RCLCO’s Mid-Year 2019 Sentiment Survey Results: Don’t Stress a Downturn Quite Yet

Headlines from this article:

- The RCLCO Current Real Estate Market Sentiment Index (RMI) has decreased since mid-year 2018 from 68.0 to 49.2, an increase from the RMI of 37.5 six months ago.

- Looking ahead, real estate is expected to experience gradually declining market conditions over the next 12 months, with the RMI anticipated to drop to 41.5.

- Approximately 9 out of 10 survey respondents (88%) believe the downturn will not occur until 2020 at the earliest, with 57% not predicting the downturn until 2021 or later. The next downturn is considered to be much less imminent than it did six months ago, when 46% of respondents believed the downturn would begin in 2019 or had already begun.

- Most respondents (70%) indicate that either trade wars or a global economic slowdown were the two most likely causes of the next downturn.

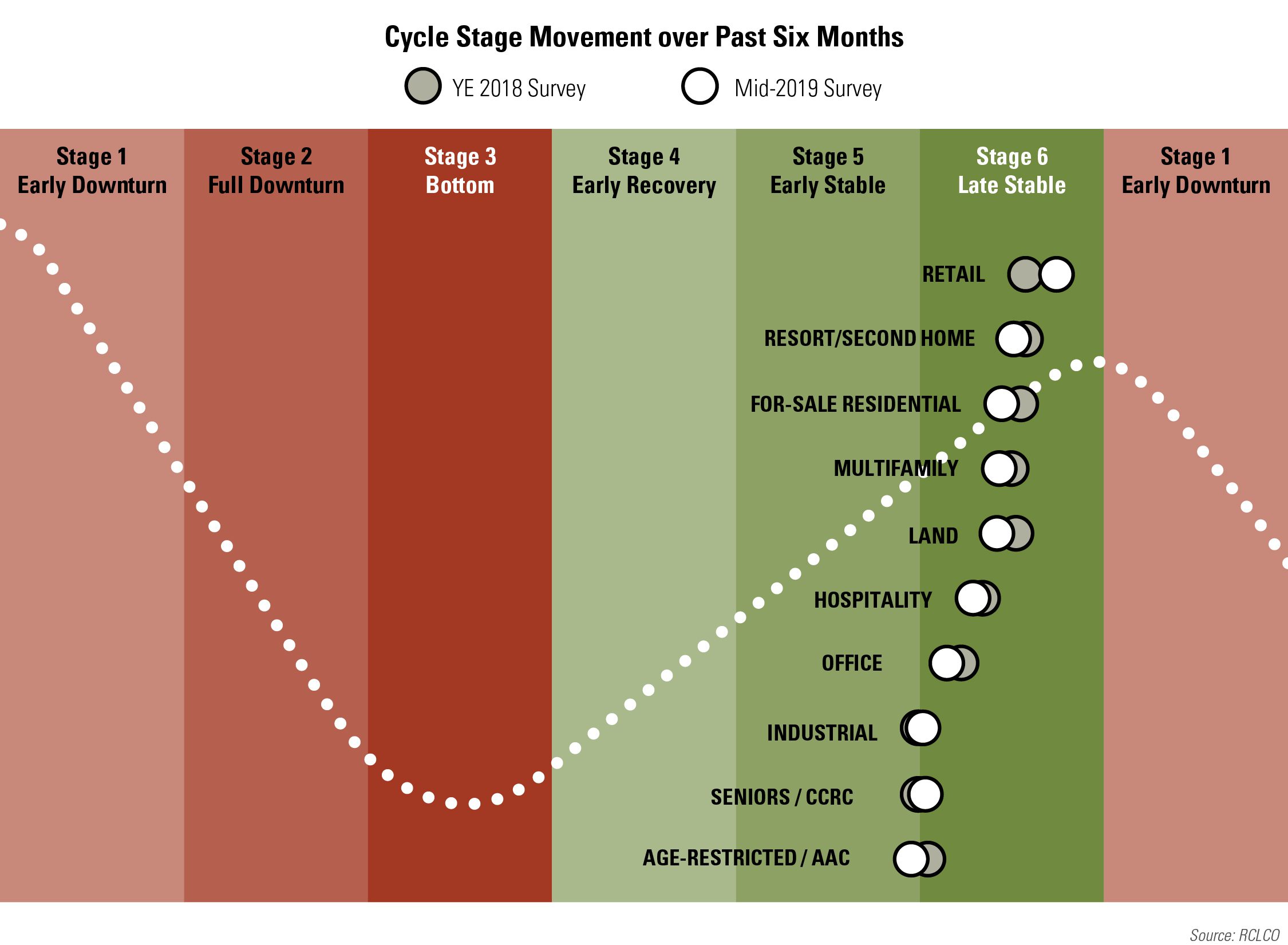

- Respondents indicate that most product types remain firmly in the “late stable” phase of the real estate cycle, with all but retail easing back from the cycle peak relative to year-end 2018 sentiments. The product types not yet in the “late stable” phase are on the cusp between “early stable” and “late stable.”

