Multifamily Metrics and Market Selection

Jobs, income, GDP—you read the market rankings every quarter, but still wonder how closely they correlate with apartment market performance? Can these economic indicators offer guidance on the future of a particular market’s apartment sector performance?

RCLCO analyzed job growth relative to key market performance indicators—net absorption, new deliveries, and rent growth—for the top 25 MSAs across the country, and the results may surprise you.

Is it only about jobs?

Job growth can identify markets where you might want to be a long-term owner, but market-hopping to follow last year’s hottest economy is no guarantee of a quick lease-up.

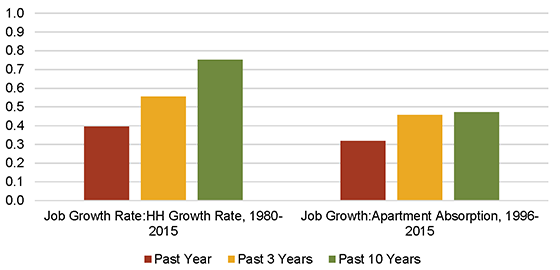

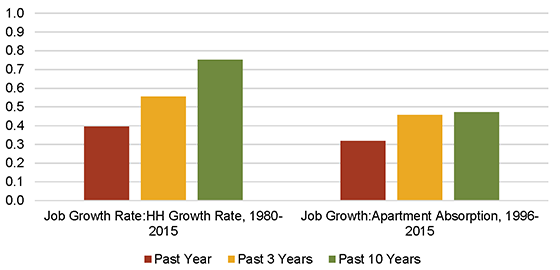

Little surprise here—over the long term, household growth is highly correlated with job growth. But the impact of strong job growth on demand for new housing may take 10 years to fully materialize, as demonstrated by when the correlation begins to level off on the graph below. The correlation is weaker for the direct relationship between job growth and apartment absorption, though the full impact is felt in just three years—much sooner than the full effect of household growth.

Perhaps counterintuitively, the year-to-year correlation of job growth with both household growth and apartment absorption is weaker and suggests other factors are also at play.

Average Correlation, Top 25 MSAs

SOURCE: Moody’s Analytics; Axiometrics

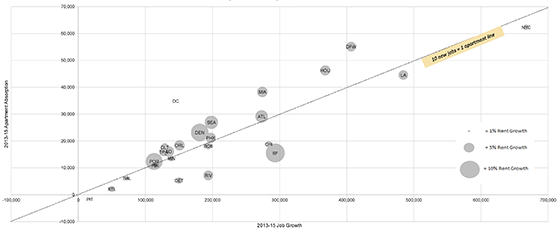

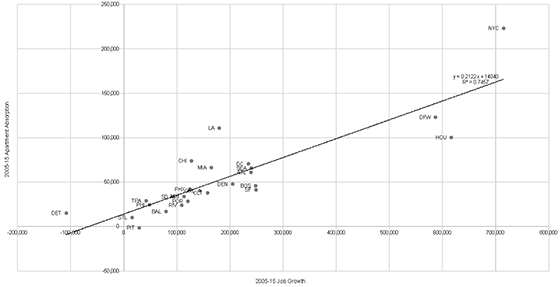

Is job growth at least an organizing principle relative to absorption?

Markets follow a consistent pattern, in which markets with more job growth have higher apartment absorption; however, each market’s relationship to the 25-market average demonstrates more about the type of market than the level of demand.

2005-2015 Job Growth and Apartment Absorption

SOURCE: Moody’s Analytics; Axiometrics

Over the last three years, roughly 10 new jobs generated demand for one newly occupied apartment unit. Over 10 years, the relationship is stronger at only five new jobs for one new apartment.

2013-2015 Job Growth, Apartment Absorption, and Annualized Rent Growth Rate

SOURCE: Moody’s Analytics; Axiometrics

So if not jobs, then what?

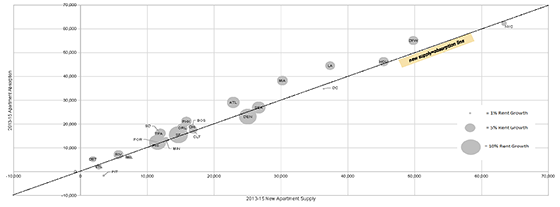

New supply is most closely correlated with absorption in the growth phase of the market cycle.

Looking at the past three years, new supply and absorption are closely related across the top 25 MSAs, with a few Sunbelt metros absorbing more than supply and none of the top 25 significantly overbuilding. The dotted line in the graph below indicates where new supply and absorption were exactly in balance.

