Cycle Update: Stable Conditions Continue

RCLCO’s National Market Sentiment Survey 3Q 2015 Results – Part 2

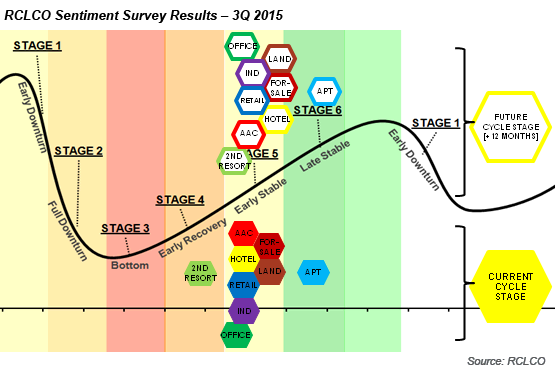

Echoing participants’ positive sentiments regarding current and future market conditions, respondents to RCLCO’s latest Market Sentiment Survey reported that most land uses are in the “early stable” phase of the real estate cycle and are likely to remain there over the next year. Since RCLCO’s last sentiment survey in January, no land uses have moved into the “late stable” stage, and most have only edged up slightly within the same stage they were in six months ago.

According to survey participants, rental apartments continue to be the only land use in the “late stable” phase or projected to be in the late stable phase one year from now. Additionally, respondents indicated that resorts/second homes continue to lag behind all other land uses, remaining in the “early recovery” phase where it has been since 1Q 2013.

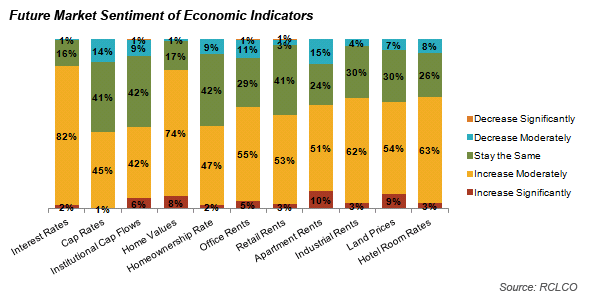

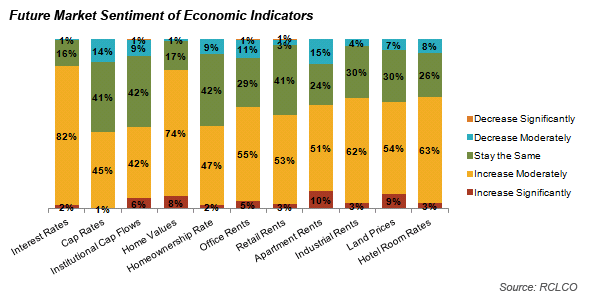

The outlook for economic indicators underlying land use performance is similarly positive but modest. There is a slight decrease in the share of respondents who believe that institutional cash flows will increase. Additionally, the proportion of respondents who expect interest rates and cap rates to “increase moderately” is higher on this survey than in 1Q 2015, when a larger share expected these rates to stay the same. However, the majority of respondents still expect indicators such as interest rates, home values, and rents to increase moderately or stay the same.

Overall, the predictions respondents made 12 months ago about today’s conditions have proved highly accurate. Based on this track record and respondents’ predictions for current conditions to continue, no major movement in the real estate cycle is anticipated over the coming year.

Multifamily Rental: Mature but Stable

Survey respondents have judged the multifamily rental sector to be in the late stable phase since 1Q 2014. In the most recent survey, however, 8% judged multifamily rental to already be in early downturn, a rate almost twice as high as that seen in the previous two surveys.

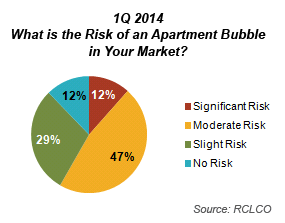

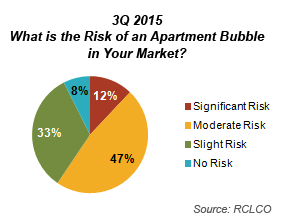

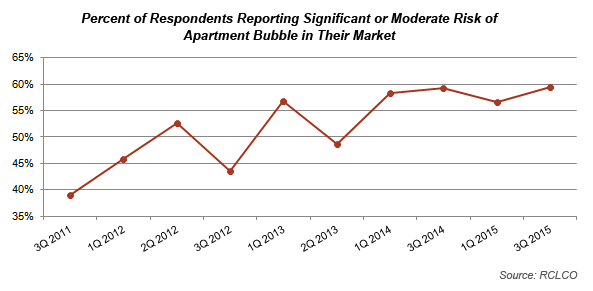

A majority of respondents (59.4%) believe there is a moderate or significant risk of an apartment bubble in their market. Yet, as the charts below show, the share of respondents reporting this level of risk has held steady since 1Q 2014.