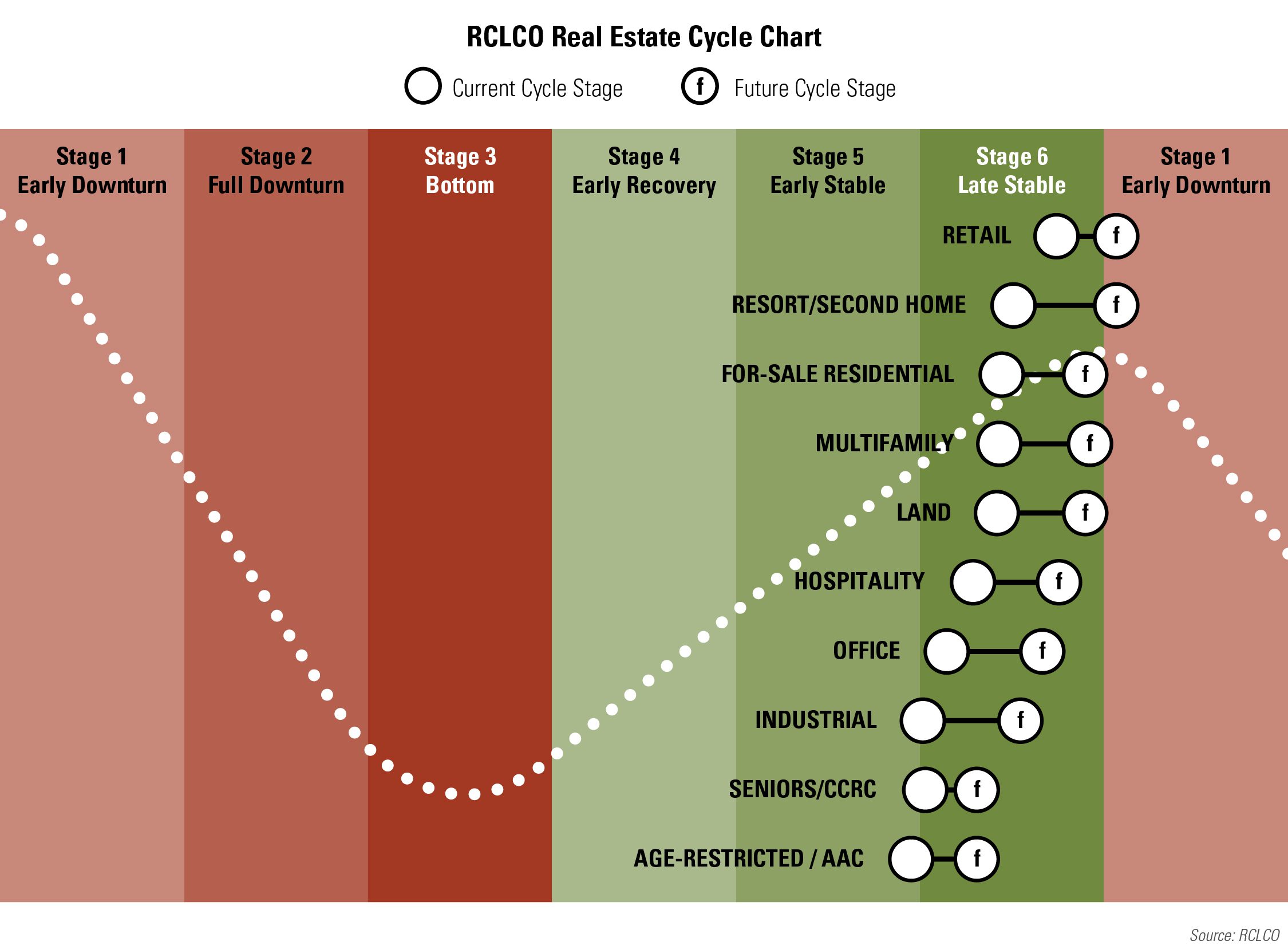

- Respondents anticipate that within the next 12 months, several product types will have moved past the peak and into the “early downturn” phase.

