Outlook for 2015: All Things in Moderation

RCLCO National Market Sentiment Survey 1Q 2015 Results Part 1

Just a year and one-half ago, respondents to RCLCO’s National Market Sentiment Survey could be described as nothing less than exuberantly optimistic about the future. Although this optimism remains after a steady year of growth in 2014, respondents’ outlook for 2015 confirms the theme of moderation in the past two Surveys.

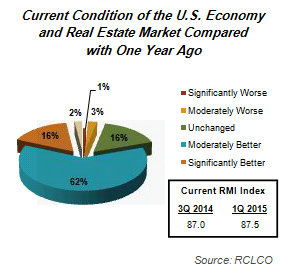

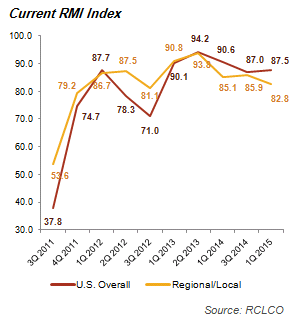

Respondents reported that 2014 was a year of modest improvements, with 62% of respondents describing national conditions as “moderately better” today than one year ago, holding RCLCO’s National Current Real Estate Market Index (RMI1) steady at 87.5 (up 0.5 from six months ago). Local and regional sentiment is somewhat less positive, with 53% of respondents describing conditions as “moderately better” today than a year ago, and a Regional/Local RMI of 82.8 (down 3.1 from six months ago), the lowest level since late 2012.

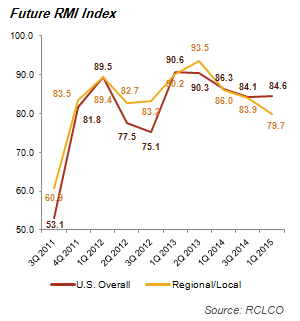

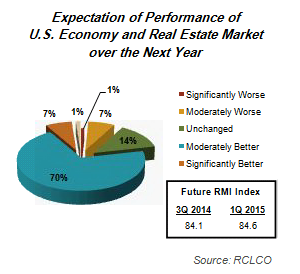

The majority of respondents are still expecting moderate improvements to continue through 2015, but some respondents are expecting growth to flat line, with 14% of respondents expecting unchanged national conditions, and 20% of respondents expecting unchanged local and regional conditions in the year ahead—a reflection of the theme of moderation for 2015. RCLCO’s Future Real Estate Market Index continues to stay relatively constant at 84.6 (+0.5) nationally and 79.7 (-4.2) regionally.

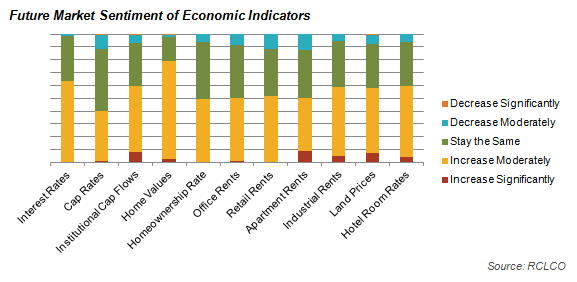

Across economic indicators, respondents continue to expect—you guessed it—positive but moderate improvements. Just over one-half of respondents are expecting moderate increases in institutional capital flows to real estate, office rents, retail rents, apartment rents, industrial rents, land prices, and hotel room rates in the next six to 12 months, while just over a third of respondents are expecting these indicators to remain unchanged, strikingly similar to sentiment in 3Q 2014.

