New Single-Family Housing Market Overview – Florida Q3 2016 Continued Strength in the Sunshine State

|

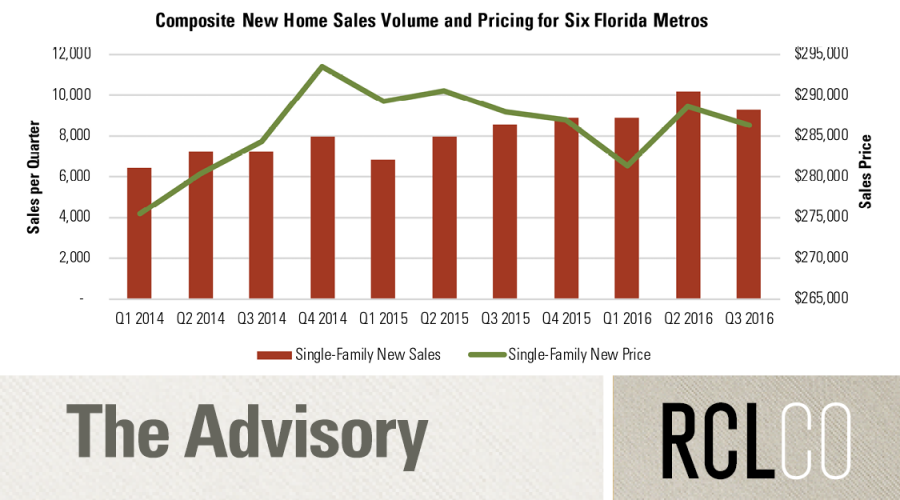

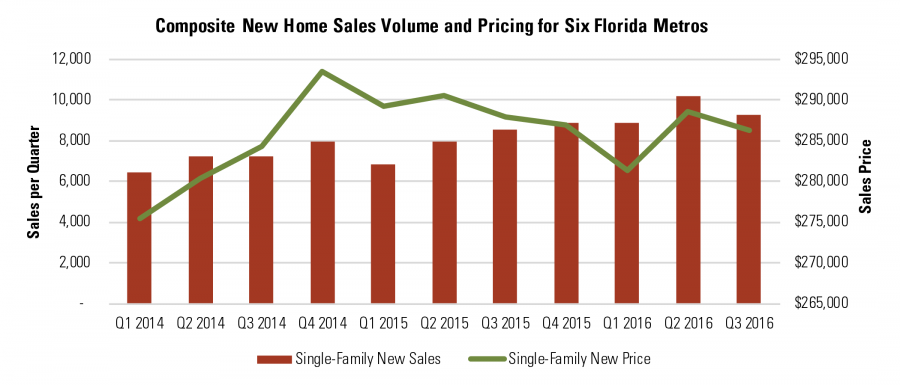

New single-family home sales for the first three quarters of 2016 across six of Florida’s metro market areas were up 22% over the first three quarters of 2015, although the pace of sales slowed between Q2 2016 and Q3 2016. Florida’s new home market continues the trend back to “normal,” thanks to strong population and employment growth, foreign and domestic migration, and a decline in bank-owned properties. At the end of Q3 2016 only 5.5% of Florida homes listed for resale were distressed, down from 10.6% at the same point last year, indicating a smaller pool of discounted inventory. According to Freddie Mac, 30-year fixed-rate mortgage rates averaged 3.45% for Q3 2016, below the 3.95% average in Q3 2015. Naturally there are concerns about how advanced we are in the economic cycle, and about price increases dampening demand due to lower overall affordability, but the demand outlook remains positive. Relocating retirees account for a large share of new home sales statewide, as the much-anticipated wave of retiring Baby Boomers has arrived in force. While Florida’s population growth overall is still below the peak of the early 2000s, age 65+ population growth is as strong as it has ever been. Florida remains the top retirement destination nationally, capturing 20% of Americans aged 65 to 74 who moved out of state for retirement last year. Tourism continues to play a strong role in boosting the state’s economy, with over 57 million tourists visiting the Sunshine State in the first half of 2016. |

