Apartment Pricing Power Remains Strong

Renters Still Willing to Pay More for Larger, Better, and Well Located Units with a New Focus on Amenities

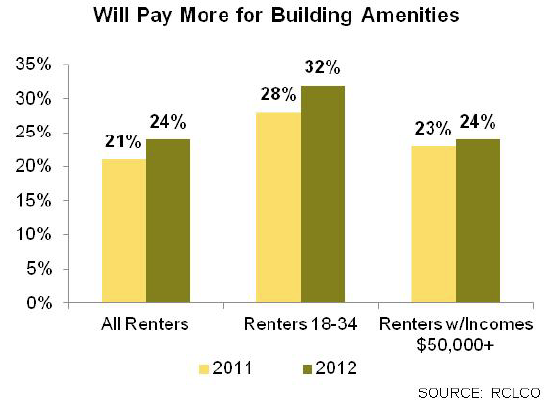

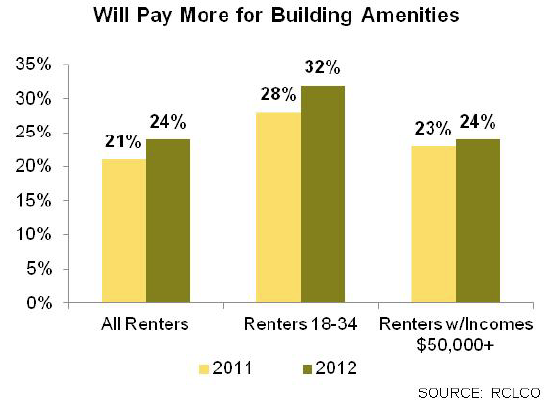

RCLCO conducted an internet-based survey in early April in which more than 1,400 U.S. renters respond- ed to the question, “As you think about your next apartment, which of the following features would make you pay more for monthly rent?” This same survey was also fielded early last summer, and the results are remarkably similar, suggesting that despite the rent increases American renters have absorbed over the last several years, pricing power has not diminished.

Consistent with last year’s findings, and not a surprise, the most popular response was “a larger apart- ment (I need more space),” with 42% of all renters selecting this response. Quite encouragingly, closely following a larger unit was the response “a better neighborhood, near shopping and other services.” 31% of all respondents indicated this motivation, essentially the same as last year’s 30%.

Among high-end renters (with incomes $50,000+), 39% said they would pay more for a better neighbor- hood, exactly the same level as last year. It’s also compelling to note that “better neighborhood” was significantly more compelling than “newer,” at 24%.

Another key takeaway is that many buyers (21%) are also willing to pay more for a “better-quality apart- ment but not necessarily larger (same size space that I have now).” Of particular interest is that younger renters (18-35) are significantly more motivated (28%) than the market overall to pay higher rent for qual- ity rather than size, providing further validation to RCLCO’s recent observations that younger apartment renters are willing to accept smaller units if well designed and well located.

Another key takeaway is that many buyers (21%) are also willing to pay more for a “better-quality apart- ment but not necessarily larger (same size space that I have now).” Of particular interest is that younger renters (18-35) are significantly more motivated (28%) than the market overall to pay higher rent for qual- ity rather than size, providing further validation to RCLCO’s recent observations that younger apartment renters are willing to accept smaller units if well designed and well located.

These findings suggest that a value-add strat- egy in prime locations may provide compelling incremental risk-adjusted returns to buying core assets in secondary locations.

Amenities were again in the middle of the pack, but showed the most positive change of any selection criteria. 24% of renters, up from 21% last year, said they are willing to pay more for “newer or better amenities.” Again, young rent- ers (32%—up from 28% last year) were the most likely to accept a higher monthly housing burden to have better amenities, suggesting that Gen Y renters in particular value lifestyle in similar measure to square footage.

This finding is consistent with other national research that highlights Generation Y’s predisposition to value communal experience, and appears to validate what is rapidly becoming an “amenities arms race” among parties active in new development. The winners of this race will be those who are most creative in broadening the definition of amenities (it should include things like car sharing, community service programs, and retail facilities) and in communicating the lifestyle benefits of new properties above and beyond newness itself.

These findings should give developers and investors some continued assurance that pricing power has probably not lessened meaningfully over the last year, and that tomorrow’s rental customer, as we argued last year, is going to pay premium rents for sophisticated and well-located product.

Still, owner/operators need to be proactive in communicating rental rate increases with a clear message of product enhancement. This is true even at newer properties where the additions or renovations might be minimal or focus on services rather than features. If the much-celebrated evolution to a nation meaning- fully comprised of renters by choice is to continue and strengthen, the quality and thoughtfulness of the rental product needs to increase as well.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us