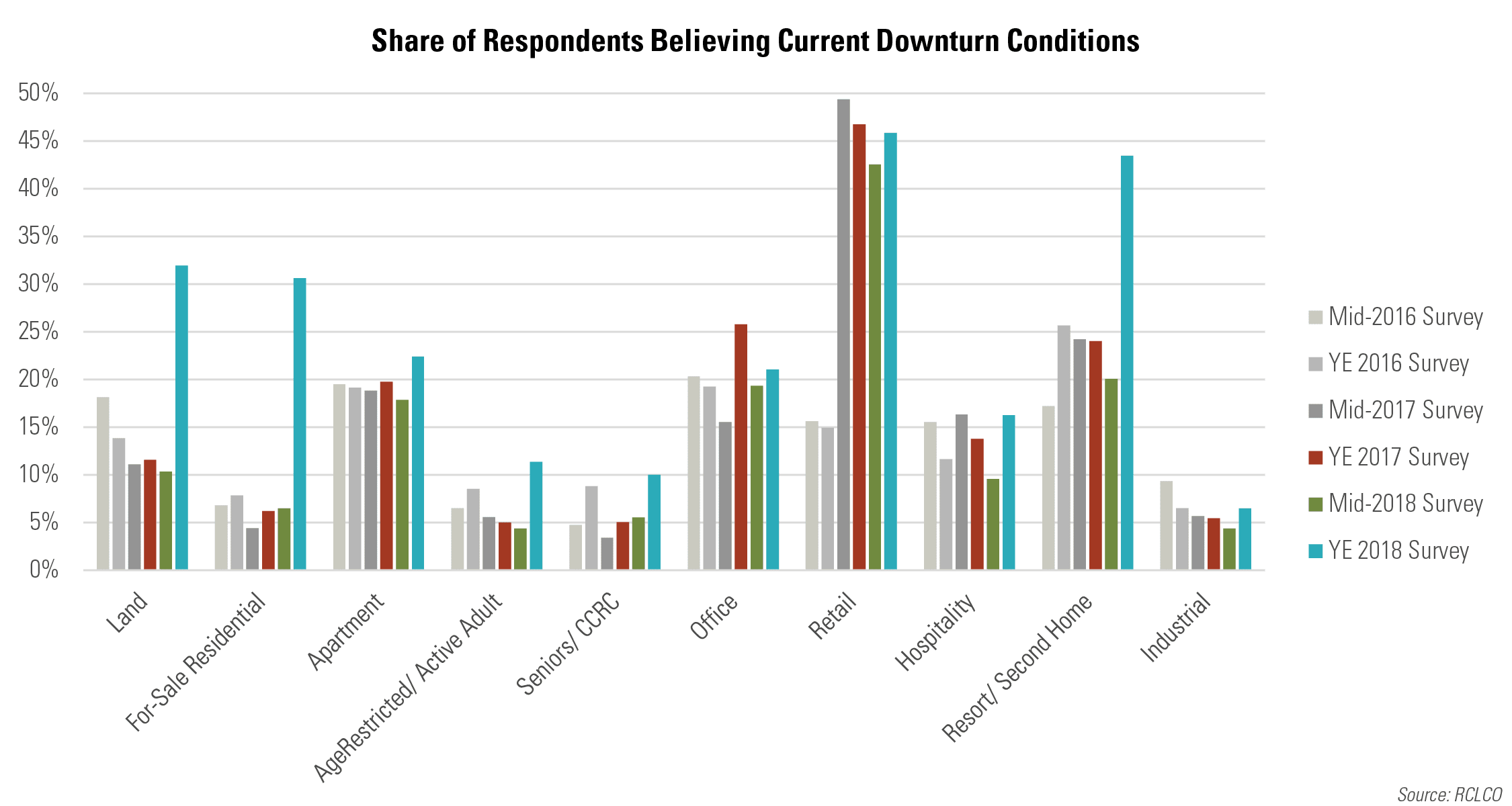

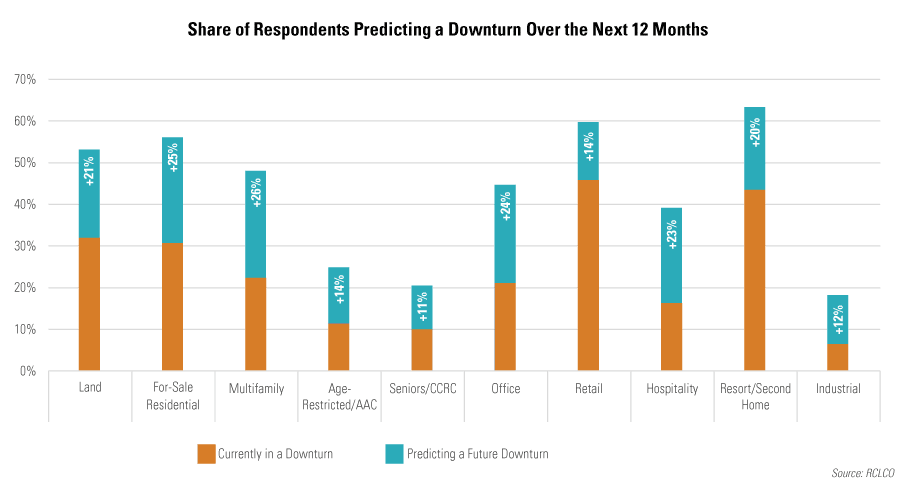

Share of Respondents Believing Current Downturn Conditions and Predicting Downturn in Next 12 Months Increases Among all Land Uses

While the majority of respondents do not believe that any product types are currently in downturn, the proportion of respondents that do believe product types are already in downturn has increased since the mid-year 2018 survey for all land uses. The most dramatic examples of this are resort/second home, with 43% of respondents indicating current downturn conditions (up 23 percentage points since mid-year 2018), for-sale residential, currently at 31% (up 25 percentage points), and land, currently at 32% (up 22 percentage points).

Respondents believe that all product types are more likely to be in downturn in 12 months than they are now. By 12 months from now, the majority of respondents expect several land uses to be in downturn. The year-end 2018 survey indicates that 63% of respondents expect resort/second home to be in downturn (up 20 percentage points from the 43% of respondents who believe it is currently downturn), along with 60% for retail (up 14 percentage points), 56% for for-sale residential (up 25 percentage points), and 53% for land (up 21 percentage points). Additionally, close to one-half of respondents expect several other land uses to be in downturn–48% for multifamily (up 26 percentage points) and 45% for office (up 24 percentage points).

Comparison of Sentiment Survey Results to RCLCO’s Point of View

RCLCO’s point of view regarding future economic and real estate market trends, and the opportunities that these present, was published last week (click here to read). RCLCO agrees with Sentiment Survey respondents that a real estate downturn is likely between now and 2022, and that the next slowdown is likely to be easier to work through than the 2008 Great Recession. On the issue of timing of the next downturn, RCLCO agrees with the 54% of Sentiment Survey respondents who believe the downturn is more likely to begin in 2020 or later rather than prior to 2020.