22%2016 YTD new home sales volume up over 2015 YTD in 6 major Florida metros

5.5%of Florida resales are distressed – down from 10.6% in 3rd Quarter 2015

|

Although the pace of sales moderated from Q2 2016 to Q3 2016, strong underlying market fundamentals suggest the housing market may continue to strengthen into 2017 and is positioned for a strong spring season. In addition to tourists and retirees positively impacting the state’s economy, Florida continues to experience strong foreign investment. Foreign investment did fluctuate over the past year, and the election and talk of restrictions on immigration raised concerns. It is too early to gauge long-term effects, but foreign investors seem to still believe the U.S. is a good place to invest, and South Americans in particular are expected to continue to be a force in the market. However, they have been somewhat less prominent this past year due to economic challenges at home, which has resulted in slowing sales in markets most dependent on that segment, such as Miami.

RCLCO closely follows the pace of new home sales in six metropolitan areas in Florida: Orlando/Central Florida, Miami-Ft. Lauderdale-West Palm Beach, Tampa-St. Petersburg, Jacksonville, Fort Myers-Naples, and Crestview-Ft. Walton-Destin. The chart below shows the aggregate volume of new home sales, along with the weighted average of the median prices for new homes in these markets. As a whole, new home sales in these markets were up 9% over Q3 2015, and up 22% over 2015 YTD. That said, new home sales in these markets were down 9% compared with Q2 2016. Three out of the six markets saw a dip in new home sales volume from Q2 2016 to Q3 2016, even though 2016 YTD new home sales were up, and the pace of sales in Q3 2016 was stronger than in any quarter in 2015. Nonetheless, the slowing between the second and third quarters was not experienced in 2015. It appears that the market was influenced by the election and the uncertainty that many buyers were feeling. It is too early to tell if this will be a continuing trend or just a temporary slowdown, but given underlying fundamentals, our expectation is that the market will improve in 2017 as it has over the past year despite the dip in Q3 2016. New home prices in Q3 2016 were essentially on par with where they were in Q3 2015, though overall prices adjusted downward 1% from Q2 2016 to Q3 2016. Strong price appreciation has kept some buyers on the sidelines, so some slowing in price growth may help in that regard.

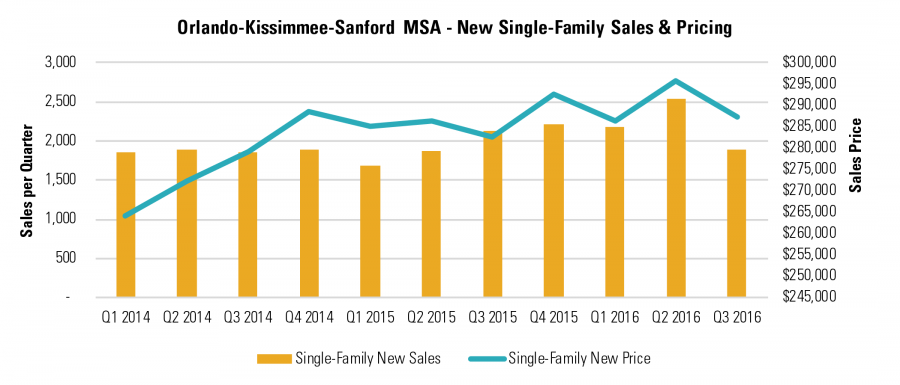

Strong Central Florida Single-Family Housing Market

The Orlando/Central Florida housing market tops RCLCO’s recent momentum index, which ranks MSAs nationally based on their potential for new single-family home sales. Total new home sales for the year through Q3 2016 were up, at 6,591 compared with 5,685 over the same time period in 2015. The potential exists for strong sales into 2017, although strong price appreciation has impacted affordability for first-time home buyers, keeping demand from reaching previous highs. Price growth has recently moderated, and Q3 2016 sales were down relative to Q2 2016, which saw the strongest sales of the past three years.

Existing home sales also slowed in Q3 2016 compared with Q3 2015. Total existing home sales for 2016 YTD were down 10% over the same time period in 2015, attributable in part to the diminishing pool of distressed homes available for sale. Prices for existing homes were up 11% over Q3 2015 prices.