Over the past few years, RCLCO Sentiment Surveys have indicated continued confidence in real estate market conditions. Respondents to the year-end 2018 Sentiment Survey, however, were notably more pessimistic with regard to current and future real estate market conditions than in previous surveys. Responses to the mid-year 2019 Sentiment Survey suggest that respondents have pulled back somewhat on recent pessimism, as improving stock market conditions and resilient underlying real estate fundamentals have given reason for moderate optimism.

Responses from the year-end 2018 Sentiment Survey seemed to indicate that the downturn was forthcoming. Six months later, responses to the mid-year survey suggest that the recession could still be at least 18 months out. Furthermore, while respondents believe that most real estate sectors are firmly in the “late stable” stage of the cycle, the general sentiment is that most asset types are not quite as close to the “early downturn” phase as they had predicted six months ago.

Overall Sentiment Is Notably More Pessimistic Than in Recent Years

While sentiments about current national real estate conditions are noticeably more optimistic than they were six months ago, they are still significantly more pessimistic than they were a year ago. Just under one-third (29%) of the respondents to the recent survey say national real estate market conditions are moderately or significantly worse today than they were a year ago. This is 14 percentage points higher than in the mid-year 2018 survey. Conversely, the share of respondents reporting better market conditions today than one year ago decreased to 28%, down 24 percentage points from the mid-year 2018 survey. The proportion of respondents believing conditions are unchanged is 10 percentage points higher than in the mid-year 2018 survey. While respondents may have been overly negative six months ago, the most recent responses show a clear longer-term downward trend in sentiment.

How Would You Rate National Real Estate Market Conditions Today Compared With One Year Ago?

Current U.S. Market Sentiment over Time

Source: RCLCO

The steep decline, and ensuing bump, in sentiment over the past year are reflected in RCLCO’s Real Estate Market Index (RMI),[1] which measures sentiment on a 100-point scale. Currently, the RMI is 49.2, a 19-point year-long decrease from mid-year 2018 RMI but an 11-point six-month increase over year-end 2018.

A decrease of approximately this magnitude was actually anticipated by respondents to the mid-year 2018 survey, who predicted that the mid-year 2019 RMI would be 54.5—5.3 points above the actual RMI. Looking forward, respondents anticipate that over the next year the RMI will continue to decrease, to 41.5 in mid-year 2020. If this projection holds true, it is suggestive of the early stages of a downturn in the real estate market.

RCLCO National Real Estate Market Index

Source: RCLCO

The year-end 2011 survey sparked a four-year span in which more than 60% of respondents projected future market conditions 12 months later to be stronger than present market conditions. Starting in year-end 2015, future sentiments began to decline gradually, experiencing an accentuated dip in mid-year 2016 before moderate improvement in the following six months. As in the current survey, the pessimism six months earlier was somewhat moderated in the year-end 2016 survey.

In the year-end 2018 survey, when the stock market was declining, future sentiments dropped sharply, as significantly more respondents predicted a decline (59%) than an improvement (12%) for the first time in the history of the survey. Over the past six months, with the stock market back to near-record levels, sentiment has improved noticeably, with the number of respondents predicting a decline over the next 12 months (38%) and those predicting improvement (21%) much closer together than they were six months ago. The largest proportion of respondents (39%) are predicting that real estate market conditions will remain unchanged over the next 12 months, which is a first for the sentiment survey since mid-year 2011. While predictions for the future are more pessimistic than they were a year ago, this supports the widely held belief that while an economic downturn is approaching, it is probably not imminent.

12-Month U.S. Real Estate Market Predictions over Time

Source: RCLCO

Respondents Indicate that the Downturn Is Unlikely to Occur Within the Next 18 Months

Prior to the year-end 2018 survey, respondents had on average tended to push off the anticipated timing of the next downturn approximately two years from the date of the survey. In the year-end 2018 survey, respondents curbed this tendency, as 45% of respondents predicted that the downturn would be upon us by the end of 2019, including 20% of respondents who suggested that the downturn had already begun.

Respondents to the mid-year 2019 survey are once again pushing off the predicted timing of the downturn several years into the future. Approximately 88% of respondents believe the downturn will occur later than 2020, including 57% who believe it will not occur until 2021 or later.

Real Estate Downturn Timing Predictions over Time

Source: RCLCO

The Majority of Respondents Believe Either Trade Wars or a Global Economic Slowdown Will Be the Primary Cause of the Next Downturn

The mid-year 2019 survey also asked respondents what they believe is the most likely cause of the next real estate downturn. The options provided were:

- Trade wars

- Global economic slowdown

- Stock market meltdown

- Real estate overbuilding

- Risky lending practices

- Military engagements

- Other

Over two thirds (70%) of respondents selected one of two potential causes: trade wars (35%) and a global economic slowdown (35%). While several respondents note that a variety of these potential causes are interconnected, respondents provided many justifications for each of these two answers.