Home prices remain a point of optimism with respondents—76% expect moderate increases in the next six to 12 months, although expectations for significant increases have all but disappeared. These expectations mirror current conditions, as home price appreciation stayed positive, but decelerated for much of 2014. Year-over-year increases were at 4.8% in the last quarter of 2014, down from 10.8% in December 2013, according to S&P/Case-Shiller Indexes. In markets such as Dallas, Houston, and Seattle where limited supply has escalated prices at a level well above national averages, a cooling of pricing may actually be positive for the industry, as absorption has slowed in many of these markets due to lack of affordability. As economic conditions continue to improve and unemployment falls, increased interest rates are becoming inevitable at some time in the future. Although exact timing remains unknown, 63% of respondents expect moderate increases in the coming six to 12 months (up from 57% in 3Q 2014), while 35% expect current rates to hold steady in the next six to 12 months.

As economic conditions continue to improve and unemployment falls, increased interest rates are becoming inevitable at some time in the future. Although exact timing remains unknown, 63% of respondents expect moderate increases in the coming six to 12 months (up from 57% in 3Q 2014), while 35% expect current rates to hold steady in the next six to 12 months.

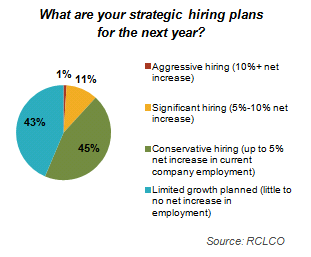

Hiring plans for the year ahead also reflect the theme of 2015, with 45% of respondents planning conservative expansions (up to 5% increase in net company employment). Just 12% of respondents are planning a 5%+ net increase in company size, with the remaining 44% implementing a no-growth strategy, with little to no net increase in employment planned. These results indicate that flattening growth rate expectations are generally being translated into strategic hiring plans.

Hiring plans for the year ahead also reflect the theme of 2015, with 45% of respondents planning conservative expansions (up to 5% increase in net company employment). Just 12% of respondents are planning a 5%+ net increase in company size, with the remaining 44% implementing a no-growth strategy, with little to no net increase in employment planned. These results indicate that flattening growth rate expectations are generally being translated into strategic hiring plans.

A deeper look at hiring plans indicates that recent growth levels, more than forecasted levels, are playing a role in regional differences, as respondents in 2013 and 2014 high growth markets appear to be playing “catch up” with hiring plans. Namely, 81% of Mountain West respondents (CO, UT) and 67% of Pacific Northwest respondents have plans for at least some hiring in the next year, compared with just 56% of firms nationwide. These plans are likely driven by Denver and Salt Lake City, two of Forbes’ top 10 growth markets in 2014, and Seattle, the nation’s fastest growing metro in 2013.

Up Next: Keep an eye out for RCLCO’s National Market Sentiment Survey Results 1Q 2015 – Part 2 in mid-February as we take a deeper dive into regional sentiment differences and discuss real estate cycle implications for 2015.

1 The Real Estate Market Index (RMI) is based on a semiannual survey of real estate market participants and is designed to take the pulse of economic and real estate market conditions from the perspective of real estate industry participants. The survey asks respondents to rate economic and real estate market conditions at the present time compared with one year earlier (Current RMI), and expectations over the next 12 months (Future RMI). The RMI is a diffusion index calculated for each series by applying the formula “(Improving – Declining + 100)/2.” The indices are not seasonally adjusted. Based on this calculation, the RMI can range between 0 and 100. RMI values in the 60 to 70+ range are indicative of very good market conditions. Values below 30 are typically coincident with periods of economic and real estate market stress/recession.

Article and Research prepared by Len Bogorad, Managing Director, and Trish Kennelly, Senior Associate.

RCLCO provides real estate economics and market analysis, strategic planning, management consulting, litigation support, fiscal and economic impact analysis, investment analysis, portfolio structuring, and monitoring services to real estate investors, developers, home builders, financial institutions, and public agencies. Our real estate consultants help clients make the best decisions about real estate investment, repositioning, planning, and development.

RCLCO’s advisory groups provide market-driven, analytically based, and financially sound solutions. RCLCO’s Strategic Planning and Litigation Support Advisory Group produced this newsletter. Interested in learning more about RCLCO’s services? Please visit us at www.rclco.com/strategic-planning

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us