The area’s world-class tourist attractions—Walt Disney World and Universal Studios; the second largest convention center in the U.S.; and the second largest university in the country, University of Central Florida, continue to drive the local economy along with growth in professional and business services. The Orlando MSA ranks first in projected household growth nationally through Q2 2017, and has been a top performer in terms of employment growth over the past year. The MSA ranks fourth nationally in projected single-family permits through Q2 2017 and ranks seventh among the top 25 MSAs in total single-family permits pulled since Q2 2009 (the end of the Great Recession). In addition to tourism, the region boasts strong growth in construction and professional & business services. For example, ADP recently announced a new office in Maitland that will employ 1,600 persons within five years. Unemployment is just 4.5%, near historically low levels. Average hourly earnings improved steadily coming out of the recession, and remain at historically high levels.

The largest feeder market states for domestic migration to Central Florida are New York, New Jersey, Illinois, Pennsylvania, and Ohio. Foreign migration from Central and South America and Puerto Rico also continue to contribute to the area’s strong household growth.

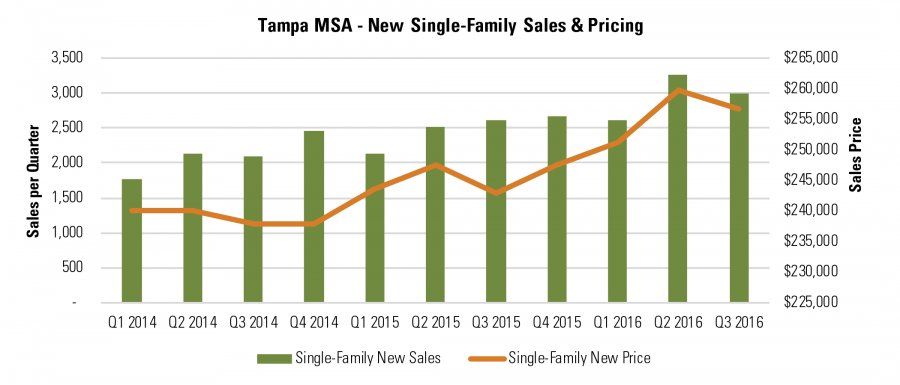

Strong Tampa MSA Single-Family Housing Market

As shown on the chart below, Q3 2016 prices and sales for new single-family homes were above Q3 2015, though the pace of sales moderated slightly between the second and third quarters. About 15% more new homes were sold in Q3 2016 than in Q3 2015, with an increase in median price of 6%. The expectation for 2017 is for new home sales volume to continue increasing, with price increases slowing.

The Tampa MSA (Hillsborough, Hernando, Pasco, and Pinellas counties) is the second largest MSA in Florida, with nearly 3 million residents. Job growth has been strong, with 32,000 new private sector jobs added over the past year: 8,500 in professional & business services and 6,100 in leisure & hospitality. The unemployment rate is just 4.7%, somewhat up from a low of 4.1% in May 2016.

Single-family permits for Q3 2016 are up 28% over Q3 2015. New master-planned communities such as Asturia and Bexley are expanding the options for new home buyers and are expected to do well. Southern Pasco County is experiencing substantial new growth, as are the South Tampa and Largo areas. Even formerly blighted areas such as the Edge District near downtown St. Petersburg are attracting buyers to purchase new urban-style townhomes such as those being developed at 801 Conway.

Existing home sales for 2016 YTD were on the same pace as they were during the same period in 2015, with approximately 70,000 sold thus far. The median price for existing home sales is up 16% in Q3 2016 over Q3 2015.