With regard to trade wars, the most common sentiments are that tariffs limit the purchasing power of the average consumer and increase the costs of intermediary goods (particularly in construction), which will eventually adversely affect the pipeline of projects and investments. In terms of a slowdown in the global economy, the most common opinions are that weakening economic conditions in Europe and China and political distrust are the most likely causes of a destabilized global economy.

Source: RCLCO

A “stock market meltdown” (10%), considered to be a manifestation of consumer uncertainty, and “other” (8%) were the next most commonly selected answers. There was quite a bit of variance in the comments of those selecting the “other” option, but a plurality of these respondents pointed to domestic political uncertainty, particularly surrounding the 2020 presidential election.

Reverse in Cycle Movement for a Majority of Product Types over the Past Six Months

Respondents to the year-end 2018 survey reported notable cycle movement for most product types over the previous six months, with all products either firmly in or creeping towards the late stable phase of the real estate cycle. Respondents to the mid-year 2019 survey have moved all product types except retail back away from the peak. However, these corrections are modest in the context of the past year and longer. Current positioning for retail, for-sale residential, land, hospitality, office, and age-restricted/AAC are significantly closer to the peak than they were a year ago. In contrast, multifamily, industrial, and seniors/CCRC positions have not changed much since mid-year 2018.

In this survey, retail, resort/second home, for-sale residential, multifamily, land, hospitality, and office all remain definitively in the “late stable” phase, with age-restricted/AAC, seniors/CCRC, and industrial uses remaining on the edge between “early stable” and “late stable.” Although the various product types are positioned differently within the “late stage” phase, their current positions and recent movement away from the early downturn stage are consistent with the general sentiment that the downturn is approaching, but not imminent.

Resort/Second Home and Retail Anticipated to Cross the Threshold into “Early Downturn” Phase

Respondents believe that all land uses will be at least in the “late stable” phase within the next 12 months, with resort/second home and retail crossing into the “early downturn” phase. Following closely behind, for-sale residential, multifamily, and land are expected to move close to the end of the late stable stage. Hospitality, office, industrial, seniors/CCRC, and age-restricted/AAC are all expected to be in the middle of the “late stable” phase. This is a slightly more moderated outlook than at year-end 2018, when for-sale residential was also expected to enter into early downturn within 12 months.

Share of Respondents Believing Current Downturn Conditions and Predicting Downturn in Next 12 Months Increases Among All Land Uses

While the majority of respondents do not believe that any product types are currently in downturn, the proportion of respondents that do believe product types are already in downturn has increased since the mid-year 2018 survey for all land uses except multifamily and office. The most dramatic examples of this are resort/second home, with 36% of respondents indicating current downturn conditions (up 15 percentage points since mid-year 2018); for-sale residential, currently at 20% (up 13 percentage points); and land, currently at 21% (up 11 percentage points). Keeping with the trend, significantly fewer respondents in mid-year 2019 believe that each product type (except retail and hospitality) is currently in downturn than believed this in the year-end 2018 survey.

Share of Respondents Believing Current Downturn Conditions

Source: RCLCO

Respondents believe that all product types are more likely to be in downturn in 12 months than they are now. By 12 months from now, the majority of respondents expect a few land uses to be in downturn. The mid-year 2019 survey indicates that 63% of respondents expect retail to be in downturn (up 11 percentage points from the 52% of respondents who believe it is currently downturn), along with 56% for resort/second home (up 21 percentage points). Additionally, close to one-half of respondents expect several other land uses to be in downturn—46% for for-sale residential (up 26 percentage points) and 44% for land (up 23 percentage points).

Share of Respondents Believing Current Downturn Conditions and Predicting Downturn Conditions over the Next 12 Months

Source: RCLCO

RCLCO’s Point of View on the Real Estate Economy

Real estate has continued to benefit from an expanding U.S. economy, with fundamentals either continuing to improve or holding steady across all asset types. Pricing and transaction volume continue to be buoyed by yield-seeking capital, as interest rates have declined over the past quarter. While operating fundamentals remain strong, growth rates have tempered, which, combined with capital market risks, indicate that real estate may be nearing the end of the “late stable” stage of the market cycle, and heading into an “early downturn.” This is consistent with the opinions of Sentiment Survey respondents.