Who took the Survey

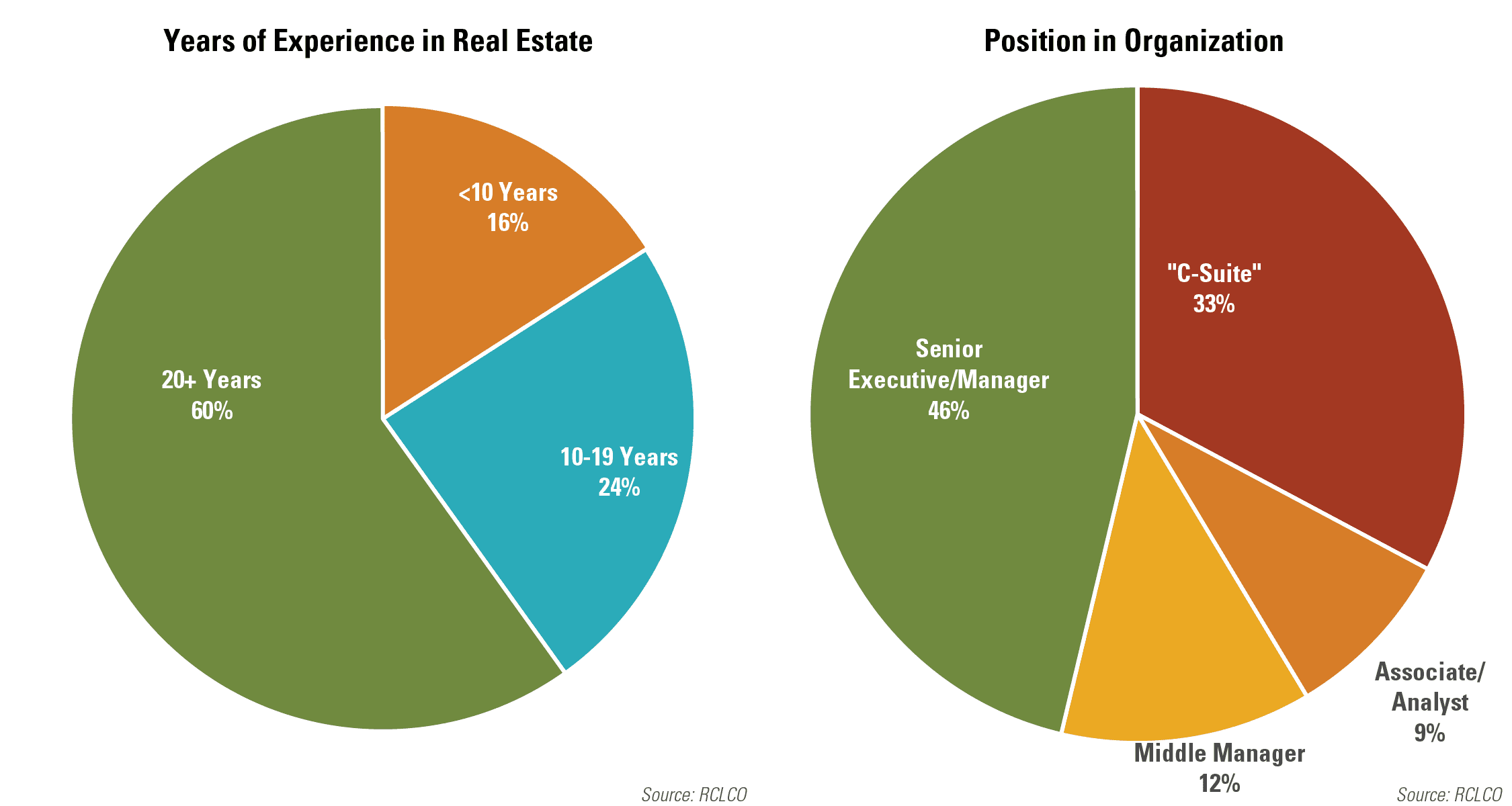

RCLCO’s Market Sentiment Survey tracks the sentiments of a highly experienced pool of real estate professionals from across the country and across the industry. Three-fifths (60%) of respondents have worked in the real estate industry for 20 years or more, and 79% of respondents are C-suite or senior executives in their organizations.