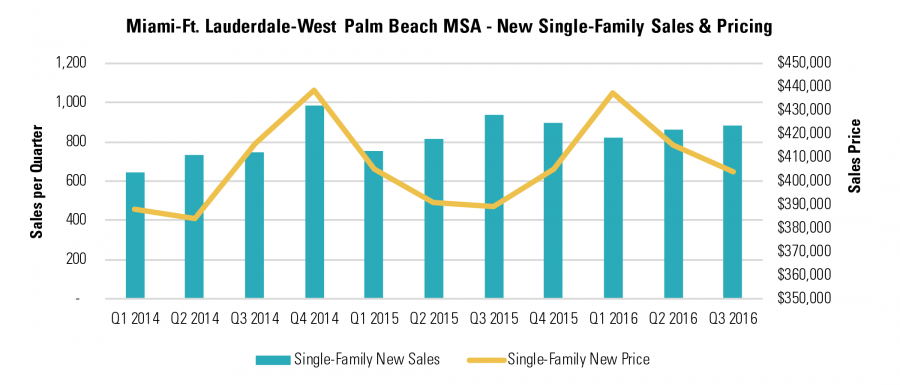

Southeast Florida’s Single-Family Housing Market Has Slowed

New single-family home sales in the Miami-Fort Lauderdale-West Palm Beach MSA (Dade, Broward, and Palm Beach Counties) in Q3 2016 were up slightly from Q2 2016, though they were down 6% relative to Q3 2015. Median prices were 4% higher in Q3 2016 than in Q3 2015, though they have moderated since Q1 2016. The new home sales outlook for the Miami-Fort Lauderdale-West Palm Beach MSA is for continued moderation in volume and prices due to a reduction in purchases by foreign buyers. The area has always been more prone to market fluctuations given its relationship with South America as well as the influence of second-home buyers, although much of that is focused on the condominium market along the coast.

Miami/Dade County is the most impacted by the stronger dollar and weaker South American economies, with Broward and Palm Beach Counties less affected. However, the impact of affordability remains a concern particularly in Palm Beach County, given strong price growth over the past several years.

International trade and tourism are major drivers of the southeast Florida economy. Despite the stabilization in sales pace, the Southeast Florida economy provides a reasonably strong foundation for the new home market, having experienced steady job growth over the past three quarters. Miami benefits from the port and financial and business services, though as you move up the coast towards West Palm Beach more of the economy is focused on services for second-home owners and retirees and health care. The region’s unemployment rate is at 5.1%, near its lowest level during the current economic cycle. Miami alone attracted 15.5 million visitors last year, and Palm Beach County is currently on track to beat last year’s record of 6.9 million visitors despite the impact of algae blooms on the coast, and Zika virus concerns. Strong regional visitation is driving a hospitality boom in Palm Beach County, with nearly 1,300 hotel rooms currently planned or under construction. Given the area’s relationship to Latin America, international businesses in industries such as finance, manufacturing, and distribution play important roles in the economy, and the economic fluctuations in those countries influence the outlook here. More than one-half of visitors to the area are international, with Brazil the largest market.

The market for existing homes for Q3 2016 follows a similar pattern to the new home market, and price increases in 2017 are expected to be moderate, with sales volume similarly stabilizing.

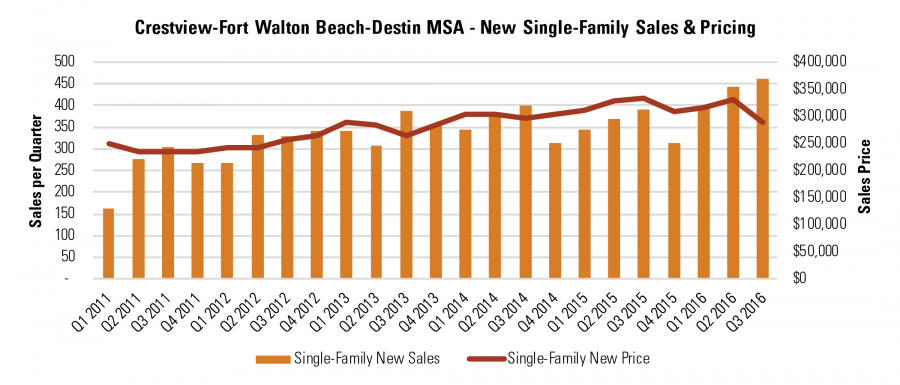

Home Sales Continue Upward Trend in the Panhandle

The Panhandle area of Florida is beautiful, but it is one of the smallest new home markets in the state. The Crestview-Fort Walton Beach-Destin MSA includes Okaloosa and Walton Counties, whose premier attractions are the white sandy beaches that attract millions of visitors each year. The area is experiencing growth in retirement demand, and Where to Retire magazine listed Destin as a top U.S. retirement destination, though the weather is more similar to Alabama and Georgia than to most of Florida. Along with tourism and retirement, Eglin Air Force Base and defense-related industries are major economic drivers. Other than second-home buyers and retirees, much of the new home market in this region is driven by active or retired military. Unemployment is 4.1%—hovering near its lowest level during the current economic cycle.