This shouldn’t be confused for a causal relationship—new supply, by itself, does not automatically mean new demand. In some markets that have been historically undersupplied, it is one possible explanation. Other markets could see a similar relationship for other reasons, such as:

- Strong overall long-term growth means future depth of market not accurately predicted by historical construction/absorption;

- Shift towards renting from owning;

- New product inducing moves out of shadow market.

Rent growth, shown by the size of bubble, was unrelated to the relative supply-demand balance over the three-year period.

2013-2015 New Apartment Supply, Apartment Absorption, and Annualized Rent Growth Rate

SOURCE: Moody’s Analytics; Axiometrics

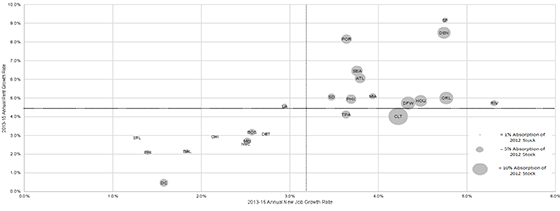

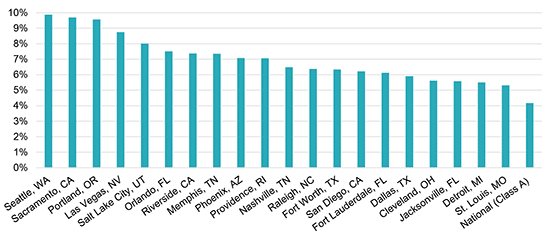

What types of markets have seen strong rent growth?

Not complicated—the ones with strong job growth!

Looking at job growth, rent growth, and absorption, there are two distinct quadrants. Job and rent growth are correlated; an MSA with high job growth tends to have high rent growth and vice versa. While absorption rate (highly correlated with new supply) varied among MSAs with high job and rent growth, it was uniformly low in MSAs with low job and rent growth. In other words, some metros with strong economies experienced considerable apartment construction and absorption, while absorption in other areas with strong economies was limited by supply constraints; but none of the low-growth cities have seen significant apartment construction.

The strongest rent growth seems to occur in two types of healthy markets:

- Historically supply-constrained markets that can’t build enough new product to meet their full demand potential, such as San Francisco; and

- Markets experiencing their first cycle of aggressive urban development, such as Denver.

However, it’s worth noting that there are economic risks in these markets as well, in addition to pipeline concerns in specific markets and submarkets.

2013-2015 New Job Growth Rate, Rent Growth Rate, and Apartment Absorption Rate

SOURCE: Moody’s Analytics; Axiometrics

How do these relationships play out over the recovery and growth phase of a cycle?

Here the disparity between high supply and low supply market appears to remain intact.

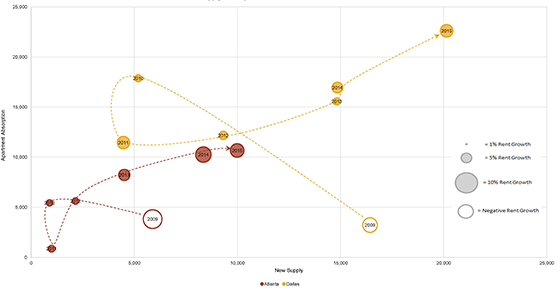

Markets with low barriers to entry, such as Dallas and Atlanta, demonstrate a clear responsiveness between supply, demand, and pricing year to year that characterizes market cycles. The bottom of the cycle (e.g., 2009) shows oversupply, with flat or shrinking rents. Deliveries then contract, absorption begins to increase, and rents start to grow. The lull in new supply eventually suppresses absorption until the expansion/growth phase begins to meter capital and new supply into the market. Rent growth is strongest during this stable phase as supply and absorption continue to expand in tandem.

Supply, Absorption, and Rent Growth, Atlanta & Dallas, 2009-2015

SOURCE: Axiometrics; RCLCO

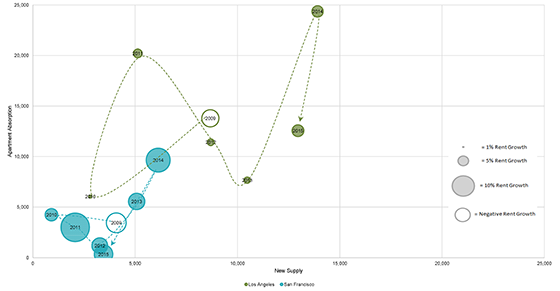

In markets with high barriers to entry, such as San Francisco and Los Angeles, absorption equaled or exceeded supply even in 2009, and these markets all but skipped the early recovery phase. Rent growth increased early on as supply constrained absorption, and remained stable or increased as new construction began in the market. Even though absorption dropped from 2014 to 2015, these markets remain undersupplied at year-end 2015, as all new supply was absorbed, occupancy remained stable, and rent growth accelerated.