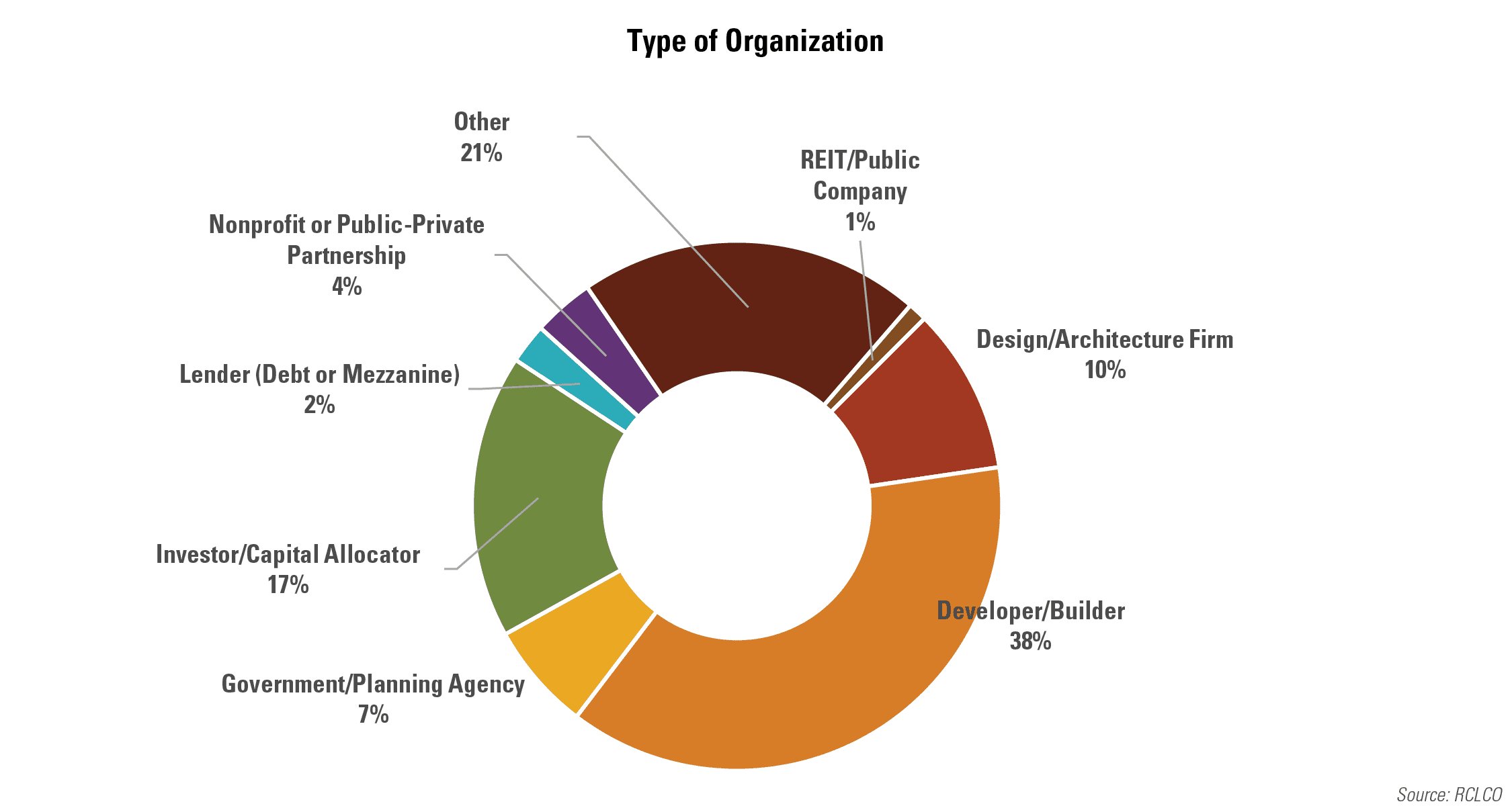

Developers and builders comprise the largest share of respondents, at 38% of the sample. Another 17% are investors or capital allocators, followed by 10% in design or architecture firms. The remaining one-third (35%) of respondents come from a variety of other types of organizations within the real estate industry and public sector.