After flirting with inversion during the early part of the year, the yield curve has maintained an inverted form over recent weeks, hinting that there is risk of recession within the near- to medium-term. When it occurs, real estate will experience some pain, even if not to the same degree as during the last downturn. Absorption may no longer keep up with deliveries of new multifamily and industrial buildings, and office and retail assets may struggle to maintain occupancy in the face of changing demand characteristics.

There is still more capital than there are good real estate opportunities that meet return expectations, and capital stacks at the asset level have been constructed more conservatively in the upturn phase of this cycle, so we don’t expect to see that much stress in the system. And while we don’t expect to see a repeat of the dislocation experienced during the Great Recession, there will still be opportunities in the next downturn. Accordingly, we recommend that market participants keep some “dry powder” available for opportunistic buys. Equal attention should be paid in the latter stages of the expansion to “eyes wide open” underwriting, and income and value creation through focused operations. Real estate investors should underwrite with realistic assumptions about future income and expense escalations, and test for downside protection and make sure they are comfortable with the results.

Property Markets Outlook

Two general stories have emerged in real estate property markets in recent years. The first, which can be applied to multifamily and industrial real estate, is one of significant and sustained demand growth across all markets, which has led to rent growth and (eventually) to new construction. Generally, demand for multifamily and industrial space continues to sustain new deliveries, but construction pipelines are sizable nearly everywhere, and could create some further localized distress when an economic slowdown occurs. This is consistent with Sentiment Survey respondents’ belief that multifamily and industrial, unlike most product types, are no closer to the peak than they were a year ago.

The second story, which can be applied to office and retail, features property types threatened by oversupply and/or structural obsolescence thanks to changing demand characteristics. Performance of these property types varies significantly across markets, though generally positive fundamentals (for office and retail) have resulted largely from very little construction (outside of rapidly growing tech and other “boom” markets). This will likely reverse when employment growth and consumer spending slow down.

Capital Markets Outlook

Returns continue to moderate as real estate capital market conditions continue to favor “sellers” of both property and debt investments, albeit at less feverish rates, with pricing for non-prime assets softening considerably in the past six months:

- Equity – Transaction volume remains robust; however, it has dipped from 2018 levels and has not kept up with fundraising efforts, leading to record levels of “dry powder.” Cap rate spreads to treasuries have dipped below their long-term average, likely pricing out some would-be real estate investors who are worried about where we are in the cycle. While cap rates have not moved much, asset pricing for non-prime assets relies more on current performance than on projected performance—an adjustment that has caught sellers by surprise.

- Debt – Net capital continues to flow into the real estate sector, led by commercial banks, life insurance companies, and the GSEs. Investment underwriting standards have remained relatively stable over the past year, after years of loosening credit standards, leading to the availability of capital.

Keep an eye out for a more detailed RCLCO Point of View, to be published next week, which will include more information about the various real estate sectors, and advice for what real estate companies should be thinking about as we approach the “early downturn” phase of the cycle.

Who Took the Survey?

RCLCO’s Market Sentiment Survey tracks the sentiments of a highly experienced pool of real estate professionals from across the country and across the industry. Approximately three-fifths (63%) of respondents have worked in the real estate industry for 20 years or more, and 79% of respondents are C-suite or senior executives in their organizations.

Years of Experience in Real Estate

Source: RCLCO

Position in Organization

Source: RCLCO

Developers and builders comprise the largest share of respondents, at 36% of the sample. Another 17% are investors or capital allocators, followed by 9% in design or architecture firms. The remaining 38% of respondents come from a variety of other types of organizations within the real estate industry and public sector.

Type of Organization

Source: RCLCO

The respondent mix is representative of the U.S. as a whole; however, it is weighted towards those who report working primarily in coastal and Sunbelt markets. This respondent mix reflects markets where there has been significant development activity in this cycle.

Primary Region/Market

Source: RCLCO

Article and research prepared by Leonard Bogorad, Managing Director, and Maury Winter, Analyst.

References

[1] The Real Estate Market Index (RMI) is based on a semiannual survey of real estate market participants and is designed to take the pulse of real estate market conditions from the perspective of real estate industry participants. The survey asks respondents to rate real estate market conditions at the present time compared with one year earlier (Current RMI), and expectations over the next 12 months (Future RMI). The RMI is a diffusion index calculated for each series by applying the formula “(Improving – Declining + 100)/2.” The indices are not seasonally adjusted. Based on this calculation, the RMI can range between 0 and 100. RMI values in the 60 to 70+ range are indicative of very good market conditions. Values below 30 are typically coincident with periods of economic and real estate market stress/recession.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us