Supply, Absorption, and Rent Growth, Los Angeles & San Francisco, 2009-2015

SOURCE: Axiometrics; RCLCO

And here we are in 2016, wondering how long the current market cycle can continue and which metrics might foreshadow either an economic slowdown or oversupply.

Several opportunities present themselves, even if you worry about the impact of the economic cycle and the growing development pipeline, with different risks and required timeframes associated with each.

- High Growth and High Barriers to Entry—Supply-constrained markets with strong job growth should continue to produce strong relative rent growth, but we believe this likely outcome is already aggressively priced into assets in these markets. The challenge is that many of the markets that we have historically considered high-barrier, or chronically supply-constrained, actually have historically deep near-term pipelines, but we continue to believe that in the long run they will produce compelling risk-adjusted returns.

- Destination Markets—Even if a market’s economic growth slows, other factors, such as household formation among Millennials or strong international draw, may buoy demand, but rent growth will likely be weak or nonexistent. These markets are compelling if you can underwrite them with realistic forward rent assumptions, and present an opportunity to have somewhat better near-term, and particularly mid-term, cash flow.

- Sleeper Markets—Markets with weaker economic growth really haven’t yet fully participated in this growth cycle, at least from an NOI perspective. Watch for cities in the early phases of a structural economic change that may exhibit economic strength out of character with their historical performance. These markets may also present something of a cap rate hedge—their evolution and increasing capital attention might help to offset a potential broader increase in cap rates over the longer term.

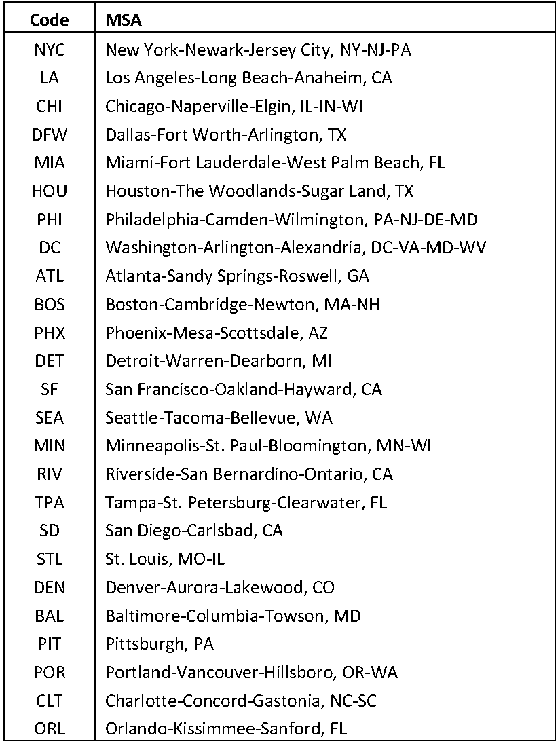

MSA Code Chart

SOURCE: RCLCO

RCLCO provides real estate economics and market analysis, strategic planning, management consulting, litigation support, fiscal and economic impact analysis, investment analysis, portfolio structuring, and monitoring services to real estate investors, developers, home builders, financial institutions, and public agencies. Our real estate consultants help clients make the best decisions about real estate investment, repositioning, planning, and development.

RCLCO’s advisory groups provide market-driven, analytically based, and financially sound solutions. Interested in learning more about RCLCO’s services? Please visit us at www.rclco.com/expertise.

Disclaimer: Reasonable efforts have been made to ensure that the data contained in this Advisory reflect accurate and timely information, and the data is believed to be reliable and comprehensive. The Advisory is based on estimates, assumptions, and other information developed by RCLCO from its independent research effort and general knowledge of the industry. This Advisory contains opinions that represent our view of reasonable expectations at this particular time, but our opinions are not offered as predictions or assurances that particular events will occur.

Related Articles

Speak to One of Our Real Estate Advisors Today

We take a strategic, data-driven approach to solving your real estate problems.

Contact Us