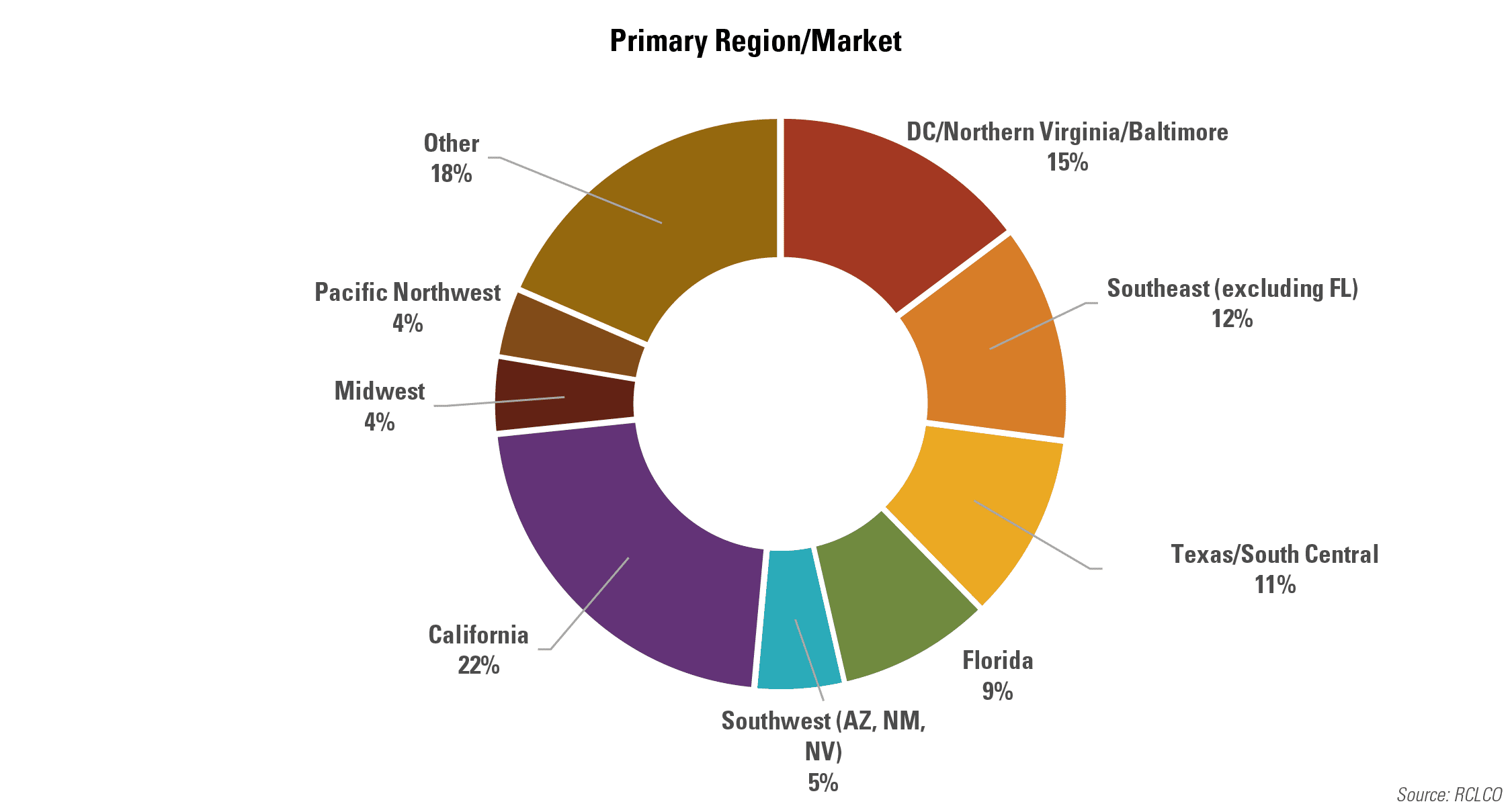

The respondent mix is representative of the U.S. as a whole; however, it is weighted towards those who report working primarily in coastal and Sunbelt markets. This respondent mix reflects markets where there has been significant development activity in this cycle.

Article and research prepared by Len Bogorad, Managing Director, and Maury Winter, Analyst.

References

[1] The Real Estate Market Index (RMI) is based on a semiannual survey of real estate market participants and is designed to take the pulse of real estate market conditions from the perspective of real estate industry participants. The survey asks respondents to rate real estate market conditions at the present time compared with one year earlier (Current RMI), and expectations over the next 12 months (Future RMI). The RMI is a diffusion index calculated for each series by applying the formula “(Improving – Declining + 100)/2.” The indices are not seasonally adjusted. Based on this calculation, the RMI can range between 0 and 100. RMI values in the 60 to 70+ range are indicative of very good market conditions. Values below 30 are typically coincident with periods of economic and real estate market stress/recession.

[2] Beginning in the YE 2017 survey, respondents could choose “2020” or “2021 or later” instead of only having the option to choose “2020 or later.”

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us