Co-Investments in Real Estate: A Quick Primer

Two Key Types of Co-Investment

As institutions consider their options for real estate investing going forward, many are adding co-investments to the traditional candidate list of funds, separate accounts, and joint ventures. Like any other strategy, co-investments have some unique characteristics as well as pros and cons that need to be weighed. It is also helpful to know that the industry uses the term “co-investment” in two distinct ways:

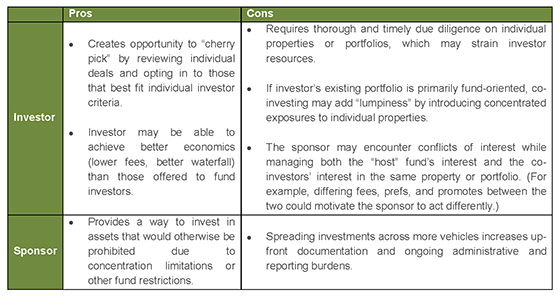

Definition #1: Investment opportunities created by concentration limitations or other fund restrictions. These are also known as “sidecar” investments. In this context, there are opportunities for investors to contribute capital alongside the “host” fund involving a specific asset or portfolio. Pros and cons for investors and sponsors are summarized in the following matrix:

In addition to the pros and cons of Definition #1, it is useful to know that co-investment provisions vary widely in partnership documents. For example:

- Sponsors may or may not be required to offer any co-investment opportunities to “host” fund investors.

- Offering co-investments to investors outside the “host” fund may or may not be permitted.

- There may or may not be a protocol for which “host” fund investors are offered co-investment opportunities, what allocations they are offered, and in what order.

- The time frames required for responding to co-investment opportunities may be tight.

- Economic terms (fees, pref, and promote) for co-investments may be required to mirror the “host” fund’s terms, or may be different but predetermined, or may be freely negotiated on a deal-by-deal basis.

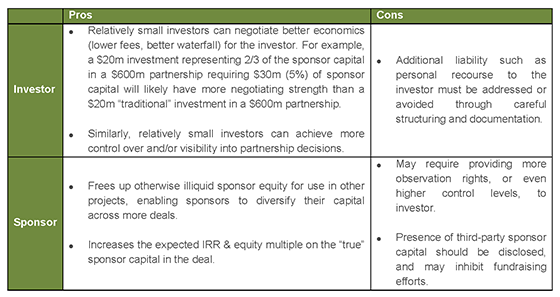

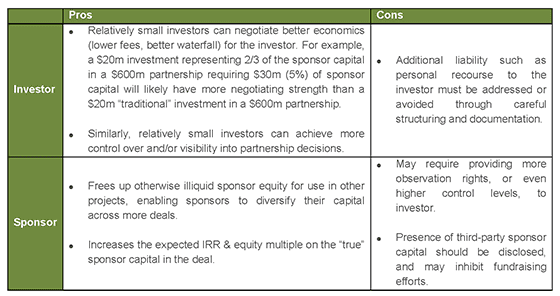

Definition #2: Sponsor capital committed to a fund, syndicate, or joint venture. In this context, there are opportunities for investors to contribute portions of the sponsor capital for funds, syndicates, or joint ventures in exchange for superior economics. This is typically structured as an “LP position in the GP” (or the LLC equivalent). Pros and cons for investors and sponsors are summarized in the following matrix:

Crucial Steps Toward Implementation

A thoughtful approach to co-investing can enhance a real estate portfolio by providing increased exposure to investments that are particularly well suited for a specific institution. To maximize potential benefits, the following steps are critical:

- Evaluate the existing portfolio’s composition to determine which property types, geographies, and/or risk profiles are underweight, both currently and prospectively, relative to the overall strategy. Focus on opportunities that fit those needs, rather than pursuing every co-investment opportunity that arises.

- Perform an honest assessment of in-house capabilities to conduct thorough and timely property-level and deal-level due diligence when opportunities arise. If doing so will strain resources, arrange for help either by reconfiguring internal staff or outsourcing.

- Review partnership documents governing current fund investments to determine existing co-investment rights, if any.

- Communicate with fund managers to help them understand your objectives and due diligence processes, so your agenda is top of mind when they encounter co-investment opportunities.

Article and research prepared by Neil Madsen, Managing Director.

RCLCO provides real estate economics and market analysis, strategic planning, management consulting, litigation support, fiscal and economic impact analysis, investment analysis, portfolio structuring, and monitoring services to real estate investors, developers, home builders, financial institutions, and public agencies. Our real estate consultants help clients make the best decisions about real estate investment, repositioning, planning, and development.

RCLCO’s advisory groups provide market-driven, analytically based, and financially sound solutions. Interested in learning more about RCLCO’s services? Please visit us at www.rclco.com/expertise.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us