The area came out of the recession more slowly than other parts of Florida, and its new home sales market continues to strengthen. In fact, 18% more new homes were sold in Q3 2016 than in Q3 2015. Total 2016 YTD new home sales were up 18% over the same period in 2015. After strong price appreciation over the last several years, the median new home price for Q3 2016 is down 14% over Q3 2015. It is too early to tell if this is a developing trend or a one-time occurrence; we will know more once we have Q4 data. Meanwhile, the potential exists for continued strong sales into 2017, as this market is still well below peak and economic fundamentals are strong.

Existing home sales in Q3 2016 were on par with Q3 2015. Prices for existing homes in Q3 2016 were up 10% over Q3 2015, though we expect price appreciation to slow.

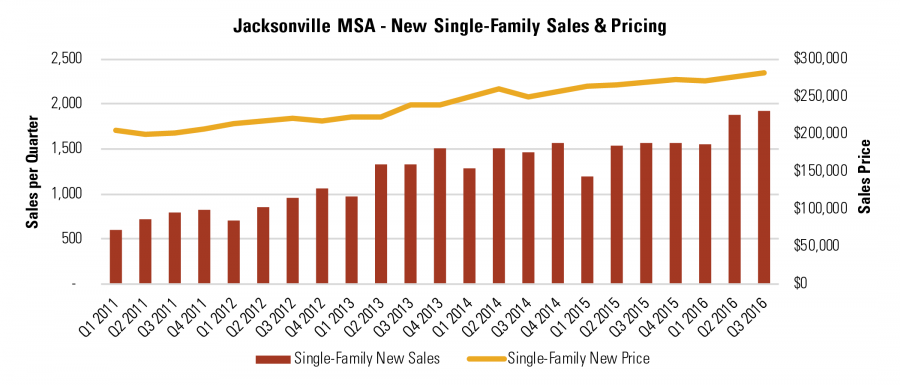

Jacksonville’s New Single-Family Housing Market Continues to Expand

Although new home sales are only at about 50% of where they were during the early 2000s boom, the area has experienced increases each year since the recession, and prices have trended steadily up as well. As shown on the chart below, Q3 2016 new home prices and sales were above Q3 2015. About 22% more new homes were sold in Q3 2016 than in the same period in 2015, with an increase in median price of 5%. For 2016 YTD, 5,341 new homes have been sold, compared with 4,306 in 2015 during the same period. We expect new home sales volume to continue to increase in 2017, with prices continuing to show moderate appreciation.

The Jacksonville MSA includes Duval, Nassau, St. Johns, Clay, and Baker counties, and is home to three Fortune 500 companies—CSX, Fidelity National Financial, and FIS. The area also has a heavy presence of aerospace and defense companies, including Boeing, Northrop Grumman, and Embraer, along with the Naval Air Station employing 22,000 persons. Amazon recently announced plans to build an 800,000-square foot fulfillment center that will employ 1,500 persons by 2019. Unemployment remains low at 4.6%, hovering near its lowest point in the current economic cycle. Hourly earnings are currently at $25.30, just slightly down from their peak of $26.09 in May 2016.

The Nocatee master-planned community consistently ranks among the top five best-selling MPCs in the country in RCLCO’s survey. The Jacksonville new home market is expected to experience relatively steady growth in volume and price over the next year.

Existing home sales for Q3 2016 were up 4% over Q3 2015, with prices at approximately the same level over that time period. Going forward, price appreciation in the existing home market is likely to slow, with moderate gains in sales volume.

