Millennials’ Influence on New Home Demand

Will the demand for new for-sale housing from the Millennial generation continue to increase as the economy slowly recovers, or has a permanent generational shift in housing preferences occurred that has forever reshaped the real estate economy? The National Association of Realtors annual survey shows that first time buyers made up just 33% of home purchasers this past year, down from about 40% on average since 1981. Is this the new normal?

While their influence on the for-sale market to date has been less than hoped for, the sheer volume of households in their 30’s coming of age, along with improvements in the cost and availability of mortgage credit, will increase demand in the for-sale housing market. Millennials’ impact on real estate is already being felt elsewhere—they are an important factor in a number of real estate trends we’re following across a range of real estate sectors. They have helped drive the recovery in the multifamily sector, and are contributing to emerging trends such as the increased demand for micro-units: small units with high per-square-foot but attainable absolute dollar rents in strong urban locations. They are driving multifamily demand in “emerging” neighborhoods now that many of the best locations are so expensive. Their high utilization of online shopping contributes to shifting demand from retail to warehouse space. They will increasingly become a force in the emerging urban owner-occupied housing market as their overall impact on homebuilding grows in the years ahead. And they are influencing the form of new community developments given their preferences for convenient, multiuse, urban, and “urban-like” suburban environments.

So who are these buyers, and what do they want in terms of the homes and communities where they will purchase? According to the Census, 43% are non-white, making them the most diverse of any recent generation. A 2014 Pew Research Center survey suggests they are more embracing of technology, and more likely to delay marriage and children. One of the greatest predictors of when consumers change their housing circumstances is a change in their stage of life. The fact that many are marrying and having children later plays a role in when they choose to buy a home. Nonetheless, they are forecast to create over 2.7 million households over the next decade, according to the Joint Center for Housing Studies of Harvard University.

The median age at first home purchase, according to the National Association of Realtors, has historically been stable at around age 30. The most likely scenario is that as more and more Millennials reach their 30’s, their impact on the demand for new single-family homes will increase. This is a huge generation, as big (or bigger depending on exactly which birth years are included) as the Baby Boomers, and just like the Boomers they will have a profound effect on the demand for for-sale real estate. However their ramp-up period is likely to be longer as a result of economic conditions and lending standards during their entry to the market. Some have suggested that the decline in younger homebuyers represents a permanent change in preferences. But the evidence points to the economy and access to credit as equally important factors. As the economy improves and as they move through various phases of their lives their housing preferences are likely to shift much as it did for previous generations.

We tend to think of recessions as short-term events, but the recent period of high unemployment and falling incomes has had longer-lasting consequences. The recession landed hardest on the younger generation and has delayed their achieving many of the milestones of adulthood, including the ability to form a household. In terms of the for-sale market, the homeownership rate among adults under age 35 fell by 12% between 2006 and 2011. The reduction in the number of first-time homebuyers has substantially slowed the housing recovery. The continuing economic recovery is gradually improving conditions. Studies by the Federal Reserve Bank of New York’s Research and Statistics group suggest that there is little evidence of permanent structural damage to the economy’s productive potential, but that tight credit and other factors holding back investment demand have been a drag on the recovery.

Even as the economy has been improving, many younger renter households have not yet become homeowners due to their lack of sufficient access to credit. They have reached the age range where many in previous generations purchased during what has been a historically tight lending market, and they often lack sufficient savings for the higher down payments typically required.

The Millennial generation’s higher levels of student debt have also adversely affected their rates of homeownership. Many more 25-year olds—about 43% currently—have such loans relative to 10 years ago. The average debt is about $20,326, compared with $10,649 in 2003, according to the Federal Reserve Bank of New York and Equifax. Servicing that debt takes an average of 5% annually out of what might otherwise be saved for a down payment for a home, and lowers the average price that can be paid. This is exacerbated by tight mortgage credit and strict lending standards. Potential housing consumers with substantial student debt have had a harder time meeting strict lending standards. The average Millennial’s VantageScore credit score is 628, compared with 735 for the Greatest Generation, 700 for Baby Boomers, and 653 for Gen X.

While much has been made of Millennials’ higher levels of student debt, the flip side is that they are the best-educated generation of young adults in American history, and educational attainment and economic success are highly correlated. More than a third of Millennials have a bachelor’s degree or higher, compared with 24% of Boomers at that same age. Sure, they got off to a rough start, coming of age in the midst of the Great Recession, but according to a recent survey by Glassdoor.com, employed Millennials see their future job prospects in a far more positive light than older generations.

Meanwhile access to credit is gradually improving. On October 20, 2014, Melvin Watt, director of the Federal Housing Finance Agency, which regulates Fannie Mae and Freddie Mac, announced steps to allow more first-time buyers into the market. FHFA is providing assurances to banks relative to losses on loans they sell to the government, and to allow borrowers to obtain government-backed loans with lower down payments than have been required. After the recession many banks had to pay billions of dollars on bad loans they sold to Fannie and Freddie, and as a result imposed stricter mortgage requirements, thereby shrinking the pool of qualified buyers. The expectation is that these new policies will help to expand the pool of qualified buyers by loosening requirements.

A recent Fannie Mae survey indicated that most Millennials would like to own their own home someday. The Federal Reserve Bank of New York Survey of Consumer Expectations found that the average renter thinks he or she has a 63% chance of moving in the next three years, and a 44% probability of buying a home when they move. While this probability is lower than that of existing homeowners, 75% of whom believe they will buy upon their next move, it still indicates that an increasing number of younger buyers will be entering the for-sale housing market.

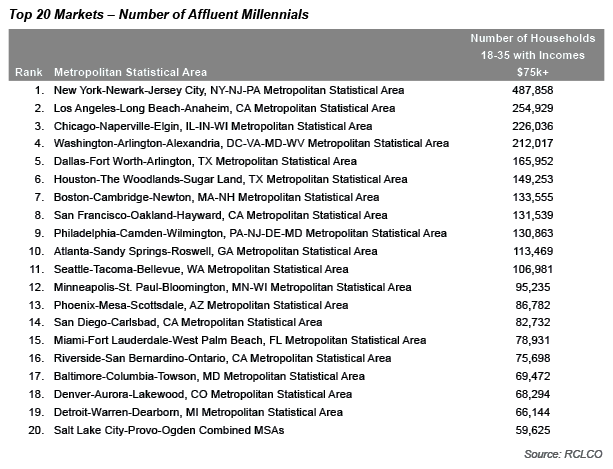

While many have been held back by circumstances, there are places in the country where there are large concentrations of affluent Millennials—New York; Los Angeles; Chicago; Washington, D.C.; Dallas; and Houston—where their influence on real estate markets will be increasingly evident. An improving economy, greater access to credit, and the sheer size of this generation of young consumers will eventually translate into increased demand across real estate sectors for new products that better meet their needs at each stage of their lives.

Article and research prepared by Gregg Logan, Managing Director.

RCLCO provides real estate economics and market analysis, strategic planning, management consulting, litigation support, fiscal and economic impact analysis, investment analysis, portfolio structuring, and monitoring services to real estate investors, developers, home builders, financial institutions, and public agencies. Our real estate consultants help clients make the best decisions about real estate investment, repositioning, planning, and development.

RCLCO’s advisory groups provide market-driven, analytically based, and financially sound solutions. RCLCO’s Community and Resort Advisory Group produced this newsletter. Interested in learning more about RCLCO’s services? Please visit us at www.rclco.com/community-and-resort.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us