Apartments Continue to Lead Commercial Property Market Recovery

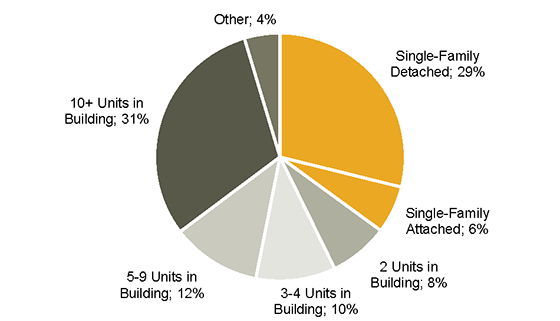

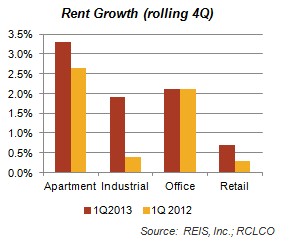

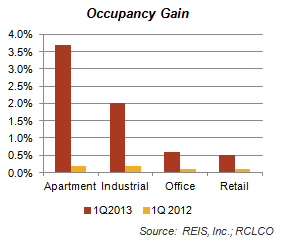

All property types in the U.S. continue to improve, with occupancy and rents up in the first quarter of 2013.1 Despite concerns about increasing apartment construction and an improving single-family market, the apartment sector continues to lead the market with both the highest occupancy gains and the highest rental rate gains2 in the first quarter. With the national vacancy rate at only 4.3%, rents are up in nearly all markets. Employment growth is up by more than 2% year-over-year in many of the energy markets and low cost service markets (primarily in the south). Thus occupancy is rising particularly fast in high-growth markets such as Houston, Phoenix, Jacksonville, and Las Vegas. High apartment supply is expected to begin hitting the market in larger quantities in the second half of the year.

All property types in the U.S. continue to improve, with occupancy and rents up in the first quarter of 2013.1 Despite concerns about increasing apartment construction and an improving single-family market, the apartment sector continues to lead the market with both the highest occupancy gains and the highest rental rate gains2 in the first quarter. With the national vacancy rate at only 4.3%, rents are up in nearly all markets. Employment growth is up by more than 2% year-over-year in many of the energy markets and low cost service markets (primarily in the south). Thus occupancy is rising particularly fast in high-growth markets such as Houston, Phoenix, Jacksonville, and Las Vegas. High apartment supply is expected to begin hitting the market in larger quantities in the second half of the year.

The office sector continues to be fragmented. While only New York and Washington, D.C. continue to have vacancy rates below 10%, the D.C. market is experiencing some weakening in occupancy rates. Rents in New York, San Francisco, and San Jose are improving quickly, and pricing reflects these expectations. However, a few high-growth markets with lower overall market occupancy rates are also improving. Texas, in particular, is charging back, with significant first quarter rent growth in Austin, Houston, and even parts of the Dallas-Fort Worth area.

The industrial market is similarly fragmented, with occupancy gains in about three-fourths of the markets. Port markets such as the Inland Empire, which led the market in both absorption and rent growth, are particularly strong, although the Inland Empire is also leading in new construction. While Texas was also a strong performer, several local markets with limited national or regional distribution access continue to struggle.

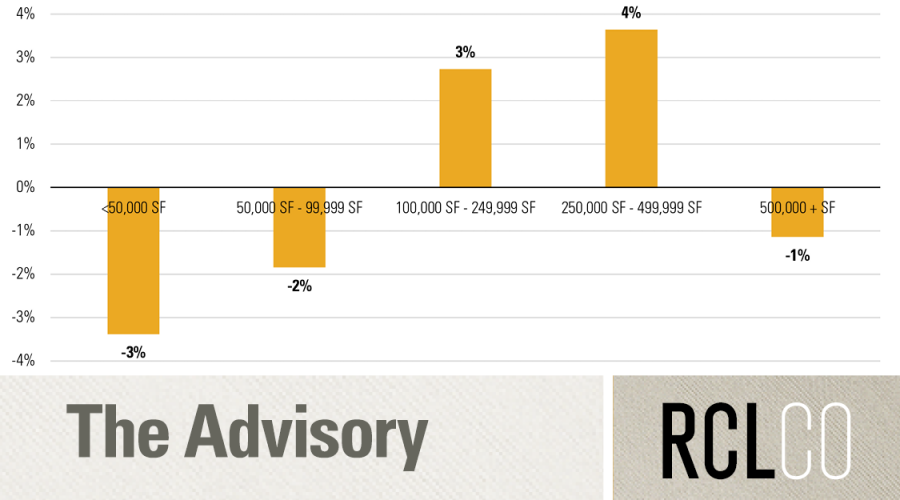

The retail sector–which continues to face increasing internet sales–is improving, but continues to struggle, with more local and regional tenants in neighborhood and community centers lagging mall tenants. Neighborhood incomes and supply restrictions continue to be paramount considerations in the performance of properties in this sector.

1On a quarter-over-quarter (QoQ) and rolling four quarter basis.

2Based on a rolling four quarter basis. Office QoQ rental growth was slightly higher at 0.7% in 1Q2013 than apartment QoQ rental growth of 0.5%.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us