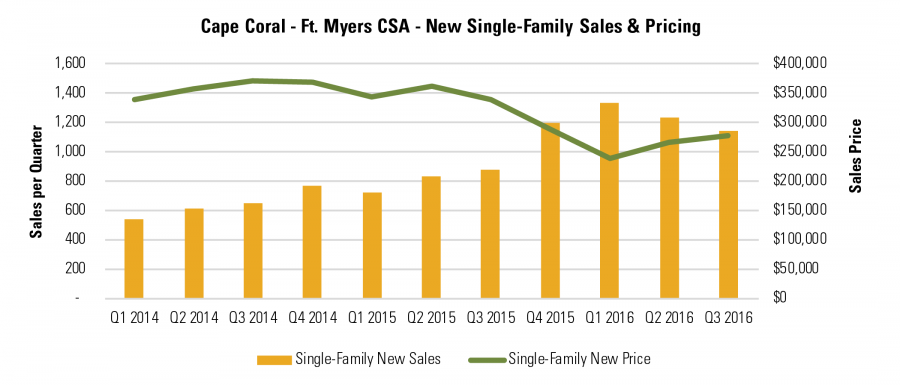

Southwest Florida’s New Home Market Continues to Have Its Best Year Since the Great Recession

As shown on the chart below, Q3 2016 new home sales volume was up 30% over Q3 2015. Total 2016 YTD sales were up 52% over the same time period in 2015. This increase in new home sales has been helped by the introduction of more moderately priced homes, with the median new home price in Q3 2016 down 18% from Q3 2015. The median new home price was $260,000 in 2016 YTD compared with $348,000 in the same time period in 2015. The area is known for its luxury gated communities, though demand for new homes has been highest among those priced at the more moderate end of the price spectrum. Master-planned community Ave Maria, an inland community in Collier with homes priced from $180,000 to $400,000, reports that 2016 has been its best year ever since opening in the early 2000s, with over 300 sales in 2016 YTD to a mix of couples, families, and active adult retirees.

For 2017, the market is likely to stabilize at a similar level as indicated by permitting activity for 2016 YTD being on par with 2015 YTD levels, though the potential for stronger sales exists.

The Cape Coral-Fort Myers-Naples CSA (Combined Statistical Area) includes Lee and Collier Counties and continues to attract large numbers of second-home buyers and retirees from the Midwest and Northeast, along with millions of visitors each year to its pristine beaches. The economy predominantly services the population, and the largest private sector employers in the area are Lee Memorial Health System with 11,000 employees and NCH Naples Hospitals with 7,000 employees. Unemployment is at 4.9%, somewhat higher than the low of 4.0% in May 2016.

Cape Coral has seen a boom in housing activity during the recovery as Naples and Collier County to the south are increasingly built out on the coast and other areas of Lee County are quickly filling up. Prices in previously overlooked Cape Coral have been increasing steadily, which has started to impact sales volume. Lehigh Acres in eastern Lee County has recovered much slower due to its lower quality infrastructure and reputation, even though new homes in the area are among the most moderately priced. The rapid growth of the area is pushing development north into Charlotte County.

Existing home sales for Q3 2016 were down 12% from Q3 2015. Total existing home sales for 2016 YTD were down 10% over 2015 YTD sales. Existing home prices for Q3 2016 were up 9% over Q3 2015.

Overall, 2016 has been a strong year for Florida single-family home sales, even with some slowing in the third quarter from the strong second quarter. Now that the election is over and some of the uncertainty about the future is removed, the anticipated continuing household and employment growth, buoyed by retiree migration, indicates continuing potential for strong sales in 2017.

Note: Data on new and existing home sales and prices is based on closings as compiled by Metro Market Trends, Inc., from county property appraisers. >

Article and research prepared by Gregg Logan, Managing Director; Brian Martin, Vice President; and Karl Pischke, Associate.

RCLCO provides real estate economics and market analysis, strategic planning, management consulting, litigation support, fiscal and economic impact analysis, investment analysis, portfolio structuring, and monitoring services to real estate investors, developers, home builders, financial institutions, and public agencies. Our real estate consultants help clients make the best decisions about real estate investment, repositioning, planning, and development.

RCLCO’s advisory groups provide market-driven, analytically based, and financially sound solutions. Interested in learning more about RCLCO’s services? Please visit us at www.rclco.com/expertise.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us