Reflecting the ongoing but moderate risk of an apartment bubble, respondents continue to forecast moderately higher apartment rents. Over the next year, 51% expect rents to increase moderately, while 10% expect significant rent increases and 24% expect rents to stay the same. The other 15% expect rents to decrease.

Resorts and Second Homes: Lagging Behind

Resorts and second homes are the only land use still in the early recovery phase. While participants are optimistic about the performance of this land use over the next 12 months (60% expect it to be “early stable” or “late stable” in 3Q 2016), they have been predicting this rather dramatic jump to the stable stage since 1Q 2014 and it has yet to materialize. Instead, the resort/second home category has merely continued to edge forward in the same phase, as the other land uses have.

Strong Opinions on EB-5

On each Sentiment Survey, RCLCO asks one “wild card” question to gauge sentiment on a particularly timely or interesting issue in real estate. This time we asked about your experience with the EB-5 program—and respondents certainly had a lot to say!

The Immigrant Investor Program, commonly referred to as “EB-5,” is a federal program meant to attract foreign investment capital to the United States in exchange for U.S. visas for foreign nationals. The EB-5 (“Employer Based”) visas are awarded based upon a minimum $500,000 investment in a for-profit enterprise that creates or retains at least 10 jobs. Projects can be funded with EB-5 capital in two ways: through individual, direct investments or through a government-approved “regional center” that acts as an intermediary. 1

While the program has been around since 1990, it has become a much more popular source of capital in the aftermath of the Great Recession. A recent Washington Post article found that while 3,340 EB-5 visas were issued in 2011, 10,692 were issued in 2014. Further, a paper commissioned by the EB-5 Investment Coalition asserts that the investments made to earn these visas generated $1.6 billion of capital and 31,000 jobs in 2013. The program is perhaps most commonly used for hotel and mixed-use real estate developments in California, New York, Florida, and Washington, D.C.

Approximately 60% of RCLCO survey participants were familiar with EB-5 but had not used the program—and only 22% of these respondents expected to use it in the future. Of the 8% of respondents who had used EB-5 financing, about one-half expect to use it again. A full one-third of respondents were unfamiliar with the program.

Comments on the program ranged from negative to positive but generally fell into a few categories. On the positive side, respondents liked EB-5’s “attractive financing rate” and its ability to bring foreign capital to second-tier markets. One person mentioned that working through regional centers makes for a better experience with the program.

However, most respondents noted that the program is a good source of capital in theory or when other financing options are limited but that it is difficult to actually procure or execute (adjectives mentioned included “messy,” “cumbersome,” “convoluted,” and “complicated”). In particular, respondents remarked on the program’s vulnerability to political influences and the large amount of paperwork, technical requirements, and general “red tape” involved in the process. Another common concern is the program’s lack of connection to the U.S. economic cycle and thus the potential to distort market pricing. As foreign demand conditions change, some respondents wondered about the future of the program.

Others were downright critical of EB-5, referring to it as “swarmy,” with a “high potential for abuse.” Another participant who had used the program previously and had a “bad experience” believes EB-5 results in marginal deals.

Several survey respondents mentioned that the program needed reform, and they are not alone. In June 2014, Senators Charles E. Grassley (R-Iowa) and Patrick J. Leahy (D-Vermont) proposed new legislation that would reauthorize the program but with a higher minimum foreign investment and greater federal oversight, including better proof that each investment generates the jobs it promises. Funding for the current program expires September 20, 2015, so expect to hear more about this issue as the reauthorization date approaches.

1 Regional centers are any government agency or private commercial entity that have been approved by U.S. Citizen and Immigration Services to collect and distribute the EB-5 “job creation credits” that investors need to obtain EB-5 visas. As of July 2015, there are 689 regional centers. Regional centers are more conducive to pooling capital from multiple investors, and they have more flexible job-creation requirements. Source: http://www.eb5investors.com/eb5-basics/become-eb5-regional-center.

Article and Research prepared by Len Bogorad, Managing Director, and Clare Healy, Associate.

RCLCO provides real estate economics and market analysis, strategic planning, management consulting, litigation support, fiscal and economic impact analysis, investment analysis, portfolio structuring, and monitoring services to real estate investors, developers, home builders, financial institutions, and public agencies. Our real estate consultants help clients make the best decisions about real estate investment, repositioning, planning, and development.

RCLCO’s advisory groups provide market-driven, analytically based, and financially sound solutions. RCLCO’s Strategic Planning and Litigation Support Advisory Group produced this newsletter. Interested in learning more about RCLCO’s services? Please visit us at www.rclco.com/strategic